US Federal Reserve (Fed) Chair Jerome Powell said the economy is progressing stronger than expected, but the balance sheet reduction process is nearing completion due to tight liquidity. Speaking at the National Association for Business Economics conference in Philadelphia, Powell stated that the banking system is approaching "adequate reserves" and hinted that the balance sheet reduction could cease within a few months. This statement comes as investors are debating how long the Fed will continue to cut interest rates.

Powell noted that $6 trillion in bonds and mortgage-backed securities have been removed from the portfolio since mid-2022, saying, "Some indicators suggest that liquidity conditions are gradually tightening. Excessive reductions in reserves could hinder growth." He added that the Fed does not plan to reduce its balance sheet, which swelled to $9 trillion during the pandemic, to previous levels, but will end this process once liquidity conditions stabilize at "adequate" levels. Powell also addressed the political pressures exerted by the Fed over the reserve interest rates paid to banks. Responding to criticism from figures like Senator Ted Cruz, Powell argued that the practice was necessary for monetary policy, saying, “Eliminating the reserve interest rate would eliminate our control over interest rates.” He noted that while the Fed’s profit transfer to the Treasury might temporarily turn negative following interest rate hikes, this would resolve with policy normalization.

On the interest rate front, Powell highlighted the weakening in the labor market. He noted that data after July showed a “significant softening,” adding, “Two risks are now more closely aligned: acting too quickly and failing to fully suppress inflation, or acting too slowly and causing unnecessary job losses.” The Fed, which cut interest rates by 0.25 percentage points at its September meeting, had signaled two additional rate cuts this year. While Powell refrained from confirming these predictions, his tone suggested that interest rate cuts could continue.

Powell noted that employment and inflation reports were delayed due to the government shutdown and that current data showed that “growth is slightly stronger than expected.” He also added that the price increases in goods were primarily due to tariffs and did not imply a new wave of inflation.

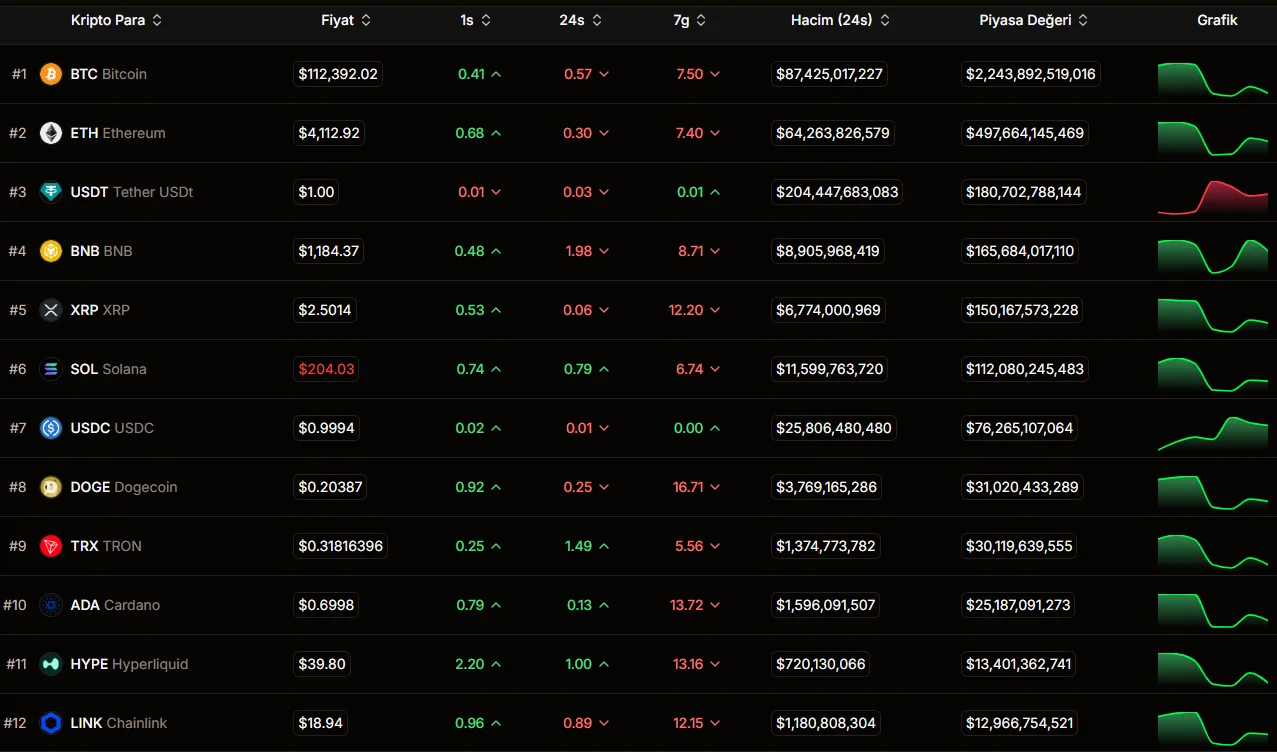

Cryptocurrencies experienced volatility

The Fed's cautious yet easing stance also resonated in the crypto markets. Powell's statements that "the balance sheet contraction process is nearing an end" triggered a 3% recovery in the Bitcoin price. The BTC/USD pair, which had recently established strong support around $110,000, regained strength following these statements.

Analysts predict that the bullish trend in Bitcoin's macro outlook will strengthen again with the upcoming quantitative easing (QE) process. According to CryptoQuant data, whales have been accumulating BTC at historic levels in recent weeks. At the same time, overbought signals seen in the gold market increase expectations that capital may once again shift to Bitcoin. The Fed's steps toward both interest rate cuts and increased liquidity have the potential to accelerate this transformation. With the upcoming inflation data, the market will have a clearer picture of whether the Fed is nearing its "soft landing" goal. For now, Powell's remarks have created a sense of cautious optimism for both Wall Street and the crypto markets.