Optimism (OP) Technical Analysis: Critical Support Test

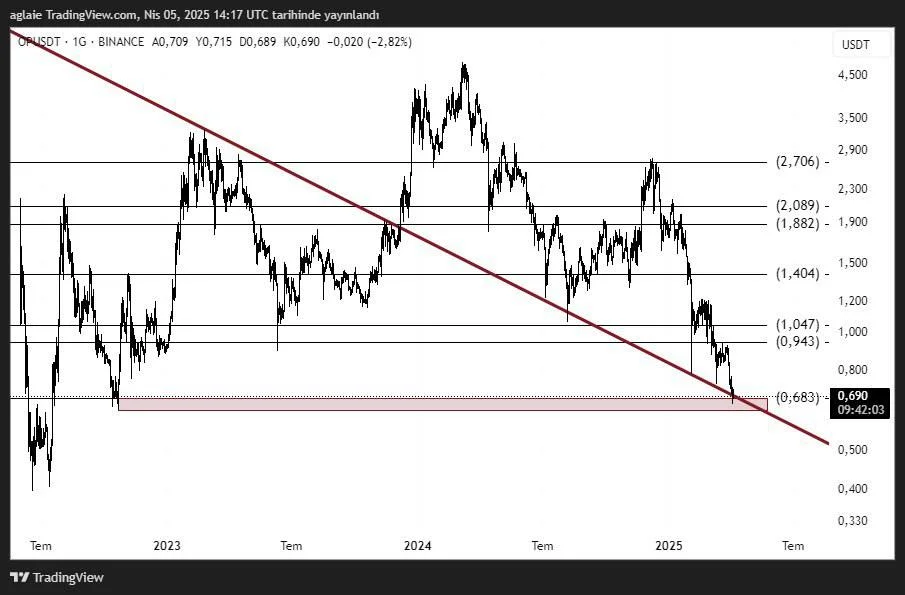

Optimism (OP) has been on a downward trend for a long time, and this decline has deepened a little due to the negative movements of major cryptocurrencies such as Bitcoin and Ethereum, especially in all financial markets, with the US customs decisions in the last few weeks. However, the level at which the decline finally came, 0.690, is in a region where there is both trend support and liquidation support that remains at the bottom level it did 2 years ago. The picture we see on the charts at the moment shows that it is possible that this region may be bottoming out and we may see upward movements from here.

A downward trend line has been prevailing on the chart for quite some time. OP continued to pay homage to this line by making lower peaks with each of his attempts. However, the fact that it has touched both this trend line and the horizontal $ 0.68 – $ 0.69 support area with the recent price movement strengthens the possibility of a pause and a change of direction. These points are the return zones that we often see in technical analysis. Of course, for this turn, it is necessary for the US Stock Markets to turn positive and for the decline on the Bitcoin and Ethereum side to end.

Support Zones:

0.683 – 0.690 $: The current main support - the price is trying to hold on here right now.

$0.500 - $0.550: If the support breaks, the strong ground is next.

$0.390: ATL level – technically the last line of defense.

Resistance Zones:

$ 0.943 - $ 1.047: The first recovery zone, strong resistance, but it is possible to overcome.

$ 1,404: The level that can be tested in the medium term.

$ 1,882 - $ 2,089: The volume zone before the decline began.

$2,706: Wide-time potential target.

The RSI is currently at 33.19, hovering quite close to the oversold limit, which may indicate that sales are now starting to weaken. While momentum indicators are gradually starting to stabilize, the increase in volume is also attracting attention in recent declines. This may be a sign of a pre-return collection process. This region is important for investors. Because although low levels often seem scary, they offer potential opportunities with the right timing and risk management.

If the price takes strength from this support zone and turns its direction up, the December of $ 0.94 – 1.05 will be raised as the first resistance. If it gains upward momentum, technically the $1.40 and $1.88 levels can be targeted. However, if this support is broken, short-term withdrawals may occur. In this case, the use of stop-loss and position control become even more important.

As a result, Optimism is trading at the bottom of the long-term downtrend. The level being tested at the moment is a strong support area that has moved the price up many times in the past. If this support works once again, there may be a strong possibility of a short-term recovery for OP. Otherwise, this breakdown may initiate a new wave of decline. Both scenarios are now very close, and once the direction becomes clear, the chances of the move being drastic are quite high. Therefore, patience, confirmation and correct position management are vital in this process.

These analyses, which do not offer investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the responsibility for making transactions and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss in relation to shared transactions.