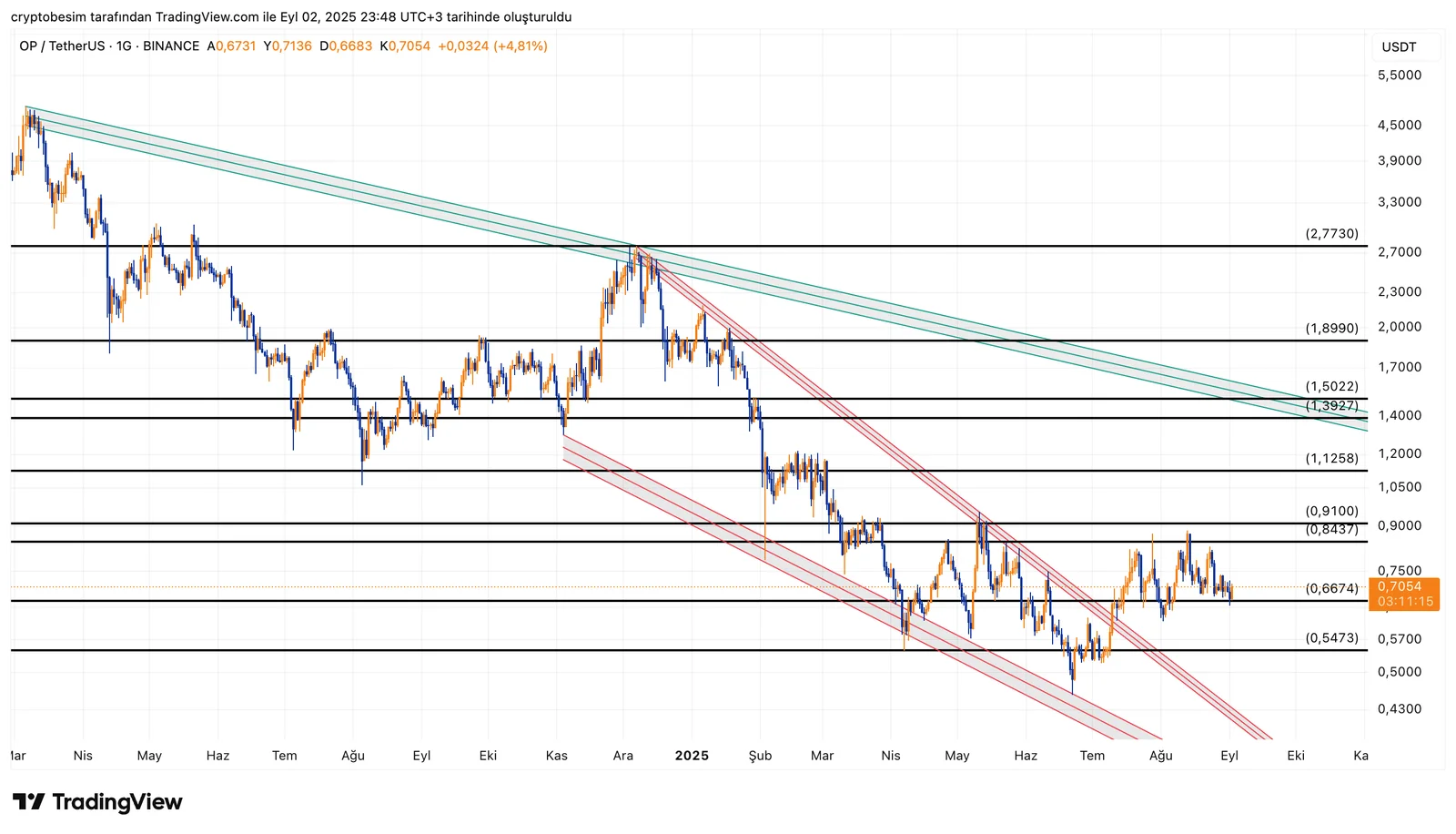

OP/USDT Technical Outlook

Analyzing the OP chart, we see that a falling wedge pattern has already broken upward. Yet, after this breakout, the price did not gain strong momentum and is now moving sideways. We can state that this sideways consolidation is not negative – it often prepares the ground for a stronger move upward.OP is currently trading around the level $0.70. The nearest resistance is in the $0.84 – $0.91 zone. If this area breaks, the next targets are $1.12 and then $1.39 – $1.50. The $1.39 – $1.50 zone is very important since it overlaps with both horizontal resistance and the long-term downtrend line. If the price breaks this area with volume, medium-term targets could extend to $1.89 and even the wedge target at $2.77.On the downside, the first support is $0.66. If this level is lost, the decline could deepen toward $0.55.In short, the outlook for OP remains positive. As long as consolidation continues above support and resistances are broken step by step, the potential for a stronger rally is high.

These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, the user is responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during the trades.