Nine major European banks have joined forces to launch a euro-denominated stablecoin under the European Union's Markets in Cryptoassets (MiCA) regulation.

The banking giants involved in the project are: ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International.

Numerous banks in Europe have joined forces to develop a stablecoin

A significant new step has been taken in the European banking sector in the digital currency arena. Nine major European banks announced the formation of a joint consortium to launch a euro-denominated stablecoin. This move aims to create a strong European-based alternative in a market currently dominated by US dollar-backed tokens.

The consortium includes ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International. The banks will establish a new company in the Netherlands and undertake the management of this initiative. The project is planned to be launched in the second half of 2026. The first phase envisages obtaining an electronic money institution license from the Dutch Central Bank and operating under MiCA regulations.

The new stablecoin will be fully compliant with MiCA, the European Union's framework regulation for crypto assets. This will provide legal protection for both banks and customers. The consortium's goal is to develop a digital payment instrument that offers low-cost and instant transactions, and can be used 24/7 for cross-border payments. Furthermore, with its programmable payment features, it is planned to create a wide range of applications, from supply chain management to securities and cryptoasset transactions.

Flaminia Lucia Franca, Head of Transaction Banking at Danske Bank, emphasized the importance of the project, saying, "Digital assets not only introduce a new form of money but also offer significant efficiency and savings opportunities for the financial sector and customers." Floris Lugt from ING's Digital Assets team stated that the sector must unite around common standards, and only then can true market adoption be achieved.

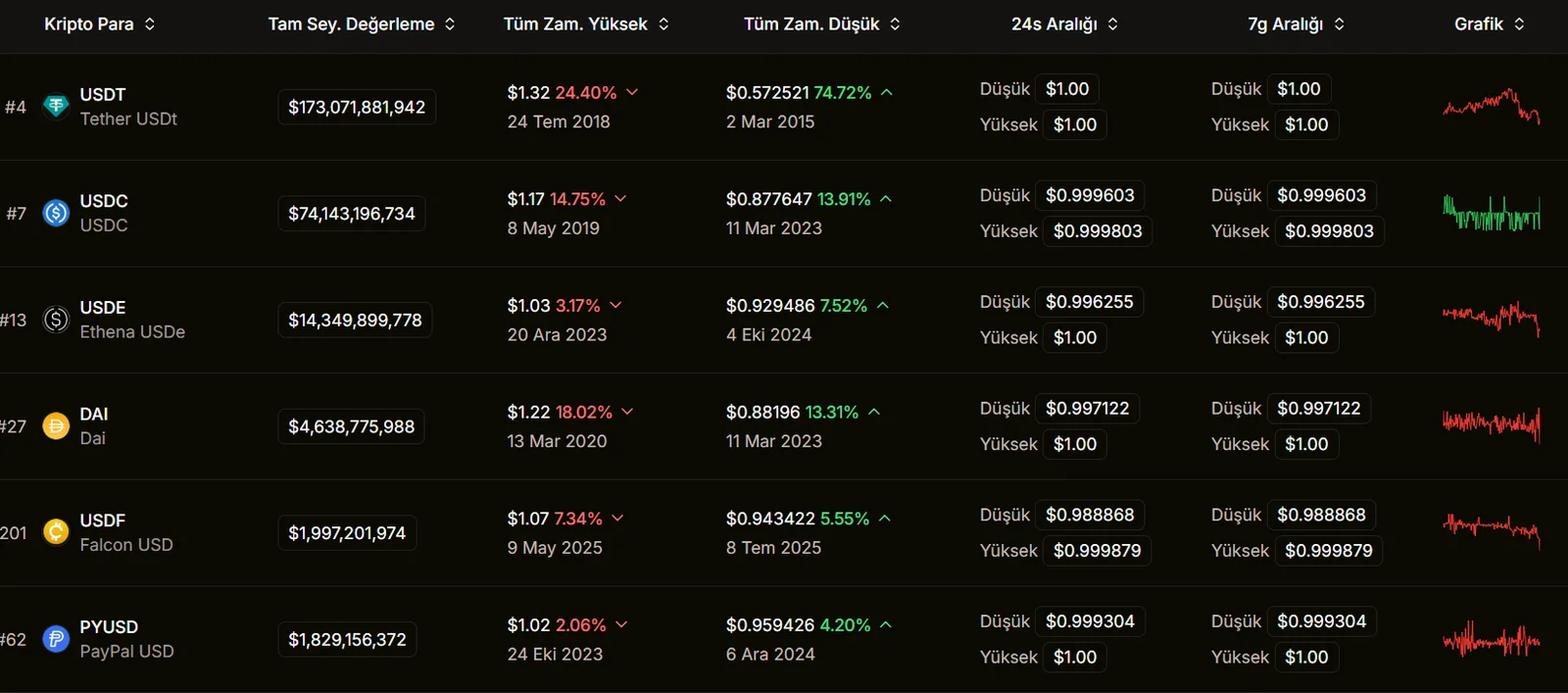

The project aims to strengthen Europe's strategic independence. As of today, 99% of the global stablecoin market is comprised of US dollar-denominated tokens (such as USDT and USDC). In contrast, according to European Central Bank data, the market capitalization of euro-backed stablecoins remains below €350 million.

This imbalance is increasing political and economic pressure in Europe to reduce dollar dependence.

The new initiative will also open the door for each bank to develop services tailored to its own customer base. While using a shared infrastructure, banks will be able to offer additional solutions such as stablecoin wallets and custody services. It was also announced that the consortium is open to other European banks, and a CEO will be appointed following the regulatory process.

With MiCA becoming effective in all EU member states at the beginning of 2025, interest in digital asset technologies among European financial institutions has rapidly increased. The development and permitting processes, which will continue until 2026, will allow both the technical infrastructure to mature and the inclusion of new participating banks.