Morgan Stanley's decision to expand its crypto asset products has clarified the strategic direction of the institutional front as we enter 2026. Following its Bitcoin and Solana initiatives, the bank has now applied for a spot ETF for Ethereum.

Morgan Stanley takes action for Ethereum this time

The latest link in the transformation comes from Morgan Stanley. Following its Bitcoin and Solana initiatives, the bank has now applied to the US regulator for an Ethereum-focused ETF. This application has brought back to the forefront a fact that has long been discussed in the market but often overshadowed by price movements: institutional demand is still unsaturated.

Morgan Stanley's move indicates that the total market is larger than previously thought. While spot Bitcoin ETFs like IBIT offered by BlackRock have established a significant advantage in terms of liquidity, the idea of "another ETF" might seem unnecessary at first glance. However, observations made by Morgan Stanley through its own client network show that there is a large group of investors who have not yet gained direct access to crypto assets. For the bank, the issue is not about taking a share of the existing pie, but about growing the pie. Ethereum's application is of particular importance at this point. While Bitcoin has long served as an "institutional gateway," Ethereum has a more complex narrative. Topics like smart contracts, staking, and DeFi integration are taking Ethereum beyond being just a store of value. Morgan Stanley's entry into this space through an ETF shows that institutional investors are now preparing for more sophisticated crypto products. The steps taken for Solana also support this diversification trend.

Ethereum Price Update

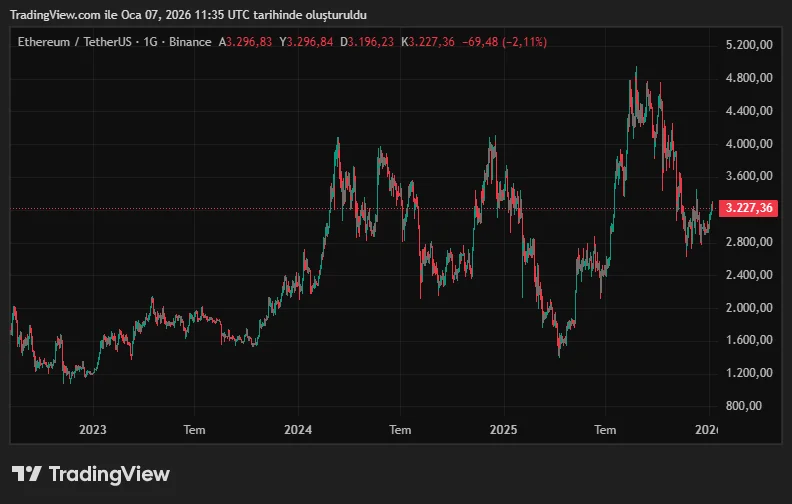

Ethereum (ETH) has recently been exhibiting a stable performance around the $3,200 range. Current data indicates that while ETH may experience limited pullbacks in the short term, it maintains its medium-term outlook. With a market capitalization of approximately $389 billion, Ethereum maintains its second-place position after Bitcoin.

The fact that the trading volume has been above $28 billion in the 24-hour period shows that interest around the network remains strong. ETH, which has recorded an increase of nearly 8% in the last seven days, shows a horizontal trend in longer timeframes. This outlook reveals that investors are cautious about the short-term direction. Developments in network usage, staking dynamics, and institutional products continue to be decisive in Ethereum pricing. In particular, the continued prominence of spot ETF applications could lead to Ethereum becoming a central asset in institutional investment vehicles.