Tokyo-based digital asset company Metaplanet continues its Bitcoin accumulation strategy without slowing down. The company announced that it has drawn down an additional $130 million from its existing $500 million Bitcoin-secured credit line.

This new loan will be used for both additional BTC purchases and the expansion of its revenue-generating activities. Management also states that stock repurchases may be made under favorable market conditions.

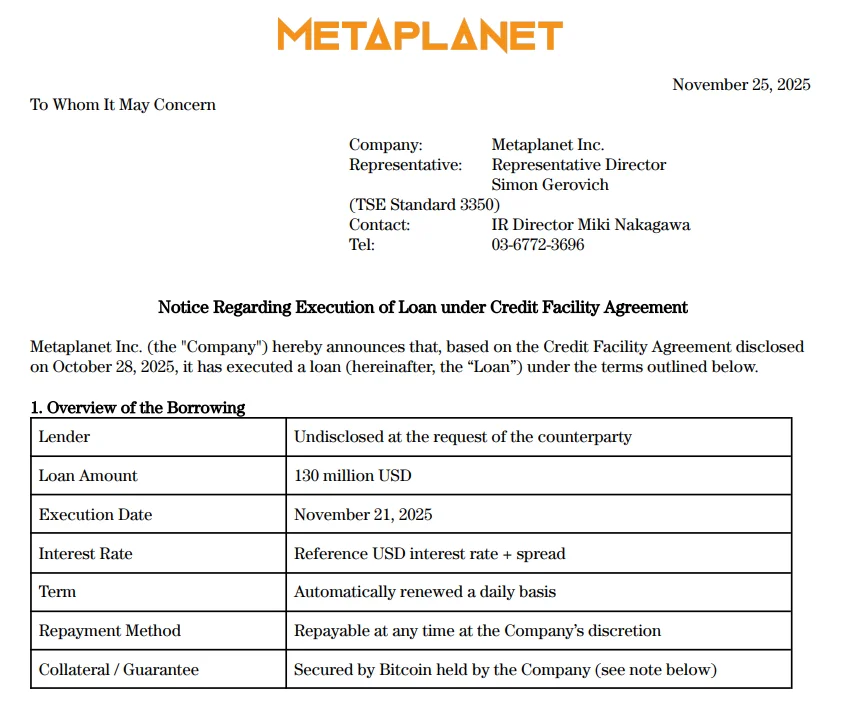

Metaplanet's announcement covers the loan transaction approved on November 21st. As with the previous $100 million loan, the company withheld counterparty information at the lender's request. The loan reportedly has a variable interest rate denominated in US dollars and automatically renews daily. The company can repay at any time.

At the heart of this financing structure is Metaplanet's massive Bitcoin reserves held on its balance sheet. The company holds 30,823 BTC. Valued at approximately $2.7 billion at current prices, this reserve serves both as collateral for the loan and as an additional safety margin during periods of volatility. Metaplanet emphasizes that its financial policy is designed to maintain sufficient margin even during collateral price fluctuations. With the new loan, the total amount disbursed has increased to $230 million.

The company announced that the latest financing tranche will be used for three primary purposes: purchasing more BTC, expanding its Bitcoin revenue-generating business, and repurchasing company shares if market conditions permit. On the revenue generation side, the company's plans to generate premium income by selling Bitcoin options are particularly prominent. The BTC used in this strategy will serve as collateral for the relevant option positions.

Metaplanet does not expect the loan to have a significant impact on the fiscal year ending in December 2025. However, it was stated that if market conditions change significantly, notification will be made promptly.

Share price under pressure, BTC holdings at a loss

Metaplanet holds the fourth-largest Bitcoin holding among publicly traded companies. MicroStrategy tops the list, followed by miner Marathon Digital (MARA) and Tether-backed Twenty One. Despite these large BTC holdings, Metaplanet's shares, like many others in the sector, have suffered significant losses in recent months. The company's share price has fallen approximately 81 percent since its summer peak. Its market capitalization-net asset value (mNAV) ratio has also fallen to 0.81.

Metaplanet's Bitcoin holdings are currently showing losses on its balance sheet. Its BTC position, with an average cost of $3.3 billion, carries an unrealized loss of approximately $600 million at current prices. Despite this, the company reiterates that it has not abandoned its long-term strategy and continues its Bitcoin-focused growth plan.