Ethereum's Layer-2 network, Linea, has finally completed its token generation event (TGE) after over two years of its mainnet launch. However, the LINEA token, which launched with high expectations, has been experiencing volatility in its early days.

The Initial Price and Drop with the TGE

Following the TGE, which took place on the night of September 11th (Turkish time), LINEA opened with a market capitalization of approximately $550 million. However, due to selling pressure from airdrop recipients, LINEA's price plummeted. Its market capitalization fell to $382 million, and its fully diluted valuation (FV) fell to $1.7 billion.

This situation is familiar to crypto investors. Popular Layer-2 tokens like ARB and OP, which launched in 2024, similarly opened higher and lost 80% of their value. Other Layer-2 projects like ZkSync and Blast also experienced significant declines after the TGE. Technical glitches and airdrop difficulties occurred

Another development that cast a shadow over Linea's TGE was a 46-minute block production outage at midnight. Many users reported difficulties claiming airdrop rights. Linea product manager Declan Fox explained that this outage was caused by a large volume of transaction packets, overloading the network's sequencer.

Massive airdrop and distribution details

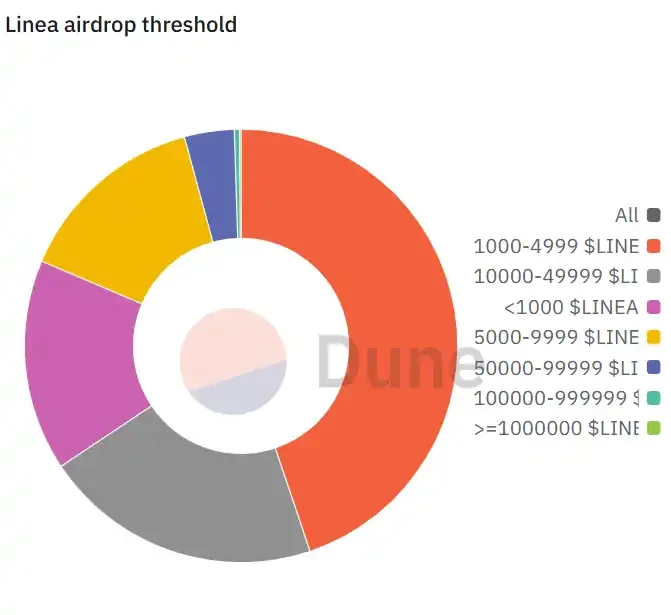

According to the data, a total of 9.36 billion LINEA tokens were distributed to more than 749,000 addresses. The most striking detail was that a single address received 137 million tokens. In addition, 208 addresses acquired over 1 million LINEA tokens. The initial circulating supply was approximately 22%, or 15.8 billion tokens. The total supply was set at 72 billion, 85% of which was allocated to the ecosystem fund.

The token's intended use is not directly for gas payments; it will be used for ecosystem incentives, rewards for those providing liquidity to DeFi protocols, community activities, and developer contributions. Linea also stands out with its two-way burn mechanism: 20% of Ethereum revenues will be burned directly, while the remaining 80% will be repurchased and burned.

Listing Process and Trading Volume on Exchanges

With the token's listing, major exchanges such as Binance and OKX saw strong interest. On Binance, LINEA's opening price reached $0.04353, but quickly fell to $0.033. On OKX, it reached $0.055 before settling at $0.045. These fluctuations suggest that the price quickly became volatile due to selling pressure from early investors.

Meanwhile, Bitget opened trading for LINEA perpetual contracts with 1 to 50x leverage. Binance and Hyperliquid also converted their pre-market trades to standard perpetual contracts.

In parallel with the market opening, Linea launched new campaigns to incentivize liquidity providers and users. According to recent announcements, an additional 12 million LINEA rewards have been added to the liquidity incentive program this week. OKX Wallet also announced a trading competition with a total of 18 million LINEA rewards.

Lubin's long-term tip

Joseph Lubin, founder of Consensys and co-founder of Ethereum, who supports Linea, stated on social media that LINEA holders could earn additional token rewards in the future. Lubin said that MetaMask and Linea are working to develop these mechanisms.