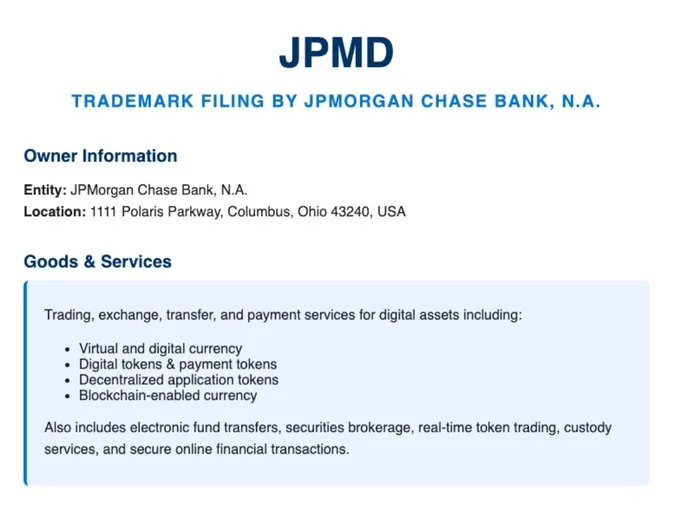

JPMorgan, one of the world's largest banks, has taken another notable step into the world of crypto assets. On June 15, 2025, the bank filed an application with the United States Patent and Trademark Office (USPTO) for a new trademark called “JPMD.” The application covers a wide range of services, including blockchain-based asset trading, payment services, and digital asset issuance. This has also sparked speculation that JPMorgan is preparing to launch a new stablecoin.

JPMorgan has filed a new application

JPMorgan's application for the “JPMD” trademark includes a number of financial services based on distributed ledger technology (DLT). These include the purchase and sale of crypto assets, custody services, electronic fund transfers, debt swaps, securities brokerage, and payment processing. Additionally, the application documents highlight solutions for fraud prevention, account verification, and data sharing for cross-border payment systems.

Although the term “stablecoin” is not directly mentioned in the application, the comprehensive definitions and service areas create a strong impression that JPMorgan has concrete plans for stable cryptocurrencies. In particular, the statement that functions such as debt exchange and brokerage services will be carried out using blockchain infrastructure suggests that an infrastructure for the digitization and tokenization of real-world assets is being prepared.

JPMorgan entered the blockchain world with Kinexys

JPMorgan took its first step into the blockchain world much earlier. The bank developed the Kinexys platform (formerly known as Onyx), based on a private version of Ethereum, and launched its own cryptocurrency, JPM Coin, on this platform. JPM Coin is used to speed up transfers between corporate customers as tokens pegged one-to-one to fiat currencies such as the US dollar, British pound, and euro.

The Kinexys infrastructure, which reached an average daily transaction volume of $2 billion as of April, forms an important foundation for JPMorgan's stablecoin projects. Thanks to this infrastructure, the bank appears poised to develop new cryptocurrency solutions accessible to a broader audience.

Dimon takes a cautious approach to blockchain

JPMorgan CEO Jamie Dimon has long maintained a critical stance toward Bitcoin and other cryptocurrencies. He has even compared Bitcoin to “cigarettes” and frequently stated that he does not personally invest in it. However, Dimon does not deny the potential of blockchain technology. In a statement made in late 2024, he emphasized that JPMorgan is “one of the most intensive users of blockchain.”

JPMorgan's move gains further significance amid the growing number of stablecoin projects from major tech and financial companies. Retail giants like Amazon and Walmart are considering launching their own cryptocurrencies, while major banks like Bank of America, Citigroup, and Wells Fargo are in talks about a joint stablecoin project.