EDU/USDT Technical Outlook

Open Campus (EDU) aims to bring educational content onto the blockchain, creating a more transparent and accessible system. The project stands out with its model that enables teachers, content creators, and students to earn directly. Having major backers such as Binance and Animoca increases overall confidence in the project. In recent days, price volatility has picked up again. With market interest remaining strong, we examine the potential direction of EDU in the coming period through its chart structure.

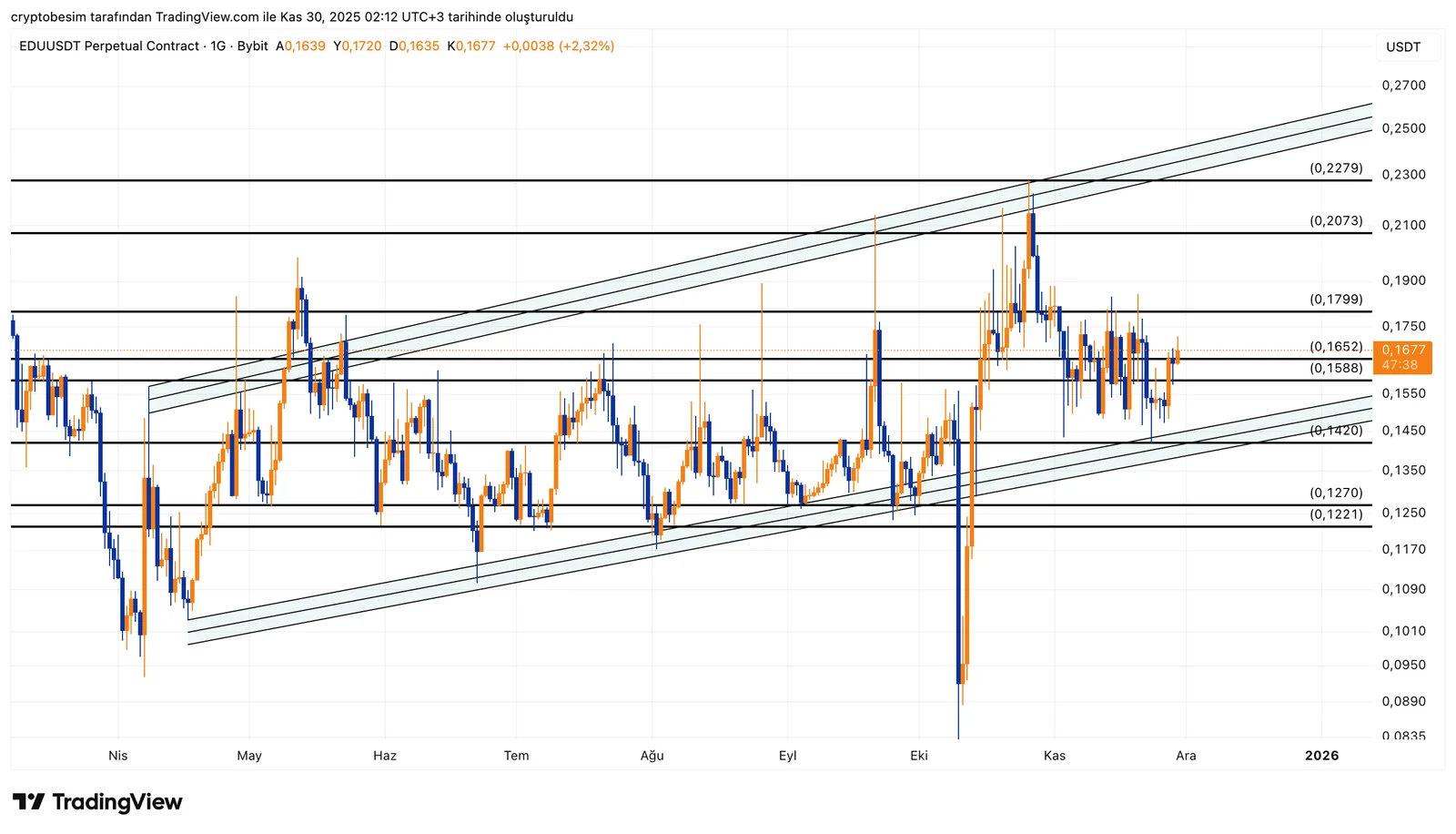

On the EDU chart, there are occasional wick extensions outside the channel, but the main structure clearly remains an ascending channel. The price recovers each time it reaches the lower boundary and faces selling pressure near the upper boundary, indicating that the channel is being respected by the market.

Currently, the price is squeezed between the midline and the upper boundary of the channel. The 0.1650 level stands out as a short-term intermediate resistance. If price manages to hold above this area, the likelihood of a move toward the upper channel band specifically the 0.1790–0.2070 range increases significantly. This zone represents a strong profit-taking region.

On the downside, the lower boundary of the channel remains the key support. The first important level is 0.1580, while below that, the 0.1420 area aligned with the channel base forms the main support. Losing this support would weaken the ascending channel structure and could extend the pullback toward the 0.1270 level.

Summary:

- Movements above 0.1650 are positive.

- The 0.1790–0.2070 zone marks the upper boundary of the channel and is a strong resistance area.

- 0.1580 is the first support, and 0.1420 is the main support.

As long as the channel structure remains intact, EDU is likely to continue producing bullish reactions within this range.

These analyses do not constitute investment advice. They focus on support and resistance levels that may offer potential short- or medium-term opportunities depending on market conditions. Trade execution and risk management are entirely the user’s responsibility. Stop-loss usage is strongly recommended for all shared setups.