The ongoing debate in the US Senate over cryptocurrency regulation has been reignited by Democrats' new bill for decentralized finance (DeFi). Leaked documents reveal Democrats' plan to "subject DeFi to stricter oversight," while industry representatives have warned that the bill would "de facto ban DeFi."

Income from DeFi platforms in the spotlight in the US

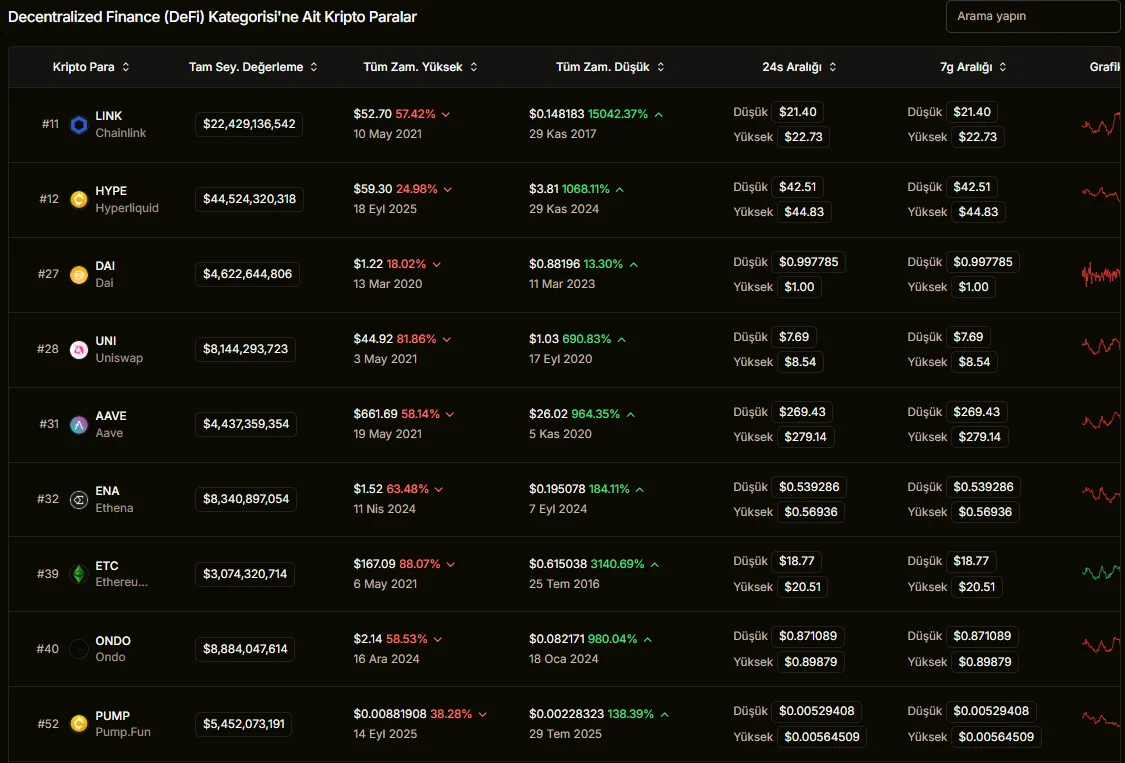

According to Politico, the proposal would require all individuals and organizations generating income from the front-end of a DeFi platform to register as brokers with the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC). The bill contains broad definitions that could include wallet developers, oracle operators, and even node operators, along with DeFi interfaces, under the scope of the regulation. Some major DeFi coins are listed below:

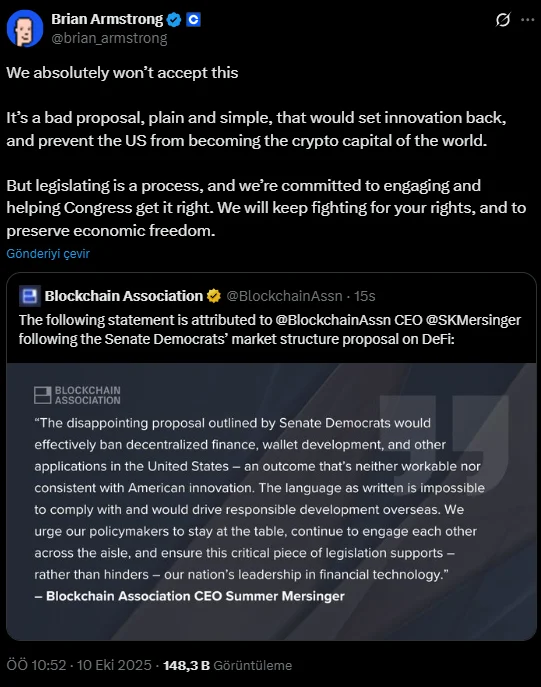

Blockchain Association CEO Summer Mersinger stated that this proposal would effectively ban "decentralized finance, wallet development, and innovative applications" in the US. According to Mersinger, "this language is far from enforceable" and could ultimately shift the center of innovation away from the US, as it would "drive responsible developers abroad."

According to the Democrats' counterproposal, the Treasury Department would create a "restricted list" of DeFi protocols deemed "too risky." Protocols included on this list would be restricted from access by US citizens, and users who generate regular income through these protocols could face criminal penalties. Furthermore, Know Your Customer (KYC) rules would be mandated for frontends of DeFi applications and even non-custodial wallets.

The Republican party suspended negotiations, stating that this counterproposal was "a convoluted and ill-intentioned policy proposal that lacks even legislative text." Catherine Fuchs, the Republican director of the Senate Banking Committee, stated in a statement that "talks have been halted until an agreed-upon date is set."

Crypto industry reacts strongly

Leading figures in the crypto industry also reacted strongly to this development. Coinbase CEO Brian Armstrong called the proposal a "bad plan," saying, "It would prevent the US from becoming a leader in crypto finance and set innovation back years." Uniswap founder Hayden Adams argued that such a law would "kill DeFi in the US." Variant's legal director, Jake Chervinsky, described the draft as "unprecedented, unconstitutional government intervention."

According to experts, if this proposal goes into effect, US-based DeFi liquidity could be significantly reduced. According to Newhedge data, US exchanges currently account for only 10% of global crypto trading volume. Such regulations could lead to a complete shift of liquidity to unregulated territories and a loss of competitiveness in the American market. Bipartisan negotiations in the Senate were already fragile. The draft "Responsible Financial Innovation Act," released in September, aimed to transfer oversight of spot crypto markets to the CFTC, limit the SEC's authority, and provide legal protections to DeFi developers. However, the Democrats' new proposal appears to have completely shaken this grounds for compromise.

While Democratic Senator Ruben Gallego stated that his party is "ready to work," Republicans dismiss this approach as "political maneuvering." For now, bipartisan cooperation on crypto regulations has reached a standstill, and the general sentiment within the industry is pessimistic. If the parties cannot agree on a joint bill by the end of the year, another prolonged period of uncertainty regarding US crypto legislation appears likely.