Jiuzi Holdings Inc. (JZXN), a Nasdaq-listed China-based electric vehicle retailer, attracted attention with its announcement on Wednesday. The company announced that it will invest up to $1 billion of its cash reserves in select cryptocurrencies under its new "Crypto Asset Investment Policy," approved by its board of directors.

The Chinese company focuses on three cryptocurrencies

In the first phase of the policy, investments will be limited to Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB). The company's move is considered a strategic step aimed at long-term value preservation and hedging, rather than a speculative entry into the crypto market. Management also announced that the assets will not be held in-house but will instead be secured through professional custodians.

Jiuzi's decision stems from the addition of a crypto industry veteran to the team. Doug Buerger, who recently took over as the company's chief operating officer (COO), will take a leading role in the new policy. Buerger stated, “Our goal is not to engage in short-term trading. We view crypto assets as long-term stores of value and hedges against macroeconomic uncertainties.”

A “Crypto Asset Risk Committee” has also been established to implement the policy. This committee, led by CFO Huijie Gao, will oversee the progress of investments within the established framework and regularly report to the board of directors.

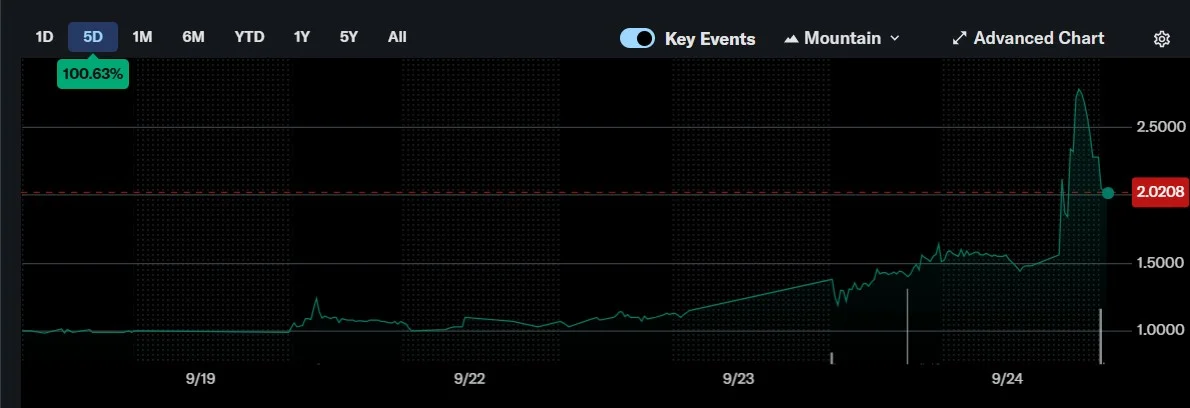

Following the announcement, Jiuzi Holdings shares surged. JZXN shares, traded on Nasdaq, gained over 55% in pre-market trading. This investor response was driven by the company's aggressive growth strategy and its willingness to use its cash reserves more effectively.

CEO Tao Li described the new policy as “a proactive step to protect and enhance long-term shareholder value.” According to Li, this initiative will not only diversify the company's financial strength but also pave the way for an innovative model that integrates traditional business practices with the crypto ecosystem. Recently, the number of US-listed companies turning to crypto investments has been increasing. The trend, initiated by MicroStrategy's Bitcoin purchases, is leading to an increasing number of companies holding crypto assets.