Cryptocurrency mining hardware manufacturer Canaan Inc. is facing the risk of delisting from the stock exchange following a sharp drop in its share price. The company announced it received a formal warning from Nasdaq, stating that Canaan's shares are violating exchange listing rules because they have closed below $1 for the past 30 trading days.

Nasdaq has given Canaan 180 days to regain compliance

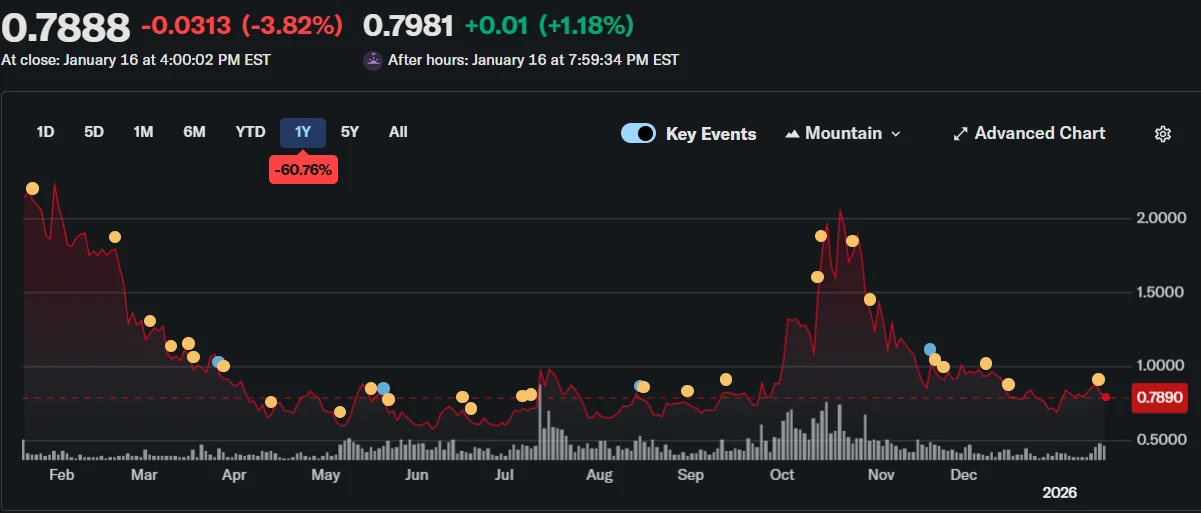

The company needs to raise its closing price per share above $1 for at least 10 consecutive trading days by July 13th. Canaan shares last closed above $1 on November 28th. On Friday, the share traded at $0.79, losing 3.8% during the day. Shares have not risen above the $3 level since December 2024. In the last 12 months, Canaan shares have experienced a total decline of 63%. This decline is closely related to the structural transformation taking place in the crypto mining sector. As many mining companies shift towards AI-driven computing services to diversify their revenue models, demand for next-generation mining equipment has weakened.

This trend is putting pressure on hardware manufacturers' sales expectations. Canaan stated that it may request an extension if it fails to meet the necessary conditions within the specified timeframe. The company indicated that it could apply to Nasdaq for additional time to comply and, if necessary, consider a "reverse stock split." In this method, the number of shares in circulation is reduced, theoretically increasing the price per share. However, this step is generally seen as a short-term technical solution and may not always positively impact investor sentiment. If Nasdaq officials conclude that Canaan cannot permanently increase its share price, the company may be delisted. In such a scenario, the shares would be moved to over-the-counter markets. This leads to decreased liquidity and more difficult trading, generally putting additional pressure on the share price. The picture isn't entirely bleak for Canaan. In October, the company announced that a US-based customer had ordered 50,000 of its latest generation “Avalon A15 Pro” mining devices. This deal, the largest order in three years, caused the share price to rise by 25% in a single day. However, this effect was not permanent. Other companies are going through a similar process. In December, Bitcoin treasury company Kindly MD received a warning from Nasdaq because its shares remained below $1 for 30 days. The company needs to raise its price by June; shares closed at $0.46 on Friday. In August, biotechnology company Windtree Therapeutics was delisted from Nasdaq for failing to meet listing requirements. On the day the delisting decision was announced, shares fell by 77%, indicating a sharp exit by investors.