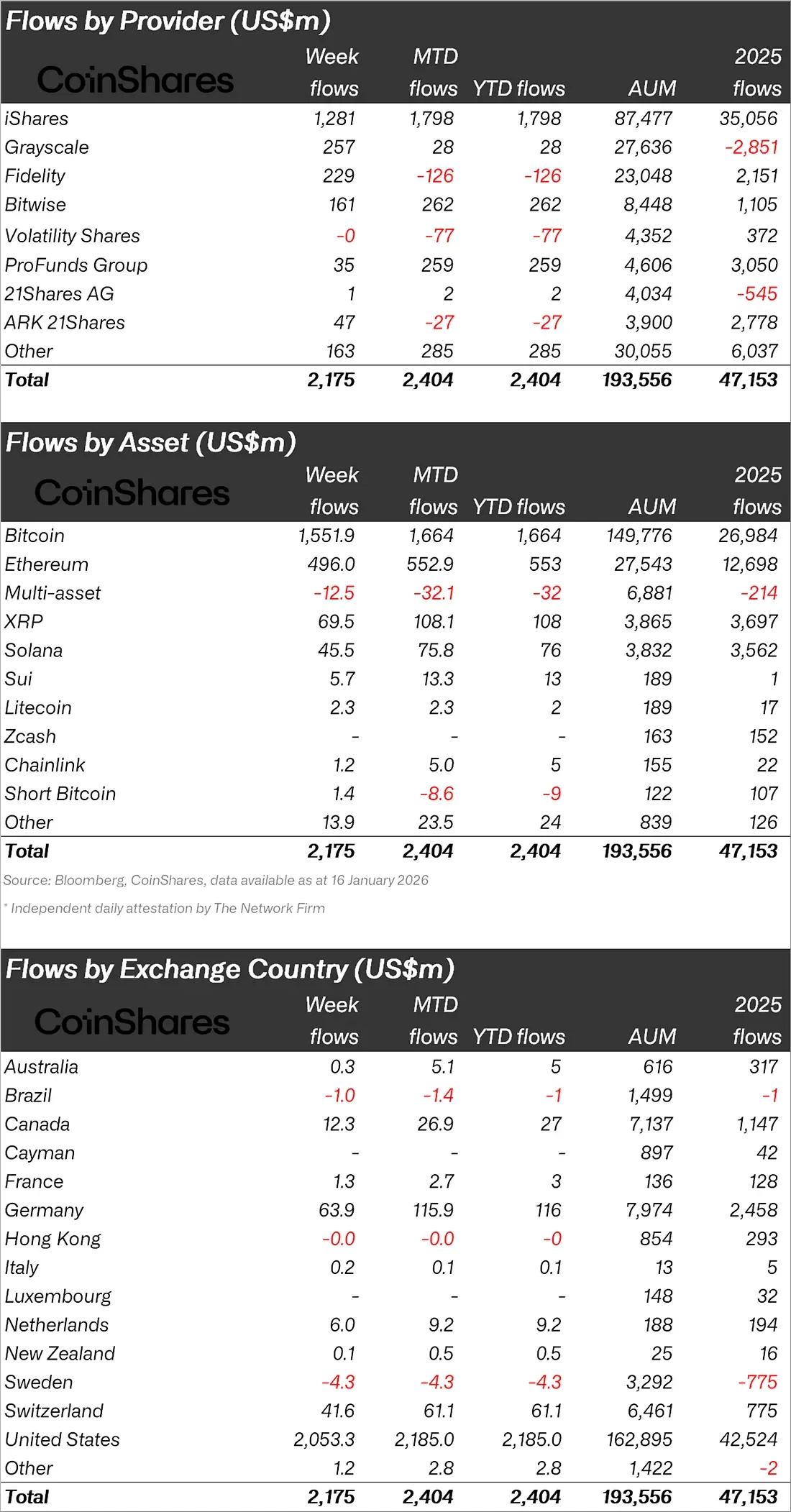

According to CoinShares data, global cryptocurrency investment assets recorded a net inflow of $2.17 billion last week, marking their strongest weekly performance since October 2025. While investor interest remained strong throughout the week, it weakened somewhat on Friday due to increased geopolitical and political uncertainties, but the overall picture showed that institutional demand remained strong. The majority of the weekly inflows occurred in the early days of the week. However, on Friday, escalating diplomatic tensions between the US and the European Union over Greenland, threats of new tariffs, and policy uncertainties in Washington negatively impacted market sentiment. Following these developments, approximately $378 million was withdrawn from cryptocurrency investment assets. CoinShares Research Director James Butterfill emphasized that this pullback at the end of the week indicated a short-term reaction to macro and geopolitical issues, rather than a deterioration in underlying demand. On an asset basis, Bitcoin maintained its clear lead. Bitcoin investment assets closed the week with inflows of $1.55 billion. While this figure represents the majority of total weekly inflows, US-based spot Bitcoin ETFs alone contributed approximately $1.4 billion. Ethereum products also performed strongly, seeing net inflows of $496 million. Solana funds received $45.5 million. This interest in Ethereum and Solana was noteworthy despite draft regulations being discussed in the US Senate Banking Committee that could limit the yield offered by stablecoins.

Altcoins Attract Attention

A broad-based participation was also observed in the altcoin sector. XRP investment products stood out with inflows of $69.5 million, while funds for smaller-scale projects such as Sui, Lido, and Hedera also saw positive flows. CoinShares interpreted this picture as an indication that institutional investors maintain their appetite for crypto assets despite macroeconomic uncertainties.

In terms of regional distribution, the US was the clear leader. US-based crypto investment products finished the week with inflows of $2.05 billion. On the European side, Germany stood out with net inflows of $63.9 million, Switzerland with $41.6 million, Canada with $12.3 million, and the Netherlands with $6 million. These figures indicated that, despite temporary fluctuations, a constructive investment environment continues on a global scale.

Not only token-based products, but also blockchain-focused stocks closed the week strongly. A total of $72.6 million inflows occurred into investment instruments tracking blockchain companies. This showed that investor interest is spreading not only to cryptocurrencies but also to the broader digital asset ecosystem.

Market pricing reflected this mixed picture. Although Bitcoin rose approximately 3 percent on a weekly basis, it retreated by around 2 percent towards the end of the week, falling below $93,000. Ethereum followed a similar trend; while maintaining its weekly gains, it experienced a significant daily decline.