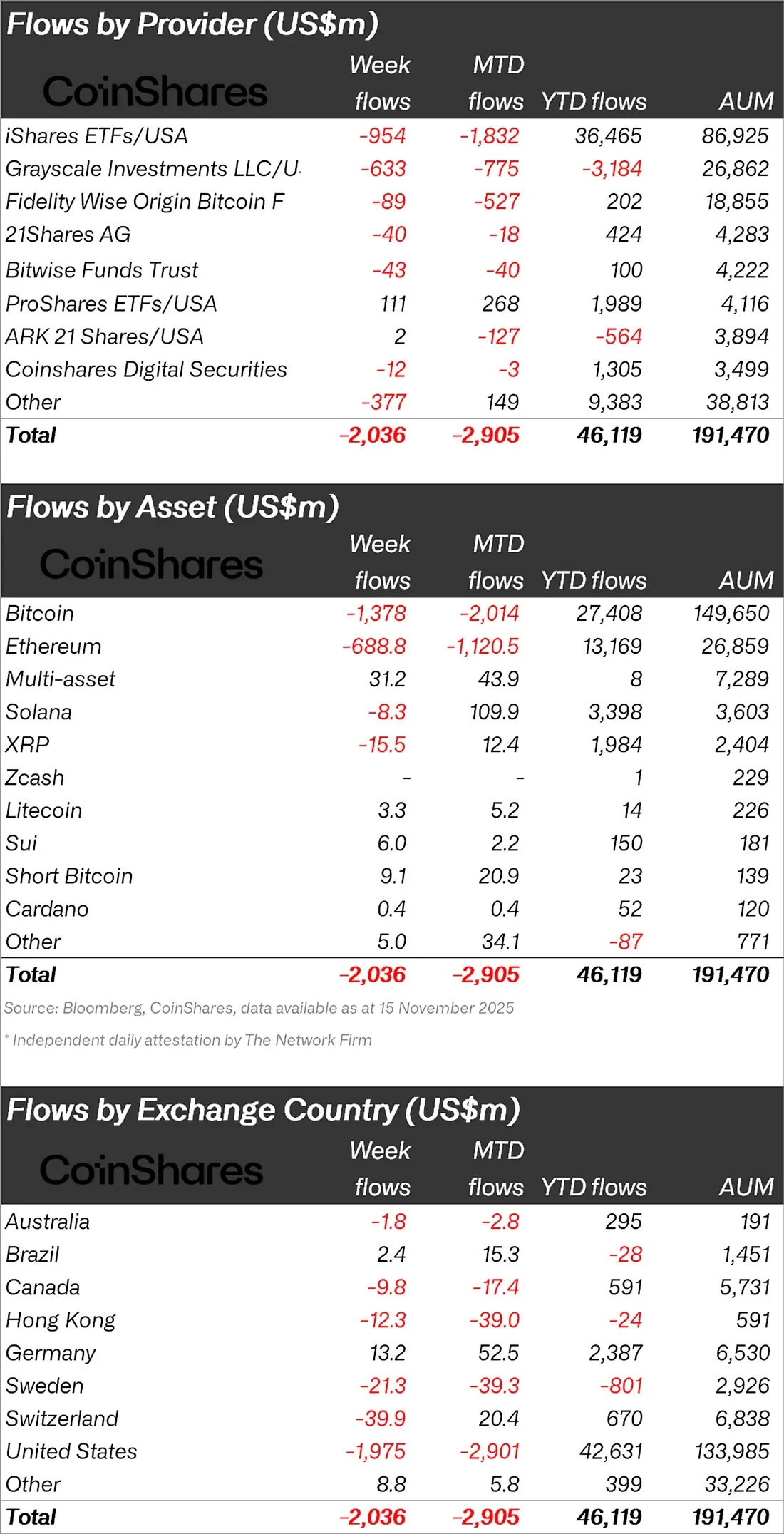

Global crypto investment products experienced a record capital outflow of $2 billion last week. The latest data from CoinShares indicates the sharpest weekly decline since February. This suggests that both uncertainty about a macro-level interest rate cut and the sell-off by large crypto investors are putting new pressure on the market.

CoinShares Research Director James Butterfill states that the reshaping of interest rate cut expectations in recent weeks has disrupted investor behavior. Combined with the accelerated selling by large wallets, the three-week total outflow has reached $3.2 billion. The pullback in digital asset prices has reduced total assets under management from $264 billion in early October to $191 billion.

The US is at the center of these outflows. The $1.97 billion outflow alone accounts for 97 percent of global capital losses. This figure demonstrates a significant weakening of risk appetite across a broad spectrum, from institutional investors to individual funds. Switzerland and Hong Kong also contributed to the negative outflows, with outflows of $39.9 million and $12.3 million, respectively.

Germany, however, painted a completely different picture. German investors capitalized on the recent declines, generating net inflows of $13.2 million. Butterfill emphasized that Germany's historical tendency to be more "opportunity-focused" during downturns resurfaced this week.

The Latest Bitcoin and Altcoin Outlook

Outflows were sharp on Bitcoin. Last week, $1.38 billion in investment products were withdrawn from the market. The three-week total loss represents approximately 2 percent of the managed assets of Bitcoin ETPs. The outflow for Ethereum is proportionally weaker. The weekly outflow of $689 million corresponds to 4 percent of the AuM in Ethereum products. Solana saw outflows of $8.3 million and XRP of $15.5 million. These figures reflect continued risk aversion across a broad segment of the market.

However, the picture is not entirely one-sided. In the last three weeks, $69 million inflows were generated into multi-asset investment products. Investors' tendency to diversify during volatile periods is strengthening. The increased demand for short-bitcoin products is also noteworthy; net inflows over the three weeks reached $18.1 million. This movement suggests investors are taking more aggressive hedging positions against downside risk.

Following the US government reopening, there were expectations of a short-term market relief. However, these hopes quickly dissipated. The Bitcoin price fell to six-month lows, testing the $95,000 level. The delay in the influx of fresh liquidity on the macro side and the selling pressure in the cryptocurrency are delaying the market recovery for now.