BNB Technical Analysis

BNB Chain is set to launch its own stablecoin. The goal of this token is to increase liquidity within the network and make money flow more easily between applications on BNB Chain. This move could support not only DeFi and trading volume, but also allow users to move more smoothly between different services on the same chain. A native stablecoin would strengthen BNB Chain’s goal of building a more independent and comprehensive financial ecosystem.

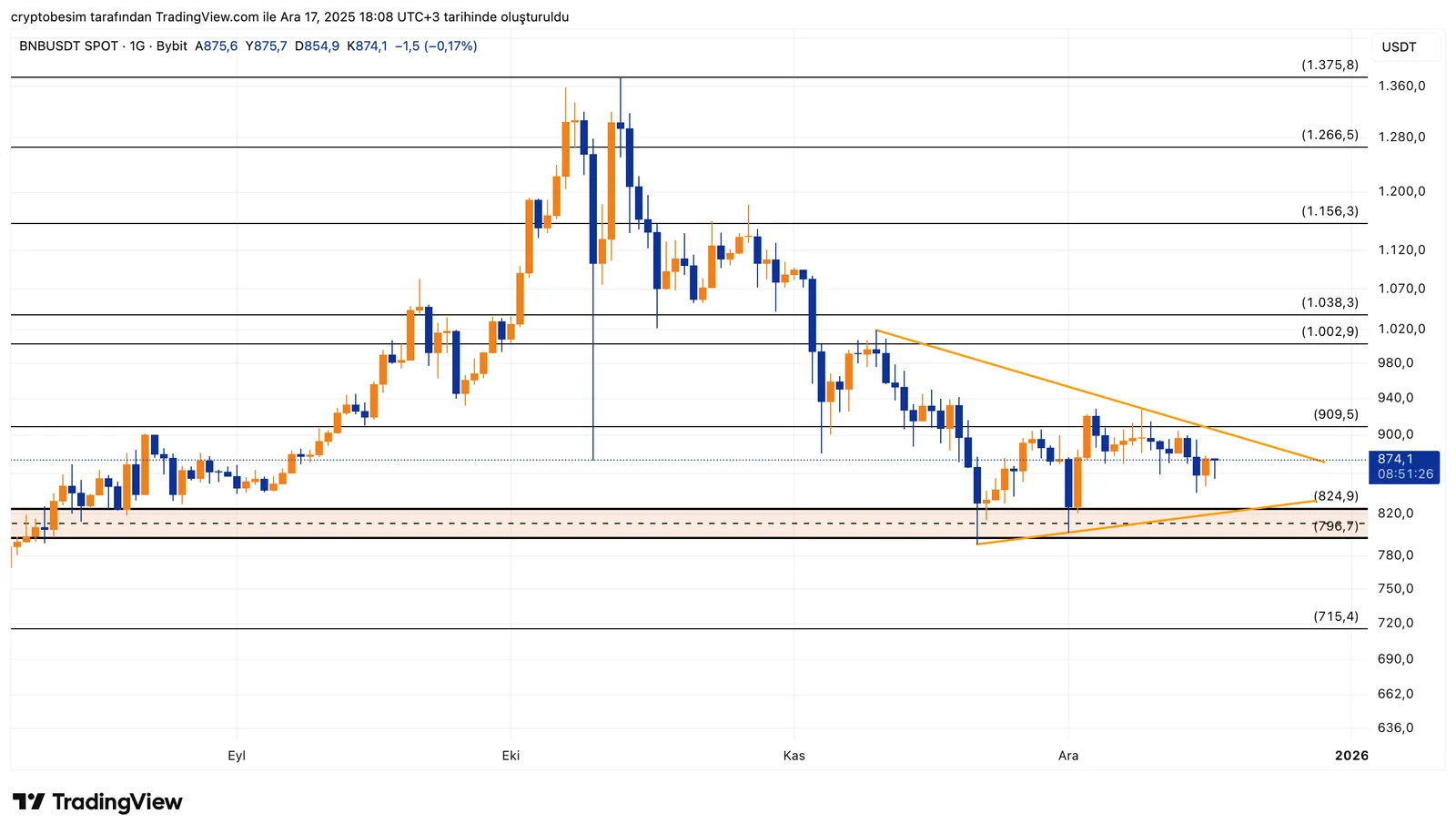

Analyzing the coin chart on the daily time frame, we see that BNB is forming a clear symmetrical triangle. The price is trying to hold this consolidation by finding support at the Fibonacci 0.618 level. After the recent drop, the $820–$800 zone acted as a strong demand area, as it overlaps with both the 0.618 Fibonacci level and the rising lower trend line. The bounce from this area suggests that selling pressure is weakening and buyers are still active.

The $820–$800 zone is the key level in the short term. As long as the price stays above this area, the triangle structure remains valid and the chance of an upward breakout stays alive. On the upside, the first important resistance is $900–$910. This zone is both a horizontal resistance and close to the upper trend line of the triangle. A clear breakout and daily closes above this level could open the way toward $940, followed by the $1,000–$1,030 range. The $1,020–$1,038 area stands out as a major target, as it was a zone of strong selling in the past.

Daily closes below $800 would weaken the structure and could push the price toward $780, then $750–$715. Losing this area would confirm a downward breakout of the triangle and could lead to a deeper decline.

In summary, BNB is in a decision phase, consolidating above the Fibonacci 0.618 support. If support holds, an upside breakout is possible; if it fails, selling pressure is likely to increase.

These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, the user is responsible for their own actions and risk management. Morover, it is highly recommended to use stop loss (SL) during the transactions.