Bitcoin (BTC) surged 5% early Friday morning, surpassing $118,000 to reach an all-time high. Rising interest from institutional investors and strong inflows into spot Bitcoin ETFs are among the primary drivers of this Bitcoin record. In the last 24 hours, the price of Bitcoin has climbed to $118,254, while Ethereum (ETH) also rose 7% to $3,000.

The $1.18 billion inflow into spot Bitcoin ETFs on Thursday, in particular, marked the second-highest daily inflow since the launch of these products.

BTSE COO Jeff Mei stated that Bitcoin's new high could be the start of a major bull run. Vincent Liu, chief investment officer at Kronos Research, stated that a calmer macroeconomic environment and increasing institutional adoption are leading investors back into BTC. Liu also stated that the perception of Bitcoin as a "gold-like, long-term regulated asset" has reinforced institutional confidence.

Presto Research analyst Min Jung also emphasized that expectations of a US interest rate cut and institutional investors' risk appetite are driving the increased demand for ETFs. Jung said, "We are observing more institutional investors, led by companies like Strategy, incorporating Bitcoin into their strategic asset allocations. The easier access provided by ETF approvals supports this expanding demand base."

Many investors liquidated with the price increase

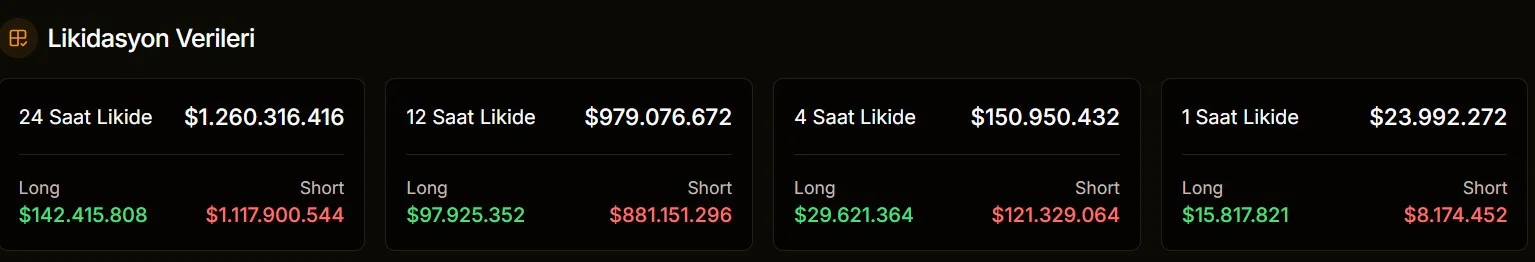

However, Bitcoin's rise wasn't limited to institutional inflows. A large wave of liquidations also occurred on the futures side. According to JrKripto's liquidation data, $1.26 billion worth of positions were liquidated in the last 24 hours, $1.11 billion of which came from short positions. This was the largest short liquidation so far in 2025.

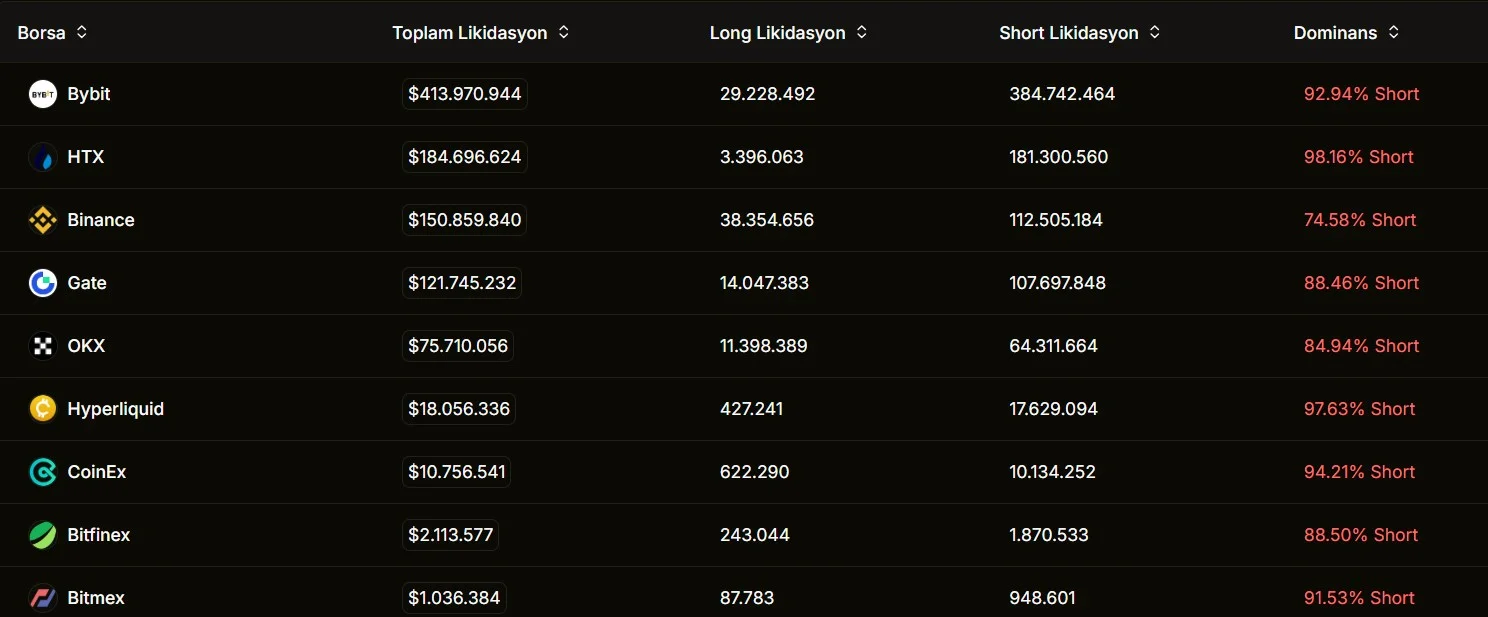

The largest liquidation occurred in a $88.5 million short position opened on the HTX exchange in the BTC-USDT pair. According to data, a total of 237,000 investors liquidated in this wave. Bybit led the way with $461 million in liquidations, followed by Binance and HTX. More than 92% of positions on Bybit were short.

In leveraged trading, short positions are automatically closed when prices rise, which can create a domino effect that further accelerates the rise. Indeed, the recent price jump demonstrated the impact of this mechanism.

Meanwhile, the US CPI data, due in mid-July, and expectations for an interest rate cut will be decisive for the market. According to analysts, the decline in macroeconomic uncertainty is increasing interest in crypto assets. Proposed legislation such as the GENIUS Act and the removal of restrictions on crypto broker taxes are seen as particularly positive for the market.