The latest US inflation data generated widespread market buzz, and Bitcoin's price was not immune. The larger-than-expected increase in the Consumer Price Index (CPI) in June prompted investors to reconsider their expectations for the Fed's interest rate policies. Bitcoin, however, experienced a brief pullback amid this uncertainty, but has recovered rapidly to stabilize around $117,000.

US Inflation on the Rise

According to data released by the US Department of Labor, the annual US CPI data rose to 2.7% in June. This rate is up from May's 2.4% and marks the highest annual increase since February. Monthly, the CPI increased by 0.3%, its sharpest increase in five months.

Core inflation, which excludes volatile food and energy prices, is also on an upward trend. In June, the core CPI reached 3% year-over-year and increased by 0.3% month-over-month. These developments, in particular, indicate that the new tariffs recently implemented by President Donald Trump's administration are beginning to impact consumer prices.

What direction will the Fed's interest rate policy take?

Markets have long been expecting the Fed to cut interest rates this year. However, these strong inflation data releases could prompt the US Federal Reserve to take a more cautious approach. Inflation running above the 2% target may require the Fed to maintain its hawkish stance.

Bitcoin's reaction: A brief decline, followed by a recovery

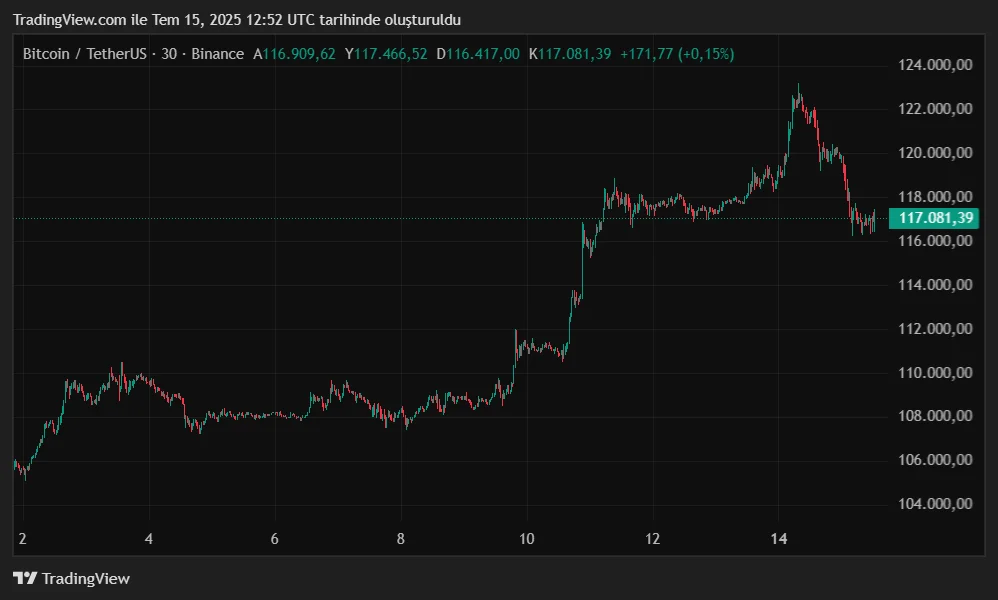

Following the release of the inflation data, the BTC/USDT pair initially experienced a brief pullback. After testing $123,000 on the night of July 14, it fell to $116,000 following the data release. However, this decline was short-lived. As seen in the image, prices recovered towards noon on July 15, stabilizing around $117,000.

In this period where macroeconomic developments are increasingly decisive, Bitcoin's direction will largely depend on the Fed's statements and new inflation data released in the coming months. While the $117,000 level currently stands as a stabilizing point, investors clearly need more dovish messaging to break out.

With the release of US PPI and unemployment figures in the coming weeks, Bitcoin's price may see renewed momentum. However, increased volatility seems inevitable during this period.