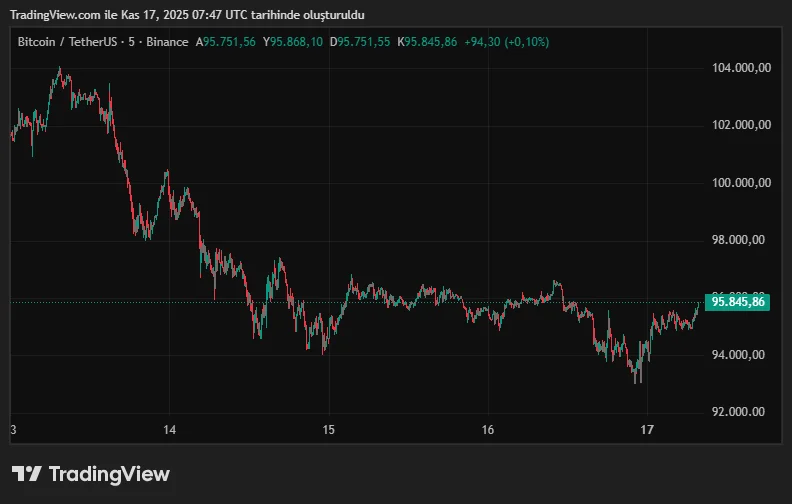

The Bitcoin market entered the weekend with a sharp sell-off, hitting a new low that pushed the price to a six-month low. The sell-off, which accelerated on Sunday afternoon, pushed BTC to $93,000, and analysts say this sharp move, despite no apparent compelling reason, is due to a "structural disruption." The Kobeissi Letter team considers this surge in volatility not a random wave but the beginning of a new bear cycle.

Bitcoin has lost approximately 25 percent of its value since its all-time high in early October. While the price eased to the $95,000 range amid the sharp sell-off over the weekend, analysts describe this decline as "strange." The current macro environment suggests a more positive backdrop for Bitcoin under normal circumstances. Inflation in the US is slowly declining, the Fed continues its interest rate cuts, and expectations for a trade agreement between Washington and Beijing have strengthened. President Trump even recently stated that "America should be number one in crypto." Therefore, the market's downward movement isn't based on a classic negative development. The Kobeissi team states that the decline is a "mechanical and structural" disruption, triggered by the massive outflow of institutions at the end of October. In the first week of November alone, there was a net outflow of $1.2 billion from crypto funds, one of the largest weekly outflows ever recorded.

Increasing Leverage Use: A Major Problem in the Market

The problem is compounded by leverage. The outflow of institutional funds, coupled with the high leverage used in derivatives markets, has exacerbated price movements. Liquidations exceeded $1 billion in three of the last 16 trading days. Daily liquidations exceeding $500 million have become commonplace. When such large liquidations occur during periods of relatively weak trading volume, the market moves sharply in both directions. This causes sentiment to shift from extreme optimism to intense fear within a few days.

The Bitcoin Fear and Greed Index fell to its lowest level since February over the weekend. Interestingly, BTC is still 25% above its April lows. Analysts summarized the reason for the current volatility by saying, "Leverage magnifies even the smallest shift in investor sentiment."

ETF outflows are at their peak

Meanwhile, ETF outflows are also weighing on the picture. US spot Bitcoin ETFs saw a total outflow of $1.11 billion between November 10 and 14. BlackRock's IBIT fund alone lost $532 million. Grayscale Bitcoin Mini Trust saw outflows of approximately $290 million in a single week. This trend suggests a short-term cooling in institutional demand.

A total of $617 million was liquidated in the crypto market over the weekend, $243 million of which came from BTC and $169 million from ETH. At the time of writing, Bitcoin is trading around $95,200, its lowest level in the last six months. Despite this outlook, analysts at Kobeissi Letter argue that the market's fundamentals continue to strengthen. The macro outlook is supportive, regulatory uncertainty is decreasing, and some long-term investors see these levels as an opportunity to accumulate. The analysts note, "These structural breaks will clear over time. The bottom may be near," indicating that this process is temporary.