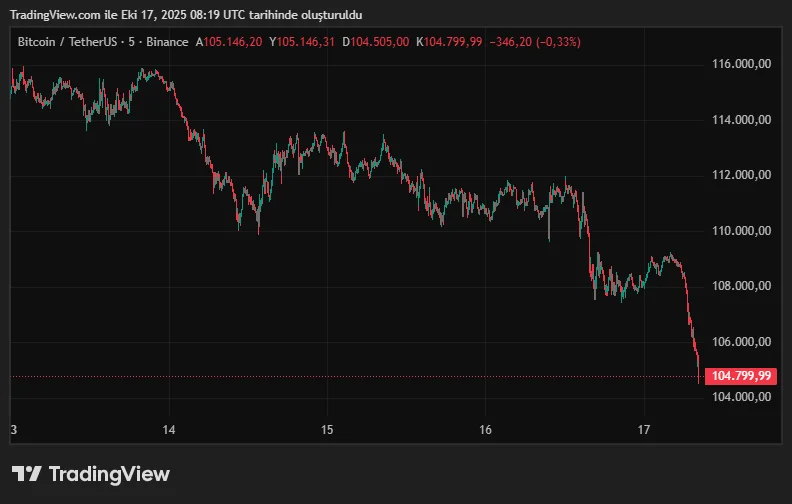

A sell-off continues in the cryptocurrency market. The price of Bitcoin fell to $105,000 as of the morning of October 17th, its lowest level since early September. This decline was fueled by both the re-escalation of trade tensions between the US and China and signals of weakness in US regional banks. Ether fell 1.5% to $3,928, while other major cryptocurrencies such as BNB, XRP, and Solana followed suit.

The Fear & Greed Index, which measures market sentiment, fell to 22, indicating that investors are in the "extreme fear" zone. This sentiment is also paralleled by the uncertainty in US stock markets.

Statements regarding bad loans from regional banks in the US, particularly Zions Bancorp and Western Alliance Bancorp, have brought the fragility of the financial system back into the spotlight. Furthermore, US President Donald Trump's statement, "We are in a trade war with China," has created a new wave in the markets. These statements have created selling pressure on all risk assets, from stocks to crypto. Presto Research analyst Min Jung said, “The market is completely driven by headlines surrounding the US-China trade war. The state of regional banks is also damaging investor confidence.” Vincent Liu, investment director at Kronos Research, commented, “While BTC and ETH are more resilient than stocks, any macro shock can quickly reverse the market due to low liquidity.”

JPMorgan explains the reason behind the decline in Bitcoin and altcoins

However, according to JPMorgan analysts, the main reason for this sharp decline in recent weeks is crypto-specific investor behavior rather than external developments. The bank's analysts note that last week's liquidations largely came from "crypto-native" traders, while traditional ETF investors and institutional players did not sell heavily during this period.

According to JPMorgan data, there was a net outflow of only $220 million from Bitcoin ETFs and $370 million from Ethereum ETFs between October 10-14. These figures represent a very small fraction of total assets under management. In contrast, open interest in the perpetual futures market, which is heavily used by crypto investors, fell by 40% in dollar terms. Analysts describe this data as "a wave of liquidations sharper than price declines."

Last week, markets experienced the largest liquidation in history, wiping out more than $20 billion in leveraged positions. The closing of over 1.5 million positions in just one week shook the market. Bitcoin is currently trading around $105,000. JPMorgan predicts that interest rate cuts or new spot ETF approvals could spark a recovery in the fourth quarter, but volatility will remain high in the short term.