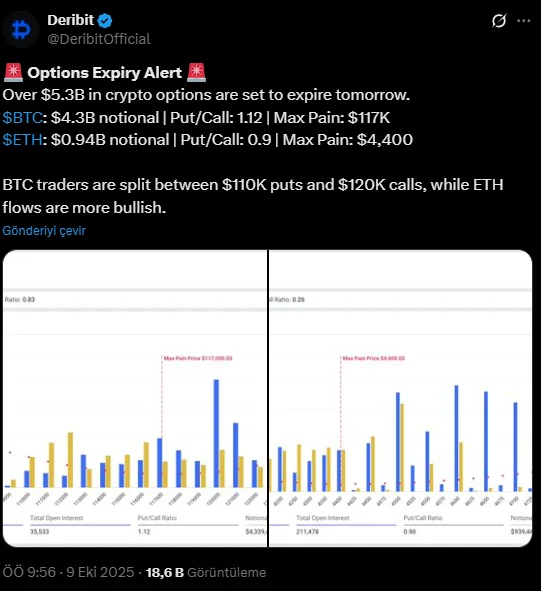

Volatility in the crypto market could rise again this weekend. According to Deribit data, a total of $5.3 billion worth of Bitcoin and Ethereum options contracts are expiring today. This development both increases uncertainty about price direction and suggests that sharp market movements are possible heading into the weekend.

Critical level for Bitcoin: $118,000

Bitcoin options account for the majority of this massive expiration volume. A total of $4.7 billion worth of contracts are set to expire today. According to analysts, the "maximum pain" level in the market before this expiration, or the price at which option buyers incur the most losses, is around $118,000. This level is also seen as a key short-term support level for Bitcoin.

Deribit data shows that Bitcoin investors' positions are split in two: one group is focused on $110,000 worth of put options, while the other maintains bullish expectations with $120,000 worth of calls. This imbalance could pave the way for sharp price movements heading into the weekend.

Bitcoin's put/call ratio in the options market is currently at 1.10. This ratio suggests that investors are seeking some downside protection, but the overall outlook remains balanced.

More optimistic sentiment prevails on Ethereum

The outlook for Ethereum is slightly more positive. Approximately $944.5 million worth of ETH options will expire today. Ethereum's put/call ratio is at 0.90, meaning there are more buy positions than sell positions. This suggests investors believe in short-term upside potential.

The maximum pain level for Ethereum is $4,400. A price hold above this level could bolster market confidence for the weekend. However, a drop below $4,300 could increase the likelihood of a short-term correction.

Liquidity decreases and volatility increases

Large-scale option expirations can cause sudden directional changes in the spot market. This is because many investors are forced to close or rebalance their positions after expiration. This, in turn, increases price volatility with high volumes of transactions on both the buy and sell sides.

Glassnode's latest data reveals that Bitcoin is still trading above its short-term investor cost floor. While this suggests continued upward momentum, it also poses the risk of market overheating. According to analysts, it is critical for the price to maintain the $118,000 support level; otherwise, liquidations in leveraged positions may occur.

On the Ethereum side, the increase in open interest indicates that institutional and individual investors are reshaping their market expectations. This makes determining the direction in the short term even more difficult.

With the expiration of a total of $5.6 billion in options, the price of both Bitcoin and Ethereum may experience short-term sharp price movements. Historically, the market has experienced high volatility for several days following such large expiration periods. Experts predict that Bitcoin could rally back to $120,000 and above if it manages to hold above $118,000, while Ethereum has the potential to rally toward $4,750 as long as it stays above $4,400. However, a breakdown of these support levels could see further selling pressure in the market throughout the weekend.