As the US federal government shutdown continues into its second day, cryptocurrency markets are exhibiting a strong recovery. Historically, government shutdowns have led to a surge in stocks; this time, a similar effect is being seen in Bitcoin and Ethereum. Bitcoin tested $121,000 on Thursday, reaching its highest level since mid-August. Ethereum, meanwhile, traded above $4,500, reaching a three-week high.

Experts emphasize that the correlation between crypto assets and stocks will increase significantly by 2025. Since 1990, the rise in the S&P 500 index during every government shutdown has boosted investors' risk appetite. In this context, Bitcoin is reportedly benefiting from the same wind.

The record-breaking rise in the gold market is also providing additional support to Bitcoin. Gold has reached an all-time high of over $3,900 per ounce. JPMorgan analysts predict that Bitcoin remains relatively cheap compared to gold at volatility-adjusted valuations and could rise to $165,000 by the end of the year. The recent shift by individual investors toward both gold and Bitcoin suggests that the pursuit of protection against inflation and currency depreciation, known as "debasement trading," is gaining traction.

Cryptos Also Have Institutional Support

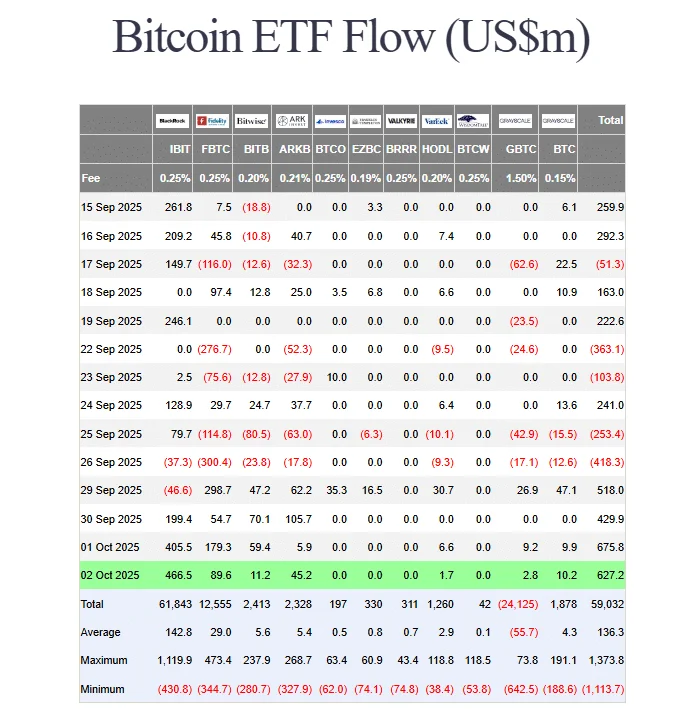

On the institutional front, spot Bitcoin ETFs have begun to play a significant role in the market. On October 1st, the daily trading volume of spot Bitcoin ETFs in the US surpassed $5 billion. BlackRock's iShares Bitcoin Trust (IBIT) fund alone attracted $405 million in inflows and currently holds 773,000 BTC, reaching a size of approximately $93 billion.

Fidelity also added a $179 million position by purchasing 1,570 BTC in a single day. This brings the total assets under management of spot Bitcoin ETFs to $155.9 billion. This figure corresponds to 6.6 percent of Bitcoin's total market capitalization.

Another development that has increased investor interest has come from traditional giants. Vanguard, which has long distanced itself from crypto, is considering offering Bitcoin and Ethereum ETFs to its clients. New CEO Salim Ramji's background at BlackRock signals a possible softening of the company's approach. Even just 1 percent of Vanguard's 50 million clients accessing ETFs could mean half a million new investors entering the market.

On the macroeconomic front, the probability of another Fed rate cut at its October meeting is priced at 98 percent. Both stocks and crypto assets began to rally after the first rate cut in September. A new rate cut could reinforce the markets' upward momentum.

All these factors combined further strengthen expectations for October, known within the crypto community as "Uptober," historically the strongest month for Bitcoin. Bitcoin, which has risen by over 14 percent on average in October since 2013, may be no exception this year. According to analysts, the technical outlook opens the door for a potential move to $128,000.