Bitcoin and Ethereum have staged a remarkable recovery after the sharp decline over the weekend. The sell-off that began on Friday led to the largest liquidations in crypto history to date. However, analysts believe the bullish sentiment dubbed "Uptober" hasn't completely faded; the market is regaining its footing after a short-lived shock.

$19.1 billion in cryptocurrency positions liquidated

According to Coinglass data, more than 1.6 million investors liquidated positions on Friday alone, closing a total of $19.1 billion. Bitcoin briefly fell below $105,000, while Ethereum fell to $3,500. This sharp decline was triggered by macroeconomic developments. China's new restrictions on rare earth exports and the US's retaliatory announcement of 100% tariffs on Chinese technology products have shaken global risk perception. This news, arriving just as markets were closed, combined with low liquidity over the weekend, led to a cascade of liquidations. Presto Research researcher Rick Maeda stated that the crash was “not a crypto-specific panic, but a macro-driven liquidation wave.” According to Maeda, the sell-offs amplified by low trading volumes over the weekend, leading to billions of dollars in forced liquidations. “A purge of this scale has de-leveraged the system. The rise we’re seeing now is a result of this mechanical process,” he said. He added that investors aren’t overly concerned about the US-China tariffs: “Polymarket data only prices in a 15% chance that these tariffs will take effect by November 1st. This suggests the market views these risks as limited.”

Bitcoin at $115,000

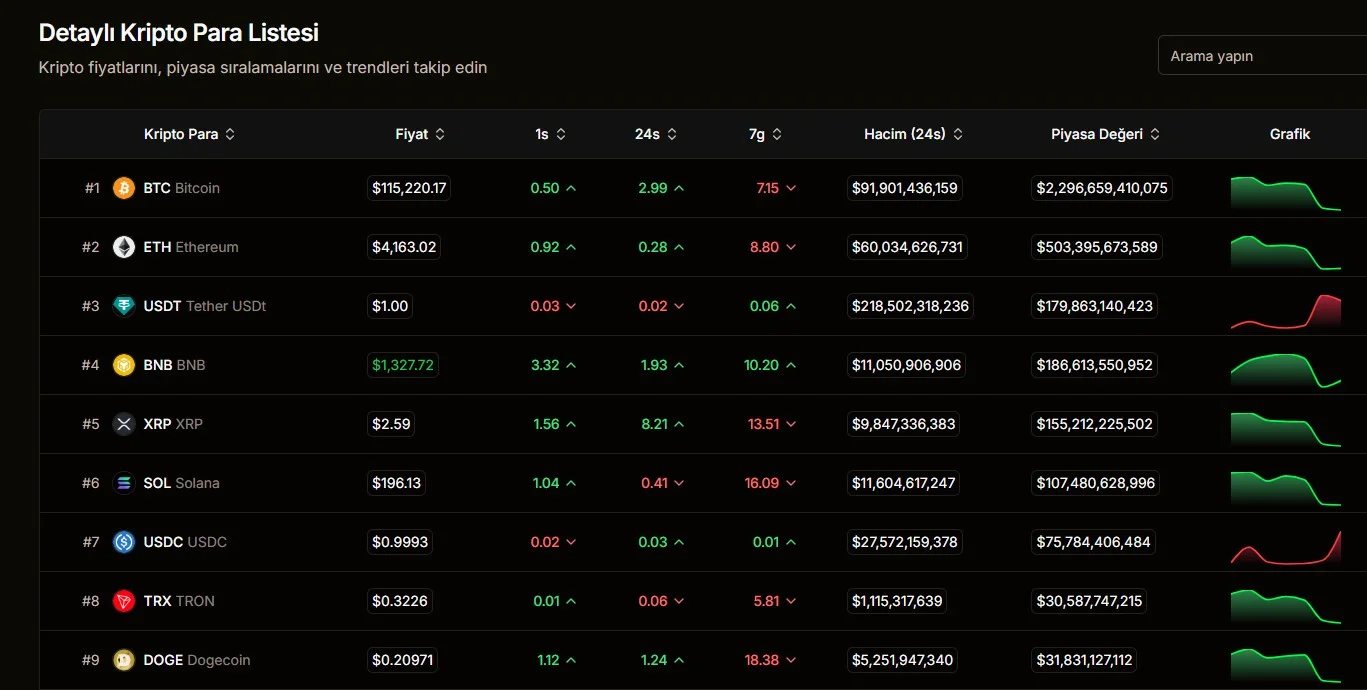

Bitcoin’s price has stabilized after the weekend’s sharp sell-off, trading at $115,220 at the beginning of the week. Ethereum is also trading at $4,163, up 0.3% in the last 24 hours. The rest of the market is also showing signs of a slight recovery; BNB rose 1.9 percent to $1.327, while XRP rose 8.2 percent to $2.59. Solana is trading around $196. The total market capitalization has risen again above $2.3 trillion, with trading volumes reaching $91.9 billion for Bitcoin and $60 billion for Ethereum.

Analyst Vincent Liu interpreted this recovery as a sign of "recovering risk appetite following panic selling." According to Kronos Research's investment director, the reduction in leverage and easing of tariff concerns have "re-encouraged the market." Liu said, "Traders are currently monitoring factors such as tariffs, technical trend lines, and dollar strength to test whether Bitcoin can sustain this upward trend."

Nassar Achkar, CoinW's strategy director, maintains that the "Uptober" trend is still alive. He believes investors are now focused on macroeconomic indicators, particularly the upcoming US Consumer Price Index (CPI) report and the Fed's interest rate decision, for direction. "ETF flows also indicate continued institutional interest in the market, suggesting a sustained recovery," he added.

LVRG Research director Nick Ruck also noted the promising on-chain data. According to Ruck, whales have reaccumulated in many assets, particularly Ethereum. "Technical indicators are signaling a strong reversal from oversold territory. This confirms the bottoms for many altcoins," he said.

Despite this, Maeda believes the scars of the market's "trauma" will not fade easily. "We are facing the largest liquidation event in crypto history. This will have a lasting impact on investor psychology. The market is now much more sensitive to macro shocks, especially the US-China trade tension," he warned.

Looking at the overall picture, the crypto market is seeking stability again after a period of significant volatility. The "Uptober" sentiment has been dashed, but it hasn't completely faded. Deleveraging, on-chain buying, and institutional inflows from ETFs are creating cautious optimism in the short term. Bitcoin holding steady around $115,000 and Ethereum holding above $4,000 suggest investors are regaining confidence for now.