Cryptocurrency exchange giant Binance made a fast start to June and shared many new features and campaigns across the platform with its users. We have compiled the highlights of Binance's latest announcements, which draw attention with the diversity in investment products and measures to increase platform security.

New program to increase altcoin liquidity launched

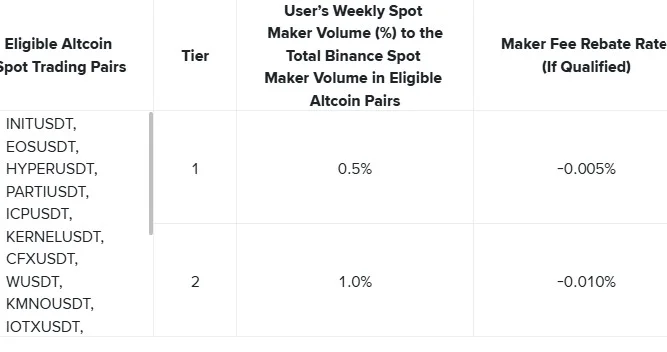

Binance aims to create a stronger liquidity environment on certain altcoin trading pairs with the Spot Altcoin LiquidityBoost Program, which will be launched on June 9. Through this program, users will be able to achieve tighter spreads, lower price slippage and an overall more efficient trading experience.

Users trading as market makers under the program will benefit from two different incentive levels depending on trading volume. On a weekly basis, users whose trading volume reaches 0.5% of the volume of eligible trading pairs on Binance will receive a rebate of 0.005%, while users who reach 1.0% will receive a rebate of 0.01%.

The trading pairs within the program are quite diverse. Binance has included the following spot trading pairs in this liquidity support program:

INIT/USDT, EOS/USDT, HYPER/USDT, PARTI/USDT, ICP/USDT, KERNEL/USDT, CFX/USDT, W/USDT, KMNO/USDT, IOTX/USDT, ONDO/USDT, TON/USDT, FIL/USDT, WCT/USDT, BABY/USDT, SXT/USDT, SYRUP/USDT and STO/USDT.

By trading in these pairs, participants will be evaluated according to their weekly market maker volumes and will be able to access favorable repayment rates. In addition, for accounts that participate in the Spot Liquidity Provider Program with this program, the more advantageous rate will apply to the pairs traded.

New assets added to Binance Loans and VIP Loan

Binance has added new crypto assets to its flexible rate borrowing product, Binance Loans (Flexible Rate), and VIP Loan platforms targeting high-volume users. Vaulta (A) can now be used as collateral or borrowing asset in both flexible and VIP loan products. In addition, Haedal Protocol (HAEDAL), Huma Finance (HUMA), Sophon (SOPH) and World Liberty Financial USD (USD1) have been activated in VIP Loan only.

New earning opportunities in Yield Arena

There are also innovations on the Binance Earn front. Among the campaigns within the Yield Arena, BABY Simple Earn Locked Products, offering up to 20.9% APY, and the Dual Investment June leadership program, which distributes rewards up to 3,600 USDC, stand out. In addition, flexible interest rates and bonus tiered reward systems are on the agenda for various cryptocurrencies such as ETH, USDT, USDC, FDUSD, BMT and SOPH. Locked products offer fixed-term high interest rates on tokens such as NEAR, SUI, LISTA.

Some pairs are being delisted

Some trading pairs that are insufficient in terms of liquidity and trading volume are being removed from the platform. As of 06:00 on June 6, 2025, trading pairs ACX/FDUSD, IDEX/FDUSD, ORCA/FDUSD, THETA/FDUSD and XAI/FDUSD will be discontinued. However, the tokens themselves will still be traded on other trading pairs.

Strict control of bot usage

Finally, Binance has taken a new step against bot use to maintain fairness in the Alpha program. The exchange announced that it has strengthened its risk control systems to identify accounts that use automated tools to earn Alpha Points. Users who take such actions will be banned from the program and additional sanctions may be imposed.