Institutional adoption of cryptocurrencies is accelerating. Most recently, Nature's Miracle, a vertical farming technology company, attracted attention with its $20 million investment in XRP. This move demonstrates confidence in the growing use of XRP in institutional payment infrastructures and its advantages.

Nature's Miracle Makes Institutional XRP Move

Nature's Miracle announced in a press release that it plans to add up to $20 million in XRP to its treasury. This strategic investment will be financed through equity financing, which was realized through the company's SEC-approved S-1 registration statement. CEO James Li stated that this initiative is a strategic move to reduce the costs of international payments in the long term, leverage the speed and liquidity advantages of XRP, and establish a stronger interaction with the Ripple network. Li said in a statement, “Following the GENIUS Act, signed by President Trump on July 18, 2025, more institutions began viewing cryptocurrencies as treasury assets. The interest of major players like Banco Santander and American Express in XRP clearly demonstrates the potential of this token.”

With this move, Nature’s Miracle, one of the first companies to be listed on a US stock exchange, has directly incorporated XRP into its treasury strategy. Initially, XRP will be purchased with funds from the S-1 filing. However, the company stated that it may increase its XRP reserves through new fundraising, share issuance, or structured financing methods in the future.

In addition to all this, Miracle plans to increase the use of XRP within the Ripple ecosystem. Instead of simply holding its tokens in reserve, the company could also invest them through methods such as staking and generating additional income.

Institutional XRP adoption is growing

Nature’s Miracle’s move stands out as part of the institutional XRP trend. Many public companies have recently begun taking similar steps:

- Nasdaq-listed Trident is working on a massive $500 million XRP treasury plan.

- Webus announced in its filing with the SEC that it aims to establish a $300 million XRP-focused digital asset operation.

- VivoPower secured funding for a $121 million XRP treasury.

- Thumzup Media approved a $250 million investment plan in digital assets.

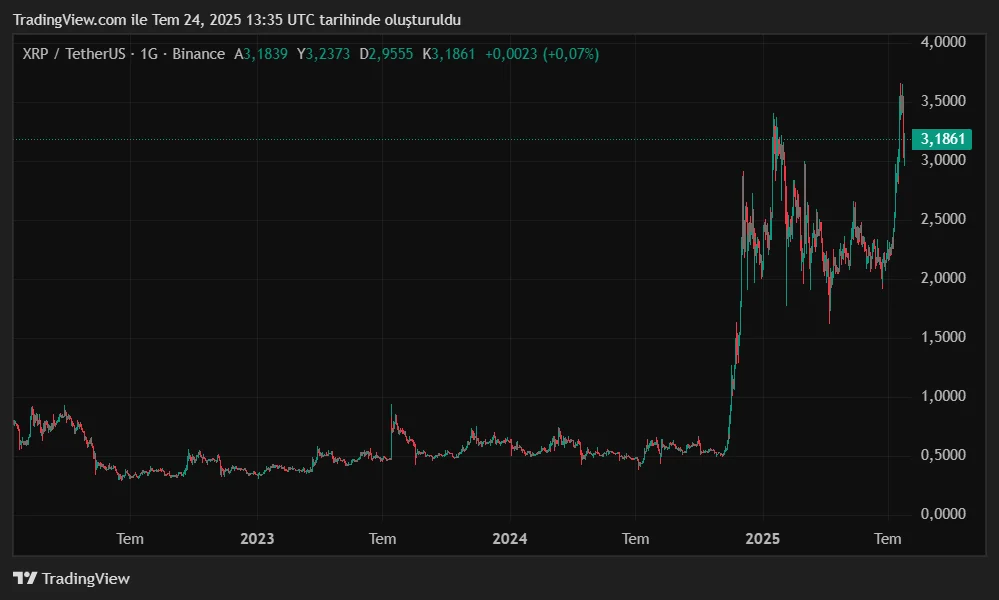

XRP recently broke records

For those unfamiliar, it's worth reminding: XRP is a digital asset developed by Ripple that offers speed and cost advantages, particularly in international money transfers. XRP, which stands out as an alternative to the traditional SWIFT system in interbank transactions, stands out with its ability to process transactions in seconds. It is actively used by many financial institutions via the RippleNet network.

As of July 24, 2025, the price of XRP is trading at $3.16. During the day, the price fluctuated between $2.99 and $3.36. XRP has a total market capitalization of approximately $187.4 billion, with a 24-hour trading volume exceeding $16.8 billion. The XRP price recently reached an all-time high of $3.65 on July 18, 2025.