Investment behavior in the United States is undergoing a fundamental transformation. Recent studies reveal that public interest in Bitcoin has surpassed that of gold. This shift affects not only individual investors but also national reserve policies. The growing acceptance of digital assets at both institutional and strategic levels is reinforcing the U.S.’s leadership in the crypto era.

Bitcoin Surpasses Gold

According to a comprehensive survey conducted by The Nakamoto Project, 80% of Americans support converting a portion of the country’s gold reserves into Bitcoin. In this poll of 3,345 participants, the proposed median conversion rate was 10%, though some respondents supported rates as high as 20%. When broken down by age group, individuals aged 26–30 were the most supportive of the shift, followed by those under 26 and those aged 31–35. This indicates growing confidence and interest in digital assets among younger generations.

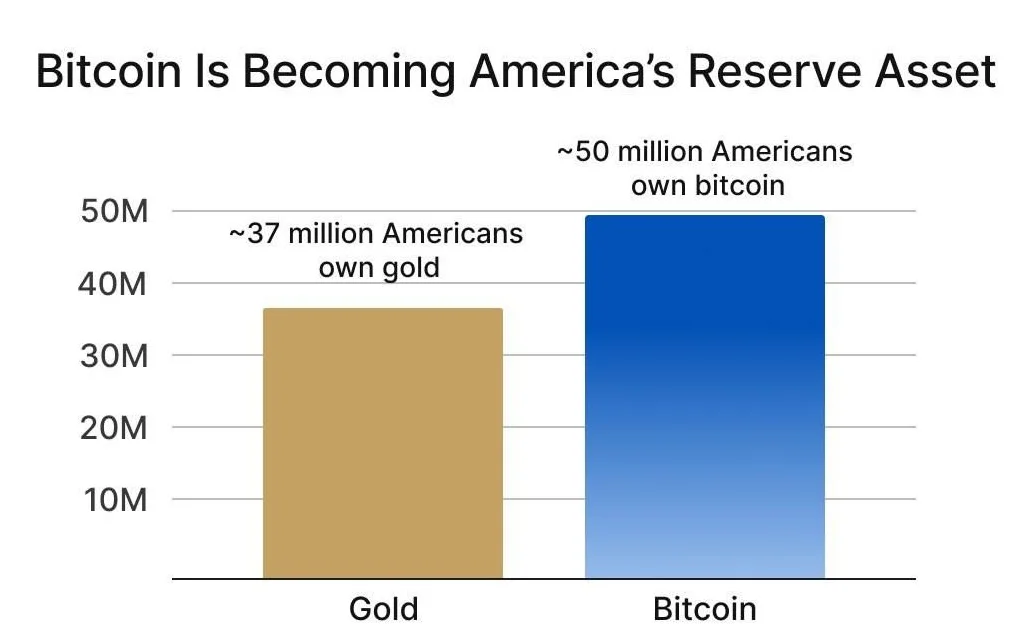

The numbers back this up: approximately 50 million Americans own Bitcoin, compared to around 36–37 million who own gold. This data shows that Bitcoin has evolved beyond being merely an alternative investment—it has become a serious competitor to traditional stores of value.

National Reserves and Institutional Strength

The U.S. government has not remained indifferent to this societal shift. In 2025, President Donald Trump signed an executive order to establish a “Strategic Bitcoin Reserve,” which is planned to be backed by approximately 207,189 BTC. Additionally, a legislative proposal introduced by Senator Cynthia Lummis outlines a plan for the U.S. to acquire 1 million BTC over the next five years.

On the institutional side, a similar trend is emerging. BlackRock’s iShares Bitcoin Trust (IBIT), with $33.2 billion in assets under management, has surpassed the iShares Gold Trust (IAU), strengthening the positioning of digital assets over gold. According to data from blockchain firm River, Americans hold 40% of the global Bitcoin supply, equating to a value of approximately $790 billion. Moreover, U.S.-based publicly traded companies account for 94.8% of corporate Bitcoin holdings.

The Bitcoin Potential of U.S. Gold Reserves

The official U.S. gold reserve stands at 8,133 metric tons. However, this reserve is still valued based on the 1973 fixed price of $42 per ounce, which pegs the total value at just $11 billion. In contrast, using the current market price of $3,200 per ounce, the actual value exceeds $834 billion. The $820 billion gap between these two figures theoretically represents a massive potential for Bitcoin investment.

Is Bitcoin the New Generation Reserve Asset?

This intense interest in Bitcoin reflects not only a shift in individual investment preferences, but also the emergence of digital assets as components of national economic strategies. The growing confidence of both the American public and policymakers in Bitcoin suggests that digital assets will play a more central role in the global financial system in the years to come.

Challenging the traditional gold standard, Bitcoin is steadily progressing toward becoming the reserve asset of the future—for both new-generation investors and institutional decision-makers.