Bitwise, a US-based investment giant, is expanding its foray into the crypto ETF space. The company's spot Chainlink ETF, codenamed CLNK, has been added to the Depository Trust & Clearing Corporation (DTCC) in the US. This development marks the product's arrival, marking the ETF's operational readiness despite the lack of official approval.

CLNK surpasses critical pre-launch threshold

DTCC is the agency responsible for clearing and custody of securities transactions in the US. Being listed on the agency's "active and pre-launch" list generally indicates that an ETF has completed its technical preparations and can begin trading quickly after approval. The inclusion of Bitwise's CLNK fund on this list demonstrates that all the necessary infrastructure has been established for a rapid launch following regulatory approval.

However, the crucial point here is that DTCC listing does not imply SEC approval. The US Securities and Exchange Commission (SEC) remains the final arbiter of an ETF's ability to trade in the market. Therefore, the timing of CLNK's trading depends entirely on the SEC's decision.

This development stands out as another example of the growing interest in ETFs in the crypto market. Following spot Bitcoin and Ethereum ETFs, asset managers are now racing to offer investors funds based on other major blockchain ecosystems. The Chainlink ETF is part of what could be called the "third wave."

Chainlink is a project known for its decentralized oracle infrastructure. This system, which provides external data to smart contracts, forms the basis of many applications, from DeFi to tokenization projects. Bitwise's ETF based on this project will allow institutional investors to access crypto assets directly without opening a wallet. This means investing in LINK will now be possible through a regulated product traded on an exchange.

For institutional investors, Chainlink represents an investment in the "infrastructure layer" of blockchain technology. Oracle systems play a critical role in both interchain data transfer and the secure operation of tokenization. Therefore, institutional interest in projects like LINK has been steadily increasing recently.

If Bitwise's Chainlink ETF is approved, it will significantly expand the range of crypto-based investment products. Following Bitcoin and Ethereum, the bridge between traditional markets and DeFi infrastructure will be further strengthened.

Furthermore, considering other ETF applications pending with the SEC, such as spot Solana and Avalanche, CLNK's approval could mark a significant turning point in the crypto ETF race. As traditional investors' interest in digital assets grows, Bitwise's move stands out as a significant development in terms of long-term institutional capital flows into both the Chainlink ecosystem and the broader crypto market.

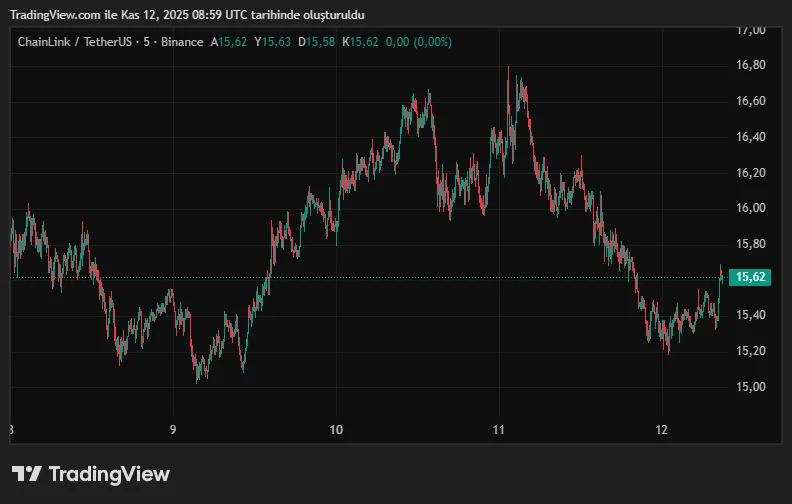

At the time of writing, LINK's price is trading around $15.5, up 2%.