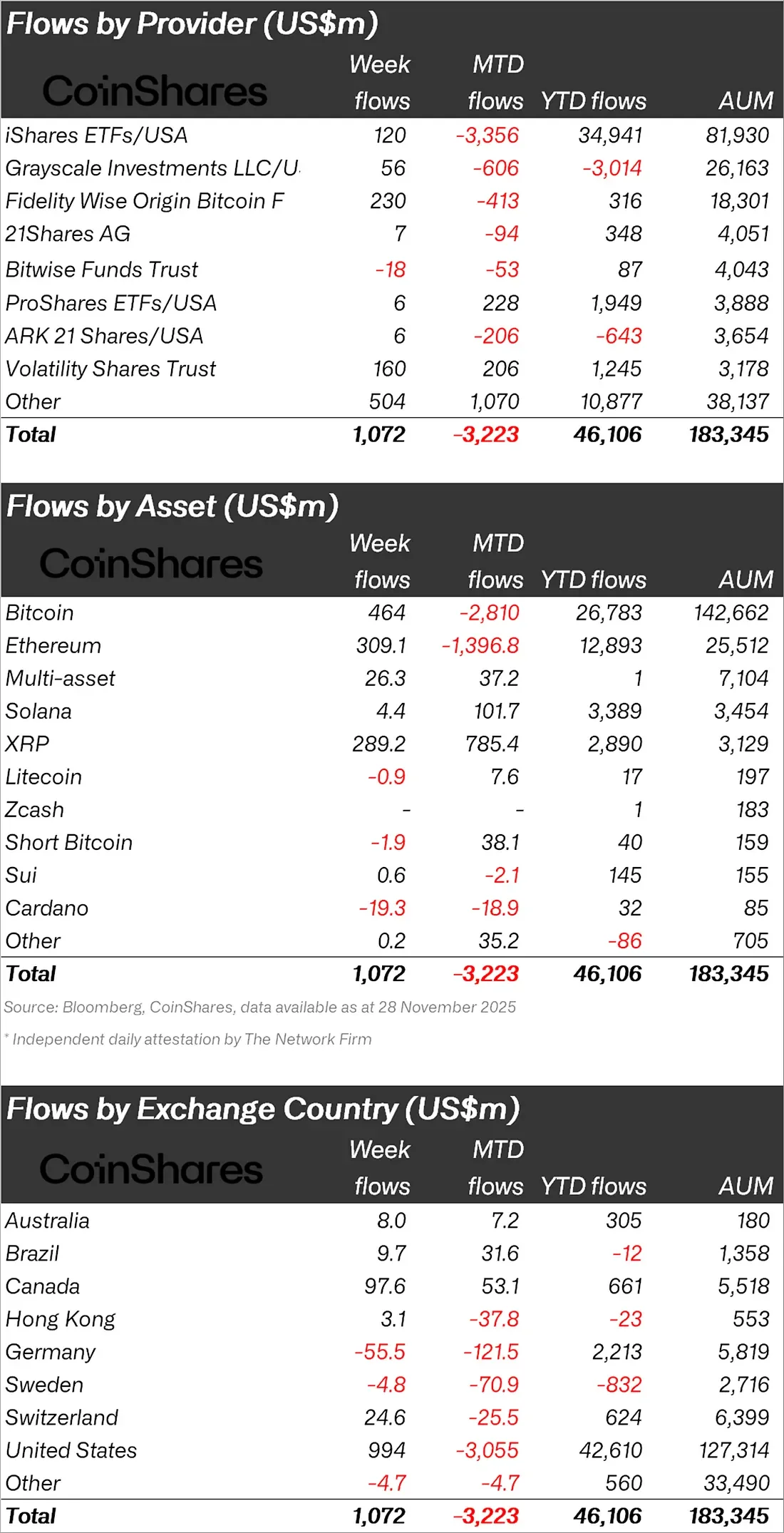

CoinShares' latest weekly flow report showed a significant recovery in institutional demand for cryptoasset funds. According to the report, digital asset investment products saw a total inflow of $1.07 billion last week. This increase indicates a rapid turnaround in investor sentiment following sharp outflows of $5.7 billion in the last four weeks. Expectations for a rate cut, reinforced by statements from FOMC member John Williams emphasizing that monetary policy remains "restrictive," played a critical role in this market recovery.

CoinShares data: How much were Bitcoin and altcoin inflows?

Volumes remained low due to Thanksgiving. Cryptoasset ETP trading volume hit a record $56 billion the previous week and remained at $24 billion this week. Despite this, the recovery in inflows suggests investors haven't lost their risk appetite as the year-end approaches.

The strongest inflow came from the US, which attracted $994 million last week alone. Canada also attracted attention with $97.6 million, while Switzerland closed the week positive with $23.6 million in inflows. There were also countries that moved in the opposite direction; Germany, in particular, distinguished itself with $55.5 million in outflows.

Asset-wise, the picture was once again dominated by Bitcoin and Ethereum. Bitcoin received $461 million in inflows last week. This trend, when considered alongside the $1.9 million outflow from short Bitcoin products, suggests that investors have reversed their bearish expectations. Ethereum, on the other hand, saw a net inflow of $308 million. The market's two largest assets served as a reminder that institutional demand remained robust in the final quarter of the year.

XRP was the star of the week. The asset broke its all-time high with a total inflow of $289 million. Demand for XRP products in the last six weeks equates to 29 percent of the asset's total assets under management. A significant portion of this sharp increase is believed to be attributed to the launch of new XRP ETF products in the US.

Cardano, on the other hand, painted a completely different picture. ADA investment products experienced $19.3 million in outflows. This decrease represents approximately 23% of the entity's total assets under management. While small inflows were seen in multi-asset products, Solana also saw a limited but positive trend; SOL funds closed the week with $4.4 million in inflows.

The report emphasizes that this sudden recovery after four weeks of weakness signals a renewed risk-taking trend on the institutional side. Strengthening expectations for a rate cut further accentuate the movement in US markets. Large funds appear to have developed a new avenue for expansion in their strategies, particularly as year-end position adjustments approach.

It remains to be seen how the FOMC decisions and year-end balance sheet movements to be announced in the coming weeks will shape the flow of money into digital asset funds.