Canary Capital's XRP ETF, XRPC, has become one of the crypto market's most notable products, far exceeding expectations on its first day of trading. The fund, which launched on Nasdaq on November 13th, saw net inflows of $245 million and trading volume of approximately $58-59 million in just one day. This figure marked the strongest opening performance among the more than 900 ETFs launched in 2025.

Buying in the first minutes of the day signaled a record-breaking prospect for the fund. Bloomberg ETF analyst Eric Balchunas noted that volume reached $26 million within 30 minutes of opening, signaling a rapid pace that exceeded his own estimate. This also eclipses the $57 million record set last month by Bitwise's Solana fund, BSOL.

The strong inflows cannot be explained solely by visible trading volume. ETF experts attribute the relatively low intraday volume, yet significantly higher net inflows, to "in-kind creation" processes. In this mechanism, large institutional investors create fund shares by directly creating a basket of assets. Because these transactions are not reflected in exchange volume, a visible gap between inflows and volume exists.

The XRP community, meanwhile, rallied behind the ETF launch. Social media engagement surged after the platform's listing on Nasdaq. Journalist Eleanor Terrett highlighted the community's influence, saying, "With the XRP Army behind it, who can really be surprised?" ETF expert Nate Geraci also noted that nearly all crypto ETFs that have entered the market in the last two years have exceeded Wall Street expectations, emphasizing that demand remains underestimated in traditional financial circles.

While institutional interest is growing, a similar appetite has been evident among retail investors. Analysts say that XRP has been widely followed for years, and this awareness naturally drives first-day interest in new products. Presto's Min Jung emphasized that the XRP Army is one of the market's most resilient communities and its strong tendency to support volume during new product launches.

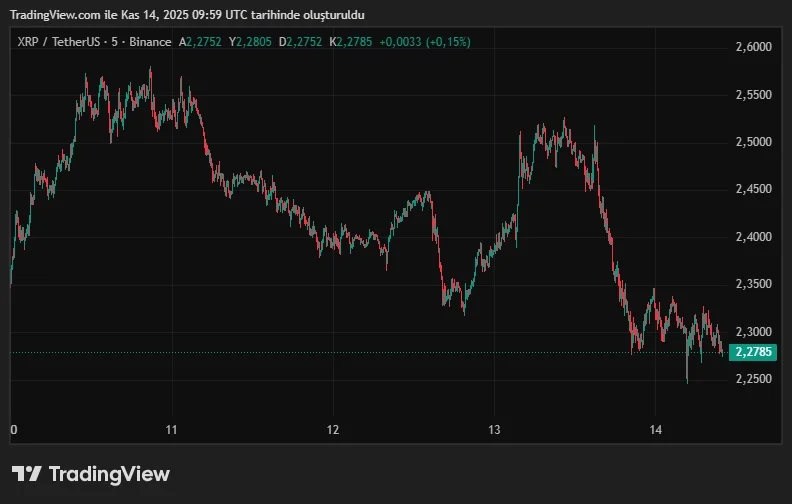

XRP Price Drops

Despite this strong start, the XRP price did not exhibit the expected momentum on ETF Day. The token lost approximately 8 percent of its value in 24 hours, retreating to $2.28. A more than 30 percent increase in trading volume indicated a high tendency for investors to switch positions. Open interest, particularly on CME and Binance, declined, with analysts attributing this to the strengthening of the "news sell" effect.

Critical levels also stand out in the technical landscape. On-chain analyst Ali Martinez states that the $2 band is a significant support area for XRP, both psychologically and technically. It is stated that if this area holds, impulse buying could intensify, while if it breaks, the pullback could deepen.

On the regulatory front, a new bipartisan initiative from the US Congress is noteworthy. The bill, which was introduced on November 10 and aims to clarify XRP’s commodity status under CFTC oversight, could shape a significant area of uncertainty for the asset’s future at a time when ETF interest is rising.