World Liberty Financial has entered into a new collaboration with Spacecoin, a startup developing satellite-based internet infrastructure. The announced partnership aims to bring decentralized finance (DeFi) applications to areas where traditional financial infrastructure is limited. In this context, World Liberty Financial plans to integrate its dollar-indexed stablecoin asset, USD1, into Spacecoin's satellite network. The goal is payment and settlement via satellite connection.

In a blog post published by Spacecoin, it was stated that the two projects are working together on a token exchange system. While technical details were not provided, this system aims to pave the way for solutions that will enable payment and settlement transactions via satellite connection. Thus, the goal is to enable transactions with digital assets in regions where internet access is newly established or where financial infrastructure is insufficient.

Zak Folkman, co-founder of World Liberty Financial, emphasized the long-term use cases when evaluating the motivation behind the partnership. According to Folkman, USD1 is positioned not only as an asset circulating within crypto markets, but also as a tool to support real-world payment and settlement processes. Collaborations built with alternative infrastructures like satellite connectivity offer new opportunities for coordination and value transfer in environments inaccessible to traditional financial channels.

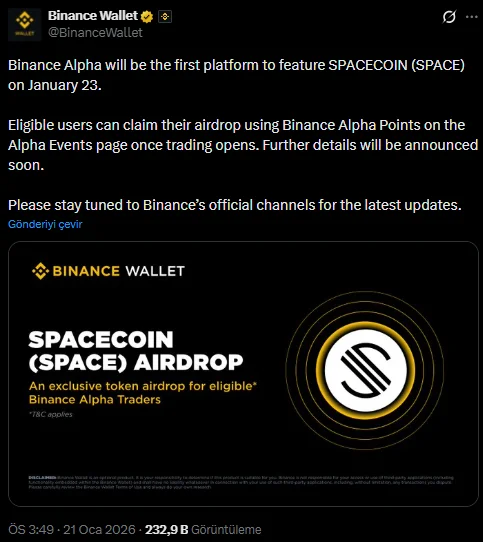

Spacecoin to be listed on Binance today

On the Spacecoin front, recent technical steps are noteworthy. The company announced the successful launch of three satellites to be positioned in low Earth orbit. The initiative aims to establish a satellite internet network that can be an alternative to terrestrial broadband infrastructure. At the same time, Spacecoin, which defines itself as a decentralized physical infrastructure network, emphasizes that a reliable financial layer is needed for this technology to be sustainable.

Spacecoin founder Tae Oh states that the collaboration with World Liberty Financial is critical at this point. According to Oh, in scenarios where users connect to the internet for the first time, not only communication but also the ability to conduct financial transactions is a fundamental need. Integrating a regulated stablecoin like USD1 into the satellite network can directly address this need.

Meanwhile, Spacecoin is preparing to launch its SPACE token on January 23rd. The launch marks the first public token release for a project aiming to build a satellite-based decentralized internet network. Spacecoin, intended to integrate blockchain-based payments with satellites in low Earth orbit, is expected to be initially listed on Binance Alpha.

This development follows recent steps taken by World Liberty Financial, which recently announced it had applied for its own trust bank charter, aiming to expand the use cases of USD1 and forge a stronger link with traditional finance. However, the project's association with the family of US President Donald Trump has led to cautious approaches in some circles.

On the other hand, World Liberty Financial continues to expand its product and service portfolio. Last month, the company announced plans to offer USD1-backed real-world assets (RWA), aiming to attract institutional investors to the DeFi ecosystem. It was also previously announced that a WLFI-branded bank card was in development, although new details about this project had not yet been revealed. There are also proposals to support the supply of USD1 with funds allocated from the project's treasury. These funds are expected to encourage wider adoption of the stablecoin on both centralized and decentralized exchanges. According to market data, the circulating market capitalization of USD1 is approximately $3.27 billion.