The US Federal Reserve (Fed) is preparing to cut interest rates following the FOMC meeting, which concludes today. Markets view a 25 basis point cut as almost certain. This decision is seen as the start of a new easing cycle in monetary policy and could create a strong liquidity surge, particularly for risk assets such as stocks, cryptocurrencies, and gold.

Fed's interest rate decision awaited

According to CME FedWatch data, markets are pricing in a 25 basis point cut with a greater than 99% probability. This step is being considered both a precaution against the economic slowdown and a move to offset the weakening employment. However, the messages delivered by Fed Chair Jerome Powell following the decision will determine the interest rate path in December and early 2026.

This meeting coincided with an unusual period of restricted data flow. Due to the ongoing government shutdown in the US, key economic indicators such as inflation, employment, and growth were not released. This situation caused the Fed to make decisions under a state of "data blindness." Officials were forced to use state-by-state unemployment claims, private sector forecast models, and local business surveys instead of official reports.

According to a Reuters poll, most economists believe the Fed will support growth by cutting interest rates this month. However, some members advocate for a more aggressive 50 basis point move, while others oppose halting the balance sheet reduction process (QT). These differences indicate differing perceptions of economic risk within the Fed.

Possible scenarios fall into three categories:

- A 25 basis point cut would create "expected and controlled" relief for the market; the dollar index and bond yields would decline, increasing risk appetite.

- A surprise 50 basis point cut would indicate that growth concerns are outweighing and increase volatility in the short term.

- Keeping interest rates steady would shock markets, leading to a sell-off in stocks and a rise in safe-haven assets like bonds and gold.

From a crypto market perspective, a rate cut is generally a positive signal. Lower interest rates and a weaker dollar encourage investors to turn to riskier assets. Bitcoin and Ethereum could benefit from increased liquidity during this period. Analysts note that BTC has seen gains of 20-50% in past price cuts, but they emphasize that data uncertainty could sharpen price movements this time around.

A similar picture is playing out on Wall Street. The Dow Jones Industrial Average, S&P 500, and Nasdaq indices closed at record highs ahead of the decision. Investors positioned themselves against the possibility of a "small but potentially sustained" price cut. While experts describe the 2025-2026 period as a "wealth creation phase," they also highlight the risk of a sharp correction toward the end of 2026, particularly in artificial intelligence and technology stocks.

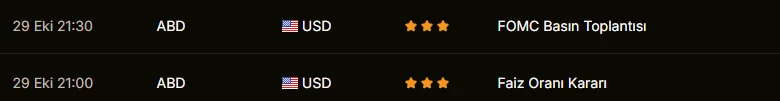

When will the decision be announced?

The Fed decision will be announced at 9:00 PM Turkish time, and Powell's press conference will begin at 9:30 PM. All eyes will be on Powell's forward-looking guidance. "The pace of further reductions," "the balance sheet reduction process," and "decision-making in a data-deficient environment" will be the most critical headlines of the evening. Even a single sentence could shake the dollar, gold, and crypto markets in seconds.