Global markets are focused on US Federal Reserve (Fed) Chair Jerome Powell's speech today at the Jackson Hole Economic Policy Symposium. The annual event in Wyoming is dubbed the "Oscars of monetary policy." This year's gathering holds a special significance: Powell will be on the Jackson Hole stage for the last time, as his term ends in May 2026.

Markets fixated on the 5:00 PM message

Powell's speech will begin at 5:00 PM Turkish time. While the main theme of the symposium is "Labor Markets in Transition," all eyes will be on the Fed's monetary policy signals. The possibility of a rate cut at the FOMC meeting in September is particularly central to market pricing. According to the CME FedWatch Tool, there is currently a greater than 73% chance of a 0.25 percentage point cut.

Within the Fed, disagreements persist. While Cleveland Fed President Beth Hammack and Kansas City Fed President Jeffrey Schmid remain cautious, Governors Michelle Bowman and Christopher Waller are more dovish in favor of rate cuts.

A Speech That Will Define Powell's Legacy

Jackson Hole is known as a platform where Fed chairs deliver historic messages. Powell's dovish statements in 2021 reassured markets and sparked a major rally in Bitcoin. His 2022 speech, a year later, took a sternly hawkish tone, triggering a sell-off in stocks and cryptocurrencies. While the 2023 speech was met with mixed reactions, expectations for 2025 are much higher: This speech is thought to define Powell's legacy.

Economists say Powell could signal not only the rate cut process but also the Fed's long-term framework. In particular, the official end of the "average inflation targeting" policy, adopted in 2020 and allowing inflation to occasionally exceed its 2% target, is on the agenda. Such a move could signal a return to tighter inflation targeting by the Fed.

Powell's speech also comes at a time of increasing political pressure. US President Donald Trump has been criticizing Powell for months for not cutting interest rates and calling for his resignation. The Trump administration's actions, which have cast doubt on central bank independence, are leading to increased scrutiny of the Fed's decisions. This situation is compounded by macroeconomic uncertainties: weak employment data, mixed inflation indicators, geopolitical risks, and political pressures within the US are making investors nervous.

A double-edged scenario for crypto markets

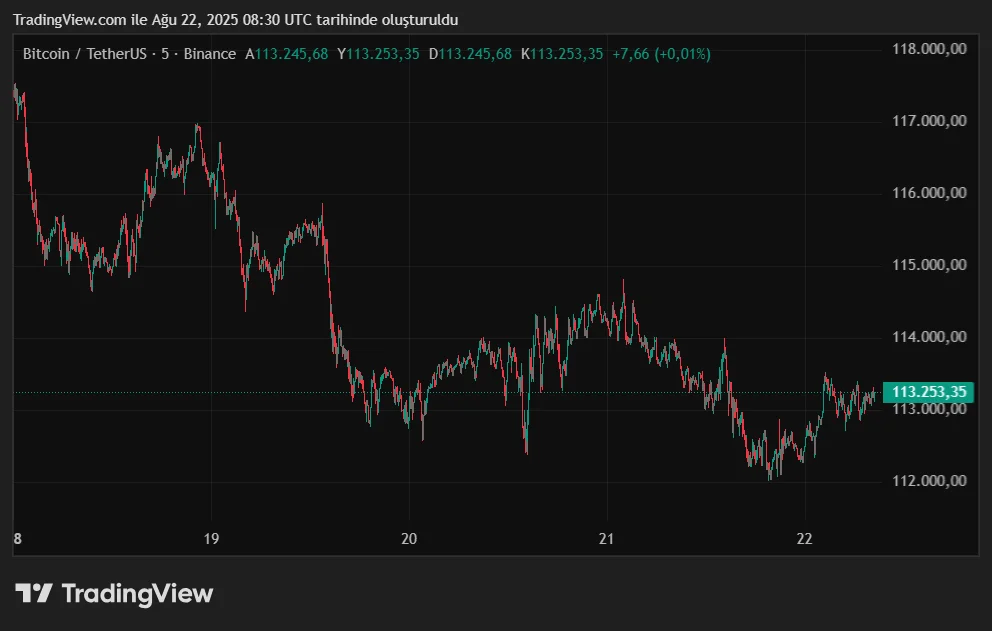

Powell's Jackson Hole message is critical not only for Wall Street but also for crypto markets. Bitcoin is currently trading around $113,000. According to analysts, Powell's dovish tone could provide Bitcoin with a new "growth stimulus." Some commentators even believe a "Bitcoin Supercycle" scenario similar to 2021 could be triggered again.