The latest data on the US labor market indicates that the slowdown in the economy is becoming more pronounced. In November, non-farm employment increased by 64,000 people, while the unemployment rate rose to 4.6%, reaching its highest level in four years. The data had been delayed due to the government shutdown in Washington, and this delay revealed a weaker picture of the labor market than expected.

According to the report released Tuesday by the US Bureau of Labor Statistics (BLS), the increase in non-farm employment in November was slightly above economists' expectations. Market expectations were for an increase of 50,000 people. However, although the headline figure exceeded expectations, the rise in the unemployment rate and revisions to the previous month indicate a weakening overall trend in the labor market.

With the November data, the unemployment rate rose to 4.6%. This rate exceeded both the market expectation of 4.4% and the 4.4% recorded in September. Thus, the unemployment rate in the US reached its highest level in almost four years. Rising unemployment has reinforced concerns that demand in the labor market is gradually cooling.

Employment data for October presented an even more striking picture. According to the data, employment decreased by 105,000 people in October. In September, employment increased by 119,000 people. This sharp drop in October is largely attributed to the US federal government shutdown. The temporary absence of public employees from their jobs and disruptions to some data collection processes put downward pressure on the figures.

When the November and October data are considered together, it is seen that the US labor market has shown a more fragile appearance than expected in recent months. The slowdown in the pace of employment growth and the rise in the unemployment rate indicate that signals of a cooling in the economy are strengthening.

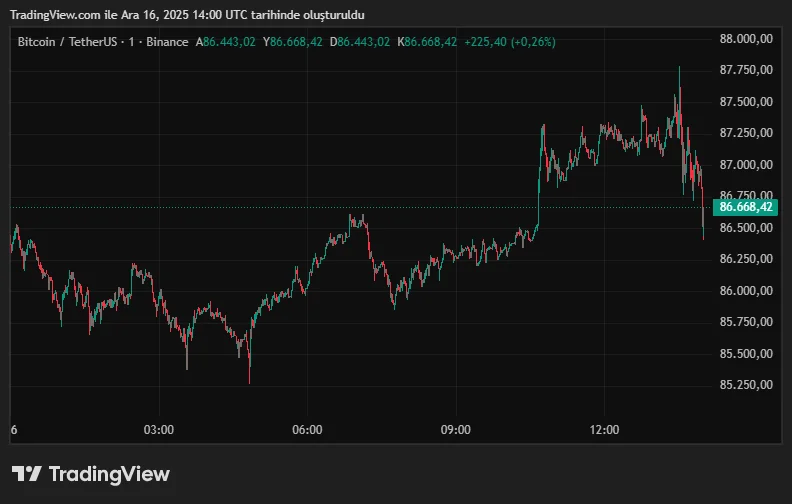

How did Bitcoin move?

Following the release of the data, limited reactions were observed in financial markets. Bitcoin gave back some of the small gains it had recorded before the report, briefly falling to the $87,000 level. US stock futures indices, on the other hand, shifted slightly from positive to slightly negative. On the other hand, the 10-year US Treasury yield remained flat at 4.17 percent.

Prior to the employment data, markets were pricing in a 75 percent probability that the Federal Reserve (Fed) would keep interest rates unchanged at its January meeting. Following the release of the data, there was no significant change in these expectations. This indicates that investors do not expect a sudden shift in the Fed's monetary policy in the short term. The overall picture shows that the US economy has not entered a strong contraction, but there has been a significant loss of momentum in the labor market. New employment and inflation data to be released in the coming months will continue to be critical for expectations regarding the Fed's policy steps.