The highly anticipated Nonfarm Payrolls (NFP) data was released in the US. While there was an increase of 139,000 jobs across the country in May, this figure was both slightly below the revised data of the previous month (147,000) and above the market expectation of 130,000. Following the development, a slight movement was seen in the leading cryptocurrency Bitcoin (BTC).

Critical non-farm employment data announced in the US

Looking at the details of the data, unemployment rate remained stable at 4.2% while labor force participation rate declined from 62.6% to 62.4%. It was noteworthy that average hourly earnings increased by 3.9% yoy, which was above market forecasts (3.7%).

However, downward revisions for the previous months limited the markets' post-data euphoria. March and April employment data were revised down by 65,000 and 30,000, respectively. Thus, employment growth in the last two months was reduced by 95,000 in total. This shows that the slowdown in the labor market may be deeper than we thought.

After the data, the US Dollar Index rose by 0.3% to 99. The US Dollar was the strongest performer of the day, especially against the Japanese Yen by 0.59%. In contrast, there was a more limited appreciation against the Euro and the British Pound.

Bitcoin and altcoins also moved

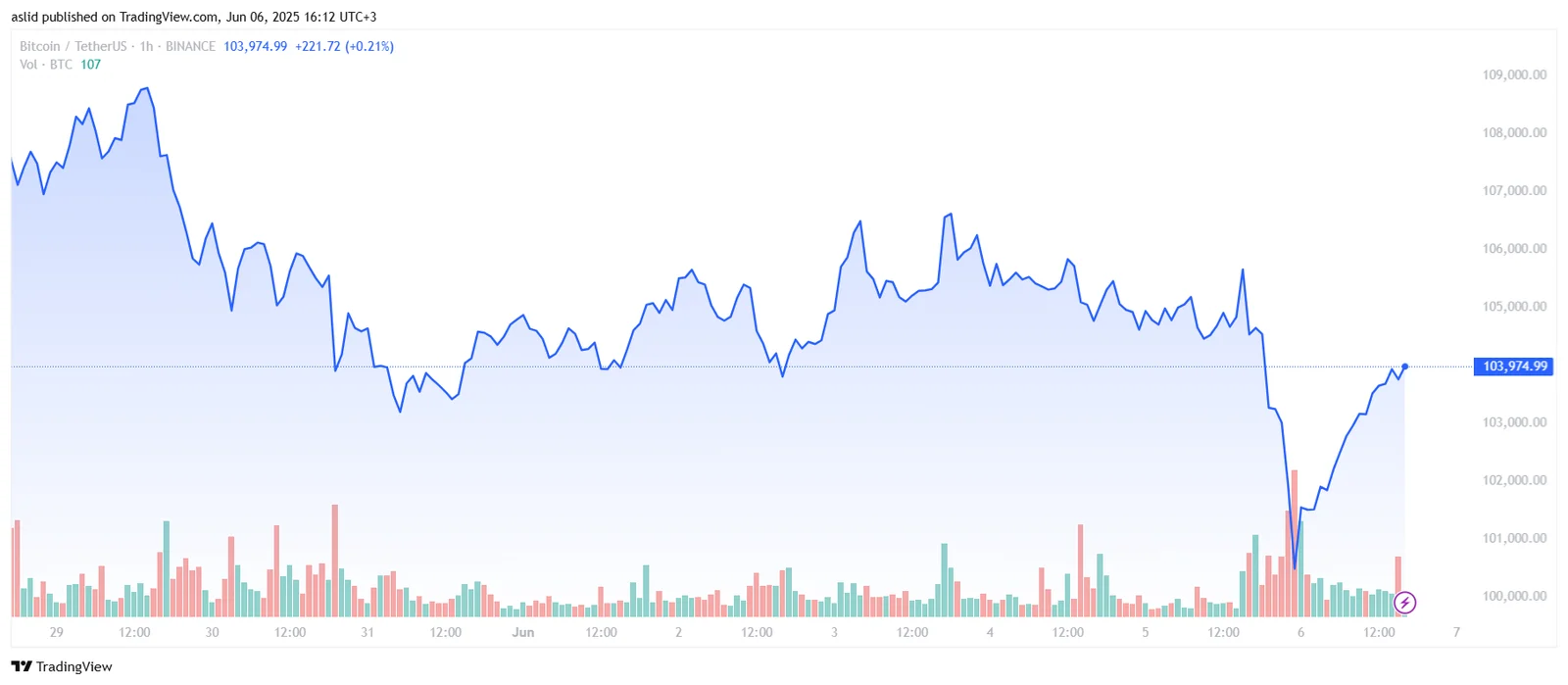

The cryptocurrency market did not remain insensitive to these developments. In the first hours of June 6, BTC, which remained at the $ 100,000 support level due to reasons such as the Trump and Musk spat, changed hands at $ 103,900 during the day. In some exchanges, the leading cryptocurrency Bitcoin (BTC) even rose to $104,200 after the data. However, with the profit realizations following this upward movement, BTC retreated towards the $ 102,000 band again. The uncertainty about the Fed's interest rate cut was effective in limiting the short-term rise.

Markets are currently pricing in a 30% chance of a 25 basis point rate cut in July. However, inflation and growth data to be released in the coming weeks could seriously affect this rate. Eyes are now on both the Fed's messages at its June meeting and the crypto market's search for a new direction.