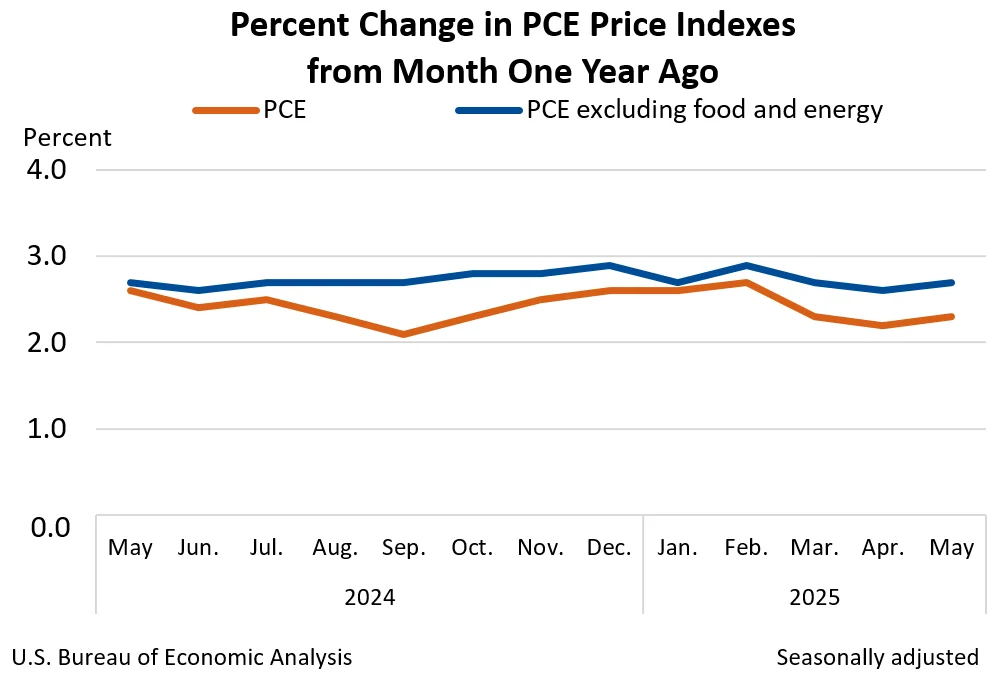

The core PCE (Personal Consumption Expenditures), published by the US Department of Commerce on June 27, came in above expectations as one of the critical economic inflation indicators on the markets' radar. The announcement of annual inflation of 2.7 percent exceeded the market expectation of 2.6 percent and once again threw investors' hopes regarding the US Federal Reserve's (FED) interest rate policy into uncertainty. The Bitcoin (BTC) price initially experienced slight fluctuations after the data.

Inflation indicator above expectations

The core PCE price index, known as the FED's favorite inflation indicator, rose to 2.7 percent on an annual basis in May. On a monthly basis, inflation was announced as 0.2 percent. This measurement, which excludes volatile items such as food and energy, is considered a critical reference in the FED's monetary policy decisions. Accordingly, it is noteworthy that the core PCE has been above the FED's 2 percent target for 51 months.

It is stated that the tariffs implemented by President Donald Trump after his re-election put pressure on import costs in particular. According to data from Yale University's Budget Lab, the average effective tariff rate rose from 2.2 percent in 2024 to 15.8 percent by 2025, reaching its highest level since 1936. Although the impact of this situation on inflation seems to be limited, experts point out the possibility that companies will pass these costs on to consumers in the coming months.

How did the Bitcoin market react?

With the announcement of the data, there were short-term fluctuations in the price of the leading cryptocurrency Bitcoin. According to market data, BTC, which was around $ 107,200 during the day, fell to $ 106,800 after the data. While volumes in the market increased in general, there was a temporary weakening in investors' risk appetite.

As can be seen in the image, BTC, which was horizontal until the morning of June 27 before the price data, turned downward as inflation figures exceeded expectations. The subsequent recovery attempts were weak.

Will there be a rate cut?

After the FED passed on the expected rate cut in June, markets are focused on September. However, an upward surprise in inflation could undermine these expectations. Bank of America economists warn that core PCE inflation could reach 3.1 percent by the end of the year, and comments are being made that this situation could delay interest rate cut expectations.

However, the same experts predict that this increase in inflation could be temporary and will fall back to around 2 percent by the end of 2026. These estimates indicate that the FED will continue to be “patient but cautious” in its interest rate decisions.

The employment and growth data to be released in the coming weeks will determine the course of both the FED and crypto investors. In particular, the impact of President Trump’s economic policies on inflation seems to be one of the main dynamics determining the course of the markets for the rest of the year.