M2 Capital, the investment arm of United Arab Emirates-based M2 Holdings, has taken a notable new step in the cryptocurrency market. The company announced a $20 million investment in ENA, Ethena's governance token. This move demonstrates both the Middle East's interest in digital asset infrastructure and the region's desire to play a stronger role in the global financial scene.

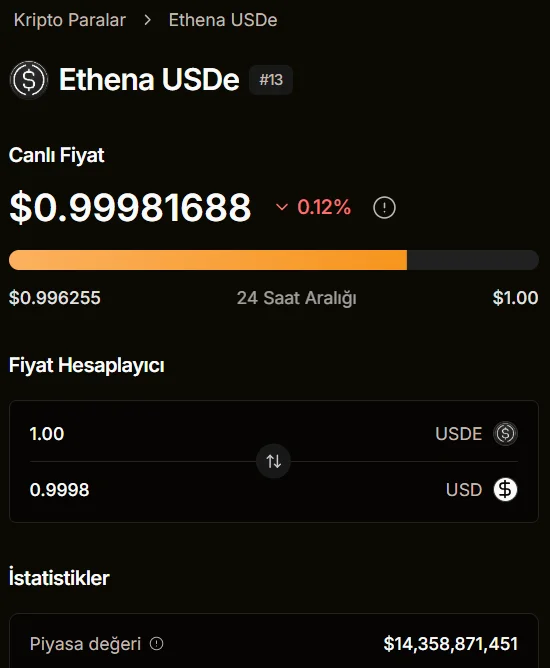

Ethena is particularly known for its USDe and sUSDe products, which launched in 2024. Backed by crypto collateral, these products provide stable value preservation through delta-neutral hedging strategies. USDe functions as a synthetic stablecoin pegged to $1, while the sUSDe version offers a yield-generating form. Thanks to this innovative approach, the Ethena protocol quickly gained popularity, with the total amount of locked assets exceeding $14 billion. USDe's market capitalization is also around $14 billion.

M2 Global Wealth plans to integrate Ethena's products into its asset management services. This will provide clients with access to crypto-based income products in a regulatory-compliant manner. Kim Wong, head of M2's treasury department, stated that the agreement could redefine trust and transparency standards in the region.

This investment also demonstrates M2's continued interest in the crypto ecosystem. The company previously participated in funding initiatives for the Sui Blockchain ecosystem. This latest move aims to not only provide capital infusion into crypto but also accelerate the Middle East's adoption of digital finance tools.

Ethena Stands Out with USDe

Ethena's success isn't limited to investor interest. The protocol has quickly captured the demand for stablecoin-like products that offer returns. USDe, in particular, has seen its market capitalization exceed $13 billion, placing it third among the largest crypto-asset-backed dollar alternatives. This performance demonstrates the emergence of a new model that differentiates itself from traditional stablecoins like USDT and USDC.

The regulatory steps taken by the United Arab Emirates also support these developments. Dubai's Virtual Assets Regulatory Authority (VARA) and the country's other financial authorities have established a comprehensive framework for crypto. This regulatory clarity is attracting both domestic and international investors. M2's investment in Ethena occurred within this very context, strengthening the region's ambition to become a global crypto financial hub. Consequently, M2 Capital's $20 million investment in Ethena is not just a capital infusion; it also signals a new era for the Middle East's gateway to digital assets. The combination of Ethena's innovative products, M2's strategic approach, and the UAE's regulatory framework is expected to further expand the crypto ecosystem in the region.