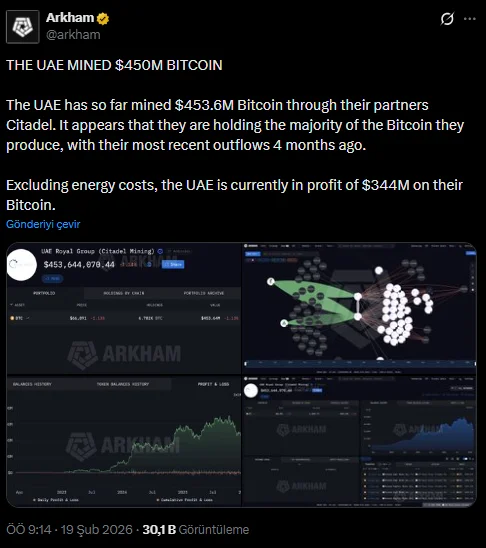

The United Arab Emirates (UAE) has generated approximately $455 million worth of Bitcoin through state-backed mining operations. According to data shared by the on-chain analytics platform Arkham, these operations, conducted through entities linked to the Abu Dhabi royal family, have made the country a prominent player in state-sponsored Bitcoin mining. Arkham's data, published on Thursday, shows that the UAE Royal Group holds a total of $453.6 million worth of Bitcoin in wallets linked to Citadel Mining. Unrealized profit from these assets, excluding energy costs, is approximately $344 million. In other words, the UAE has largely chosen to hold onto the Bitcoin it has generated to date, benefiting significantly from price increases. Data indicates that the country has generated an average of 4.2 BTC per day over the past seven days. According to on-chain records, the last fund outflow from these wallets occurred four months ago, suggesting that the UAE has adopted an accumulation-focused approach rather than a short-term selling strategy. The UAE's mining drive dates back to 2022. Citadel Mining, linked to the Abu Dhabi royal family, initiated the process by establishing large-scale operations on Al Reem Island. In 2023, US-based mining company Marathon Digital Holdings announced a joint venture with Abu Dhabi-based Zero Two to develop a 250-megawatt immersion-cooled mining facility. This step was recorded as one of the largest industrial crypto mining investments in the Middle East.

Total value declined with price drop

Arkham had previously stated that the total amount of mining attributed to the UAE in August 2025 was around $700 million. At that time, the total value appeared to be on the rise due to higher Bitcoin prices. The platform reported that the UAE had produced approximately 9,300 BTC at that time and held 6,300 BTC. According to current data, the UAE Royal Group holds approximately 6,782 BTC. This amount corresponds to 0.03% of Bitcoin's total supply. The UAE is not the only sovereign actor mining Bitcoin. The Royal Government of Bhutan has also been mining Bitcoin since 2019 using its hydroelectric resources through its investment arm, Druk Holding & Investments. Having peaked at over 13,000 BTC, Bhutan began selling in early 2026. According to Arkham data, the country has sold approximately $29 million worth of Bitcoin in the last three weeks; total sales over the last five months have exceeded $100 million. Bhutan currently holds approximately 5,600 BTC. On the other hand, some countries have accumulated Bitcoin holdings through confiscation rather than mining. The US government ranks first among sovereign actors with 328,000 BTC. A significant portion of these assets were seized by the FBI in connection with the Bitfinex hack, the Silk Road operation, and the James Zhong case. The UK is second with approximately 61,000 BTC.