As crypto markets reach all-time highs, large-scale purchases of Ethereum and Bitcoin are attracting attention. Sharplink, a gaming company led by Ethereum co-founder Joseph Lubin, and Japan-based investment firm Metaplanet not only observed this rise but also reinforced their crypto strategies with significant acquisitions.

Sharplink Makes Strategic Ethereum Purchase

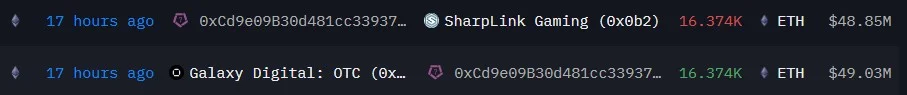

Sharplink Gaming, a company operating in the decentralized finance (DeFi) and gaming software space, added to its Ethereum treasury, purchasing approximately $49 million worth of ETH. According to Arkham Intelligence data, the company transferred 16,374 ETH to its wallet on Sunday afternoon. It was determined that these ETH were recently purchased from Galaxy Digital's over-the-counter (OTC) market. While Sharplink hasn't made an official statement, on-chain analytics platforms like EmberCN suggest the company has reached a total holding of approximately 270,000 ETH.

This move comes on the heels of a purchase of 21,487 ETH, or $63.7 million, just days earlier.

How did the Ethereum treasury strategy begin?

Originally operating as a Minneapolis-based affiliate marketing and iGaming software company, Sharplink launched an Ethereum-centric treasury strategy at the end of May. This strategy was supported by a $425 million private equity sale led by Consensys, a company led by Ethereum co-founder Joseph Lubin. Lubin also serves as Sharplink's chairman of the board.

The company positions ETH holdings not only as a financial instrument but also as a means of supporting the long-term strength and decentralization of the Ethereum ecosystem. CEO Rob Phythian clarified this in a statement, saying, "Ethereum is now Sharplink's core treasury asset."

Last week, Lubin told CNBC that the company is "buying tens of millions of dollars of ETH every day," emphasizing the continued nature of this strategy.

Share price on the rise

SBET, the company's Nasdaq-listed stock, closed at $21.65 last week, a 17% increase following the announcement of a previous purchase of 10,000 ETH. This rise was also supported by the fact that ETH reached its highest levels since early February, approaching $2,981 in the market. However, the stock is still 74% below its all-time high of $82. In particular, the false news that Lubin and Consensys had sold shares on June 12 caused a significant collapse in SBET's value.

Meanwhile, the Ethereum Foundation is facing investor backlash due to increased sales. Under the new treasury policy announced in June, the annual ETH sales rate was reduced from 15% to 5%. It was also stated that the sales would be conducted with greater transparency and in accordance with "DeFiPunk" principles.

Metaplanet Expands Its Bitcoin Strategy

While these developments are unfolding on the Ethereum front, Japanese investment giant Metaplanet made a major move on the Bitcoin front. The company purchased an additional 800 BTC for approximately $94 million, bringing its total Bitcoin holdings to over 16,000. This latest purchase was made at an average of $117,000 per BTC. The current value of its total BTC holdings is $1.64 billion, and the company's 2025 performance has already yielded a 435% return.

Metaplanet, which added 7,400 BTC to its balance sheet in the last month alone, is positioning crypto as a strategic reserve asset, following in the footsteps of institutional players like MicroStrategy. These aggressive purchases reflect the heavy inflows into spot ETFs and institutional interest. In fact, in the last seven days alone, the inflow into spot Bitcoin ETFs has exceeded $2.7 billion. While Metaplanet shares haven't fully reacted to Bitcoin's meteoric rise yet, analysts say the share price has strong upside potential. Its decreasing mNAV (market capitalization/net asset value) makes it attractive to long-term investors.