US President Donald Trump sent a harsh message to FED Chairman Jerome Powell after the ADP employment data for May, which fell well below expectations. In a post on the social media platform Truth Social, Trump called on Powell to cut interest rates, citing the European Central Bank as an example and arguing that the US was late in monetary policy. Trump's outburst, along with signs of weakening economic indicators, has renewed interest in alternative assets such as Bitcoin.

Donald Trump slams FED Chairman

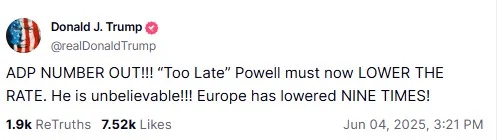

US President Donald Trump once again lashed out at US Federal Reserve (FED) Chairman Jerome Powell on his Truth Social account after the release of the ADP private sector employment data for May. In his post, Trump demanded a cut in interest rates, cited Europe as an example and gave a direct message to Powell: “He is too late”.

Trump gave the following statement: ““Too Late” Powell must now LOWER THE RATE. He is unbelievable!!! Europe has lowered NINE TIMES!”

Trump's outburst came just after the May private sector employment data released by the ADP Research Institute and the Stanford Digital Economy Lab fell short of expectations. According to the report, the US economy created only 37,000 jobs in May. This figure was well below the market expectation of 114,000.

ADP's chief economist Dr. Nela Richardson noted that despite this slowdown in job growth, wage growth remained strong and there were still signs of resilience in the labor market. However, according to Richardson, after a strong start to the year, there has been a serious slowdown in hiring.

Trump has been pressuring Powell to cut interest rates for months. However, the Fed chairman has so far ignored these calls and often reiterated his data-driven monetary policy rhetoric. The European Central Bank, which Trump made comparisons with, has cut interest rates in recent months.

So how is Bitcoin doing in the shadow of these discussions?

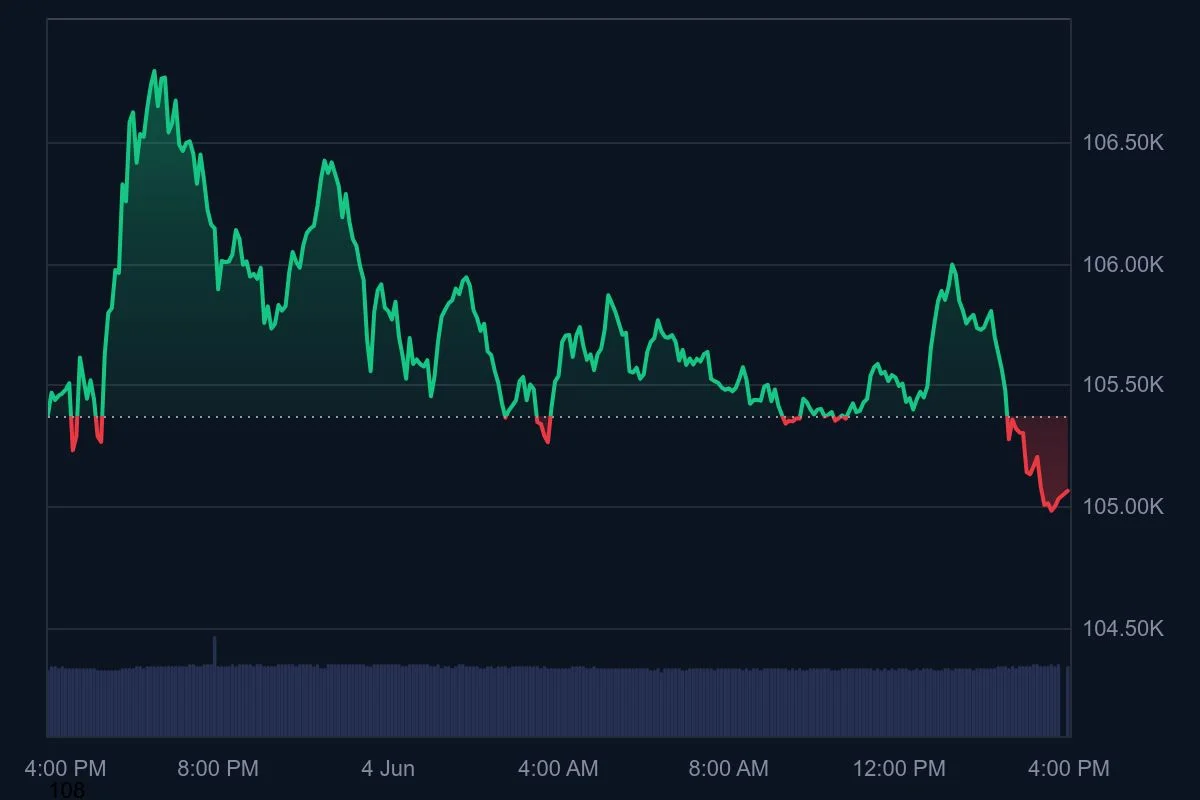

According to the latest data, Bitcoin (BTC) is trading at $105,038 at the time of writing. This represents a slight decline of about 0.31% in the last 24 hours. BTC, which tested the $112,000 level in May, has managed to stay above $100,000 thanks to strong demand and capital flows into ETFs.

Weak employment data from the US has also made the upcoming official non-farm payrolls report more critical, while investors have turned their eyes to the Fed's next step.