A surprise announcement following the tensions in the Middle East has brought a spring atmosphere to the crypto markets. Former US President Donald Trump announced that a ceasefire had been reached between Israel and Iran. This development caused sharp increases in many cryptocurrencies, especially Ethereum (ETH), Solana (SOL) and Cardano (ADA), after the sharp fluctuations experienced over the weekend.

In a statement he made on the social media platform Truth Social, Trump said, “Iran will officially begin a ceasefire and Israel will join the ceasefire at the 12th hour. At the end of the 24th hour, the world will officially declare the 12-day war over.” Although there was no official confirmation from either government, the markets reacted positively to this statement.

ETH, SOL and ADA increased by nearly 10 percent

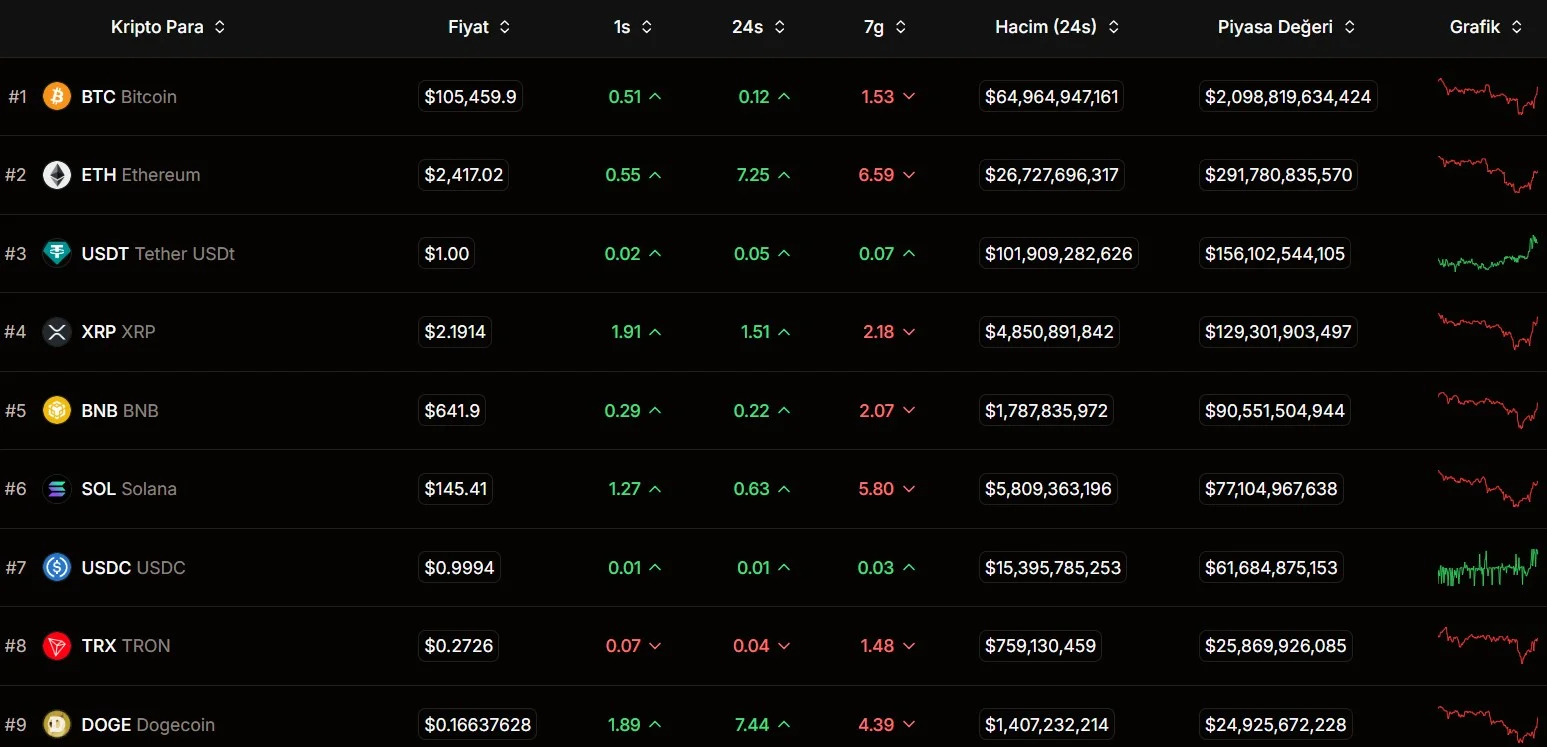

The most striking increase in cryptocurrencies was experienced on the Ethereum, Solana and Cardano fronts. While ETH climbed above $ 2,400, Solana rose to $ 145 and ADA rose to $ 0.59. These movements represent an increase of approximately 7 percent for each asset in the last 24 hours.

The market, which was trying to recover after the liquidation of approximately $600 million in long positions at the beginning of the week, as we reported the other day, has taken on a buying structure again with this new news. Other leading altcoins such as XRP, BNB and Dogecoin also gained between 4 percent and 6 percent.

There is a slight relief in the macro outlook

This rise was not limited to crypto assets only. Brent oil fell by 1.8 percent, while US stock futures also turned positive. Although the truth of the ceasefire has not yet been confirmed by the official authorities, investors' risk appetite has started to increase again.

SignalPlus research director Augustine Fan said, “We think the market will normalize in a short time and leave the recent geopolitical developments behind. However, the recent increase in Bitcoin purchases and the tendency of corporate companies to create BTC reserves may pave the way for a new correction.”

Bitcoin gathers strength around $105,000

On the other hand, Bitcoin continues to consolidate around $105,000. The price action in recent weeks shows that BTC remains resilient even in an environment of macro uncertainty. HashKey Eco Labs CEO Kay Lu said, “Bitcoin’s ability to hold above $100,000 indicates that this asset is now mature and different from traditional risk-off signals.” “The renewed momentum of institutional inflows and ETF demand strengthens Bitcoin’s position as a long-term macro hedge.” However, according to some analysts, this rise may be followed by profit taking, especially in tokens that have gained a lot of value, such as ETH. While short-term volatility is likely to continue in the market, it is stated that investors should remain cautious.