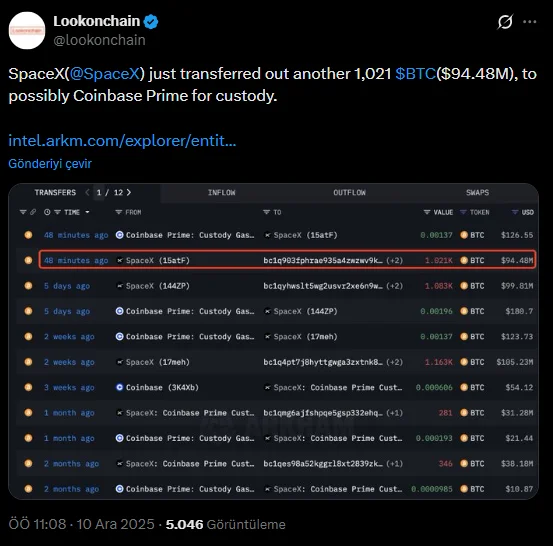

SpaceX's Bitcoin transactions are back in the spotlight. According to data shared by the on-chain analytics platform Lookonchain, the company transferred 1,021 Bitcoins (approximately $94.48 million) earlier today. The transaction is thought to have been sent to Coinbase Prime's custody service. According to records, this transfer is one of the largest outflows SpaceX has made in recent weeks and suggests the company is restructuring its institutional-level crypto asset management.

A stream viewed via Arkham Intelligence reveals the transfer was completed approximately 48 minutes ago, with assets moving from a SpaceX-labeled wallet to an address believed to be associated with Coinbase Prime Custody. Similar transactions have been observed several times in recent weeks; SpaceX has been recorded making outflows of varying amounts of BTC at short intervals. This strengthens expectations that the company is repositioning its BTC reserves in line with a specific custody strategy.

SpaceX is preparing for an IPO

The timing of the transfer is also noteworthy. Elon Musk's SpaceX is preparing for one of the largest initial public offerings (IPOs) in the company's history. According to Bloomberg, SpaceX aims to go public by late 2026 with a valuation of $1.5 trillion. If this level is achieved, SpaceX will approach the size of Saudi Aramco's record-breaking $29 billion IPO in 2019. The goal is to raise between $30 and $40 billion through the IPO; however, the process could potentially extend into 2027. The company's financial projections are heavily reliant on Starlink's growth. Revenues are expected to reach approximately $15 billion in 2025 and rise to between $22 and $24 billion in 2026. The expansion of Starlink's direct mobile connectivity services and the progress of Starship's testing for lunar and Martian missions are two key factors strengthening SpaceX's cash flow. Therefore, it's not surprising that the company wants to enter the IPO process with a strong balance sheet. Bitcoin transfers are also being closely monitored within this framework. SpaceX has confirmed in the past that it holds crypto assets on its balance sheet; Musk has stated that the company has generated positive cash flow for years and runs regular share buyback programs for employees. Recent BTC movements indicate both a professionalization of reserve management and a tendency to work with regulation-friendly institutions. On the other hand, it is stated that the $420 level set by SpaceX for share buybacks has pushed the company's previous valuation of $800 billion upwards. In a structure that includes giant investors such as Fidelity, Google, Valor Equity Partners, and Founders Fund, it is said that the share sales and buybacks aim to clarify the fair market price before the IPO.