The wave of outflows in digital asset investment products continued into its second week. According to CoinShares' November 10, 2025 report, net outflows totaled $1.17 billion last week. This figure is attributed to the ongoing uncertainty in the market following the liquidity crash in mid-October and the US Federal Reserve's (Fed) hesitation regarding interest rate cuts.

Trading volumes hovered around $43 billion throughout the week; while brief hopes of a US government reopening boosted fund inflows on Thursday, this optimism quickly dissipated on Friday.

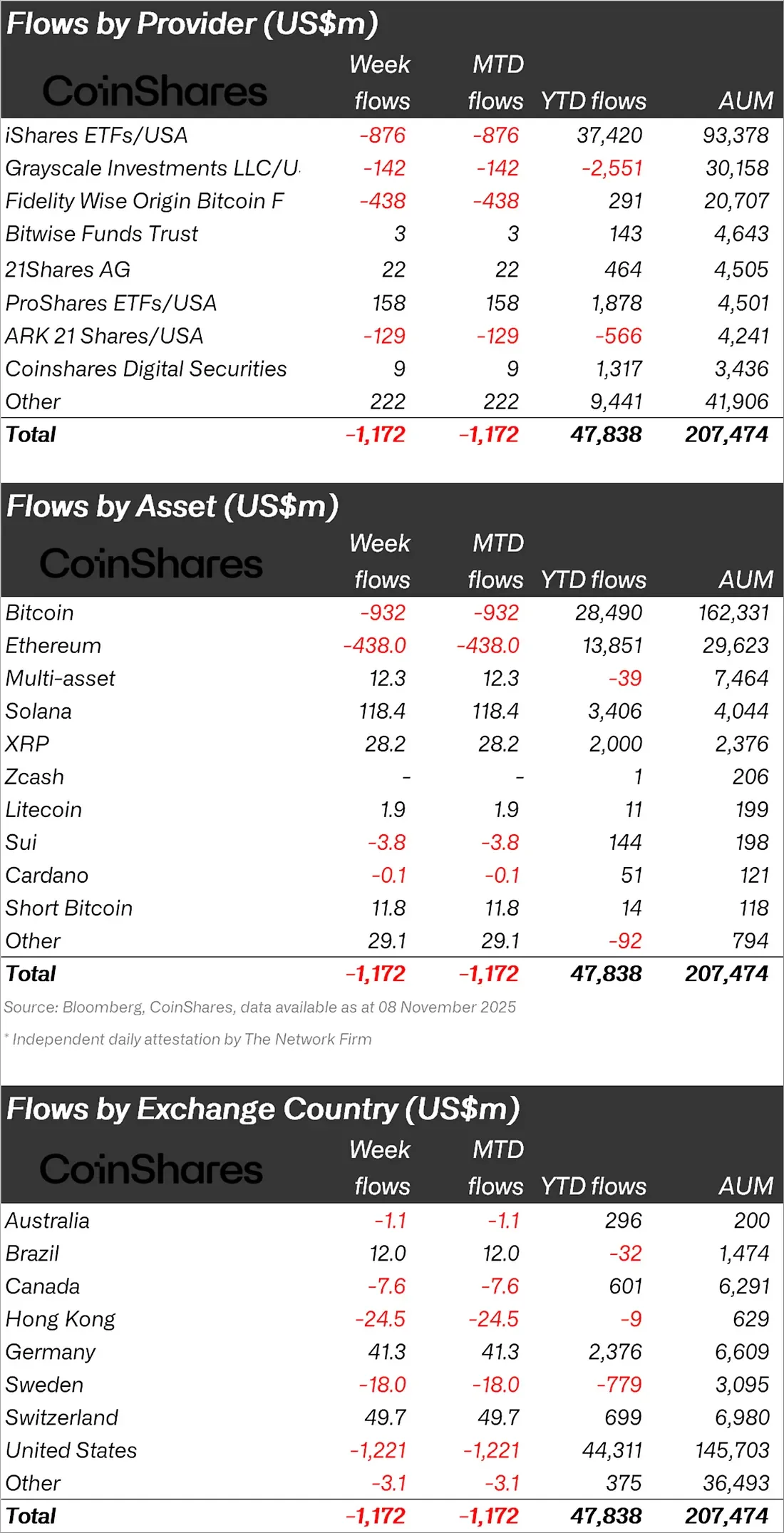

US-based funds led the negative trend. US markets alone saw outflows of $1.22 billion, while Germany and Switzerland saw positive inflows in Europe with $41.3 million and $49.7 million, respectively.

Bitcoin and Ethereum Explode

Bitcoin and Ethereum accounted for the largest portion of fund outflows. Bitcoin products saw net outflows of $932 million and $438 million, respectively. Specifically, the iShares (BlackRock) Bitcoin ETF saw $876 million in outflows, and the Fidelity Wise Origin Bitcoin Fund saw $438 million. Grayscale also saw a $142 million decline.

The sell-off in Bitcoin also fueled the shift towards short-term products. Short Bitcoin ETPs saw $11.8 million in inflows, the highest weekly increase since May 2025.

Altcoins Resist: Solana Leads the Way

Despite the selling pressure in major cryptocurrencies, altcoins remained resilient. Solana once again led the way with $118.4 million in weekly inflows. Over the past nine weeks, Solana funds have seen a total capital inflow of over $2.1 billion. XRP also saw a strong weekly inflow of $28.2 million.

Other assets saw small but notable movements: Litecoin saw $1.9 million in inflows, and multi-asset products saw $12.3 million in inflows. In comparison, Sui saw $3.8 million in outflows, and Cardano saw $0.1 million.

Table by Fund Provider

According to CoinShares data, iShares closed the week with the largest outflow, with $876 million. Fidelity saw a $438 million decline, while Grayscale saw a $142 million decline. In contrast, ProShares ETFs saw $158 million in inflows, 21Shares $22 million, and Bitwise $3 million.

While the overall net inflow into crypto investment products has maintained $47.8 billion since the beginning of the year, outflows in the last two weeks indicate a significant cooling in investor sentiment.

Regional Differences Deepen

While the US remains at the center of outflow pressure, European markets remain relatively balanced. Germany and Switzerland maintained their positive trend, while Canada and Hong Kong experienced outflows of $7.6 million and $24.5 million, respectively. The report emphasizes that the reshaping of capital flows in the market is closely linked to Fed policies and global risk appetite.