The crypto market had an extremely rough start to the week. As of Friday morning, all major assets, especially Bitcoin and Ethereum, experienced strong selling pressure; ETF data further darkened the picture. While Bitcoin ETFs and Ethereum ETFs experienced one of their worst days in history, the XRP ETF bucked the trend by recording surprisingly strong inflows around the same time.

According to Coinglass data, spot Bitcoin ETFs saw $866.7 million in outflows in one day. This figure marked the third-largest net outflow since the ETFs' launch. Ethereum ETFs were even more striking, with $410 million outflows in a single session. Even the selling pressure generated by October's high volatility couldn't reach these levels.

The outflow wave, led by the market's largest ETF providers like BlackRock and Fidelity, demonstrates a significant risk aversion among institutional investors. ETF data is no longer just a market detail; it has become one of the most powerful indicators of the crypto ecosystem's overall risk appetite. Therefore, each new breakout signals a deepening market fragility.

Macro pressures hit all risky assets

The crypto sell-off wasn't solely driven by internal market factors. US stock markets also experienced their worst day in a month. The mass sell-off in technology stocks, in particular, accelerated as investors grew increasingly concerned about the high valuations of AI companies. The uncertainty surrounding the economic outlook and the weakening of interest rate cut expectations further exacerbated the situation.

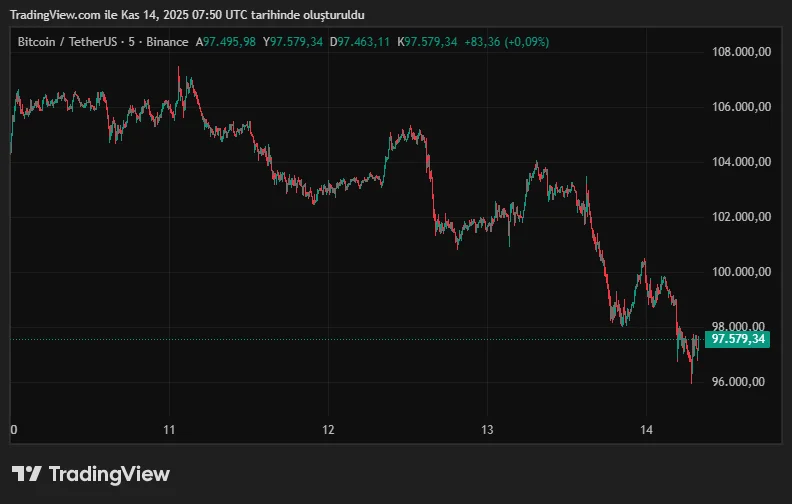

In this atmosphere, appetite for risky assets abruptly diminished; the crypto market is typically one of the most severely affected during such periods. Under this pressure, Bitcoin fell below $100,000, losing its psychological threshold and was trading around $97,000 at the time of writing. The Crypto Fear and Greed Index also fell sharply, falling into the "extreme fear" zone.

What does the technical outlook suggest?

Bitcoin closed the week with a loss of over 5%, while technical indicators confirm the dominance of sellers. The RSI of 35 suggests the market is still trading in a strong selling zone. If Bitcoin closes below the $97,460 support, analysts predict the price could weaken to the $95,000 range.

The outlook for Ethereum is also weak. After rejecting the broken trendline resistance at $3,592 earlier this week, ETH has lost nearly 10% in three days and retreated to the $3,200 region. If ETH loses the $3,170 support, analysts predict a new correction toward the $3,017 region.