Ripple, a global player in digital asset management, has made a significant breakthrough through its Ripple Prime service platform for institutional investors. The company has achieved its first direct integration in the decentralized finance (DeFi) space with the Hyperliquid platform. This step is seen as a tangible reflection of Ripple Prime's vision to bring together both traditional financial markets and on-chain DeFi products under a single infrastructure. According to a Ripple Prime spokesperson, the Hyperliquid integration provides users with access to on-chain derivatives markets. This allows clients to manage their positions on Hyperliquid alongside other asset classes they trade through Ripple Prime. These assets include cryptocurrency exchanges as well as traditional instruments such as currencies and fixed-income securities. Systemically, Ripple Prime remains the counterparty for its clients. Users transact through Ripple Prime, not directly with Hyperliquid or another exchange. This structure allows for the management of positions in different markets within a single risk and collateral framework. This eliminates the need for users to perform separate collateral or risk calculations for each platform. Processes are becoming simpler and more secure.

The path to Institutional DeFi

Ripple Prime's move coincides with a period when interest in DeFi at the institutional level is rapidly increasing. In a statement, the company's international CEO, Michael Higgins, said, "As Ripple Prime, we continue to lead the way in combining decentralized finance with traditional prime broker services. This strategic expansion will offer our clients broader access to liquidity, higher efficiency, and innovation."

Ripple Prime was rebranded following the $1.25 billion acquisition of Hidden Road, completed in October 2025. Hidden Road was known as an unbanked prime broker operating in multiple asset classes. Following the acquisition, the rebranded Ripple Prime currently serves more than 300 institutional clients and, according to Ripple's website, handles over $3 trillion in transaction volume annually.

It is stated that Ripple Prime's transaction volume has tripled since the announcement in 2025. The platform offers services including exchange, prime brokerage, and financing operations. Ripple's native digital asset, XRP, along with its stablecoin RLUSD, plays an active role in the solutions offered on this infrastructure.

In recent years, Ripple has attracted attention not only for its activities in the field of payment solutions but also for the blockchain-based technologies it integrates into the corporate finance ecosystem. The company aims to revolutionize cross-border payments in terms of speed, cost, and transparency, acting as a bridge currency for banks and financial institutions through the XRP Ledger. In addition, it focuses on developing stable digital asset solutions with its stablecoin called RLUSD.

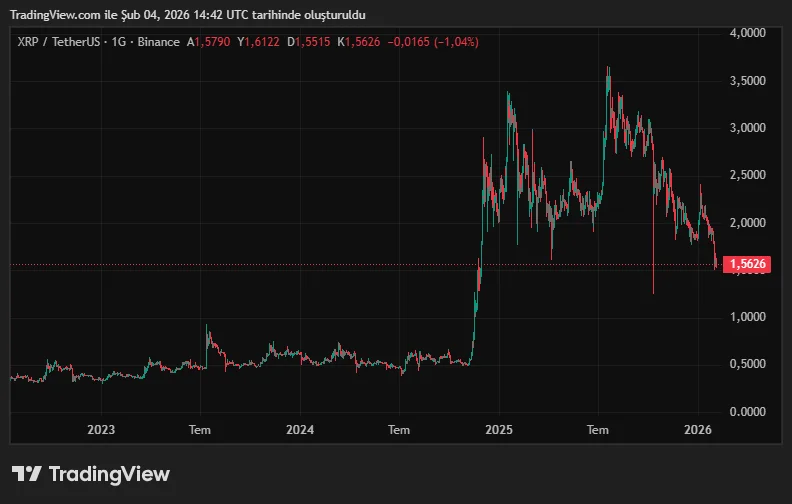

XRP is currently trading around $1.56.