Institutional investor interest in the cryptocurrency markets is regaining momentum. CoinShares' latest weekly report revealed that investments in cryptoasset funds reached a record high in July. Strong inflows, particularly into Ethereum-focused funds, signaled rising investor expectations in this area, while altcoins like Solana and XRP also stood out with notable investments. However, slight outflows in Bitcoin were also noted.

CoinShares: $1.9 billion inflow into crypto investment products

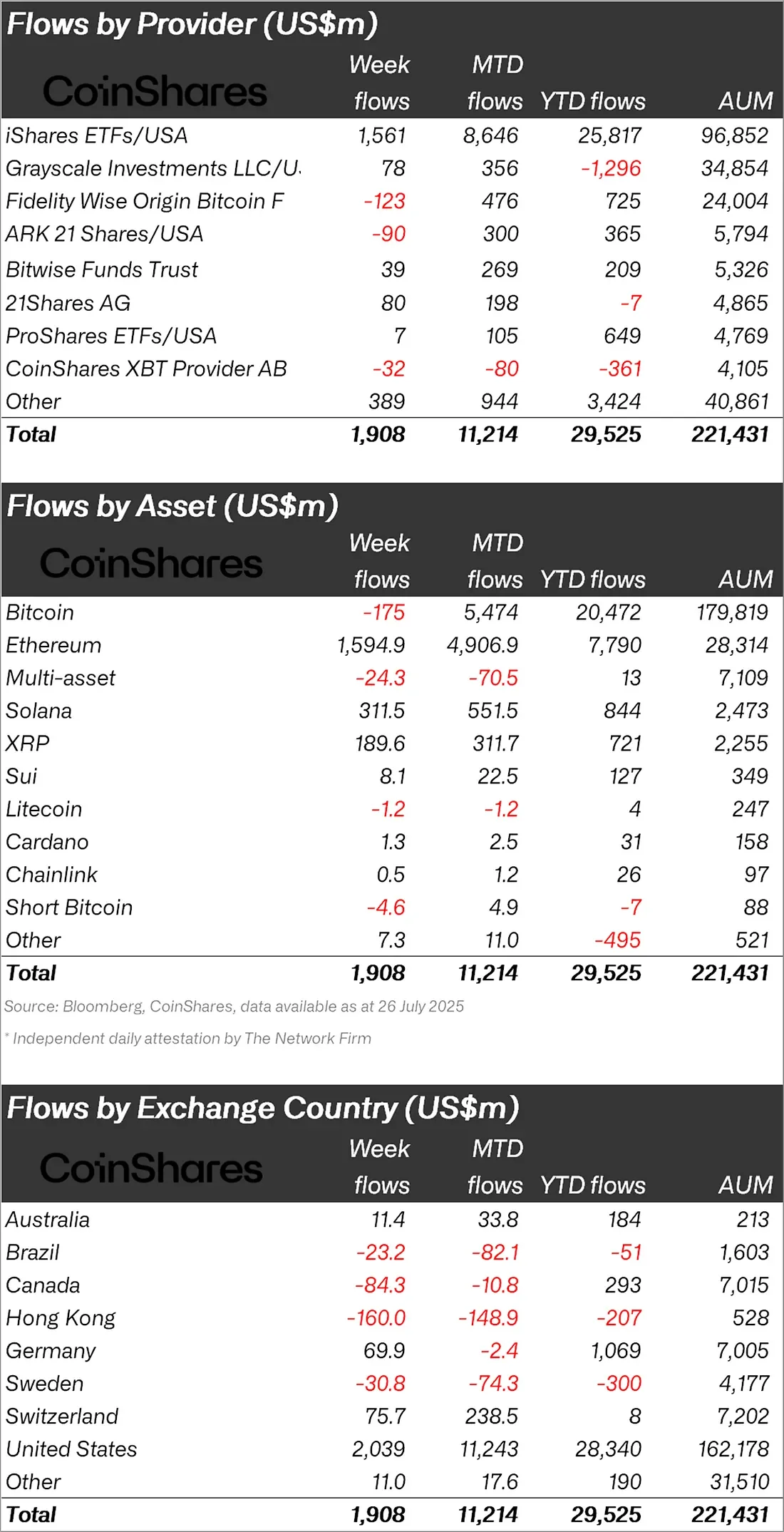

Interest in cryptoasset investment products has peaked again. According to CoinShares' weekly report, total inflows into crypto funds reached a record high of $1.9 billion last week. The total inflow for July reached a record high of $11.2 billion. This figure is well above the $7.6 billion inflow seen in December, following the 2024 US elections.

These strong inflows, combined with the 15th consecutive week of positive investment, hinted at an improvement in market sentiment. Ethereum's performance was particularly noteworthy. Ethereum, which attracted $1.59 billion in funding last week alone, experienced its second-strongest week in history. With this latest data, the total investment in Ethereum since the beginning of the year has risen to $7.79 billion, already surpassing the entire year of 2024.

Bitcoin, on the other hand, experienced a slight pullback. With $175 million in outflows, BTC, unlike other altcoins, followed a cautious course. Market observers are interpreting this as a sign of a possible "altcoin season." However, the picture is complex; there is selective interest in altcoins.

What was the interest in altcoins?

Among the prominent altcoins, Solana performed strongly with $311 million in weekly inflows. XRP, on the other hand, remained on investors' radars with $189 million in funding. SUI, a more niche market, also saw $8 million in inflows. In contrast, Litecoin saw $1.2 million in outflows, and Bitcoin Cash saw $0.66 million in outflows. This chart suggests that, rather than widespread altcoin enthusiasm in the market, strategic positions focused on specific projects are being taken. All eyes are on potential altcoin ETF approvals, particularly in the US.

The US Leads

Regionally, the majority of inflows came from the US ($2.03 billion). Germany also contributed $70 million. However, outflows occurred in markets such as Brazil (-$23 million), Canada (-$84 million), Hong Kong (-$160 million), and Sweden (-$30 million). This suggests that interest in crypto funds remains largely American-centric.