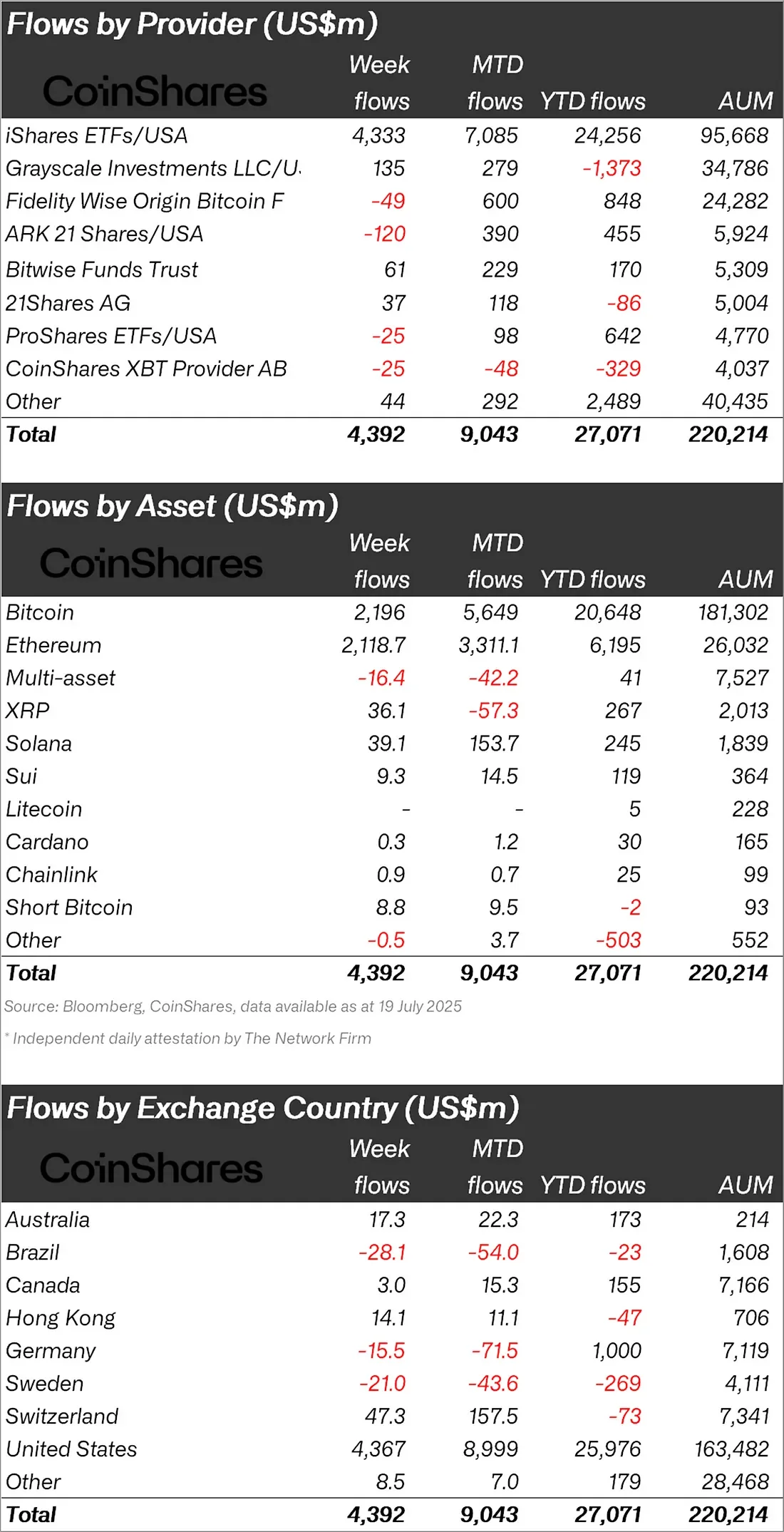

According to the latest weekly data from digital asset giant CoinShares, crypto asset investment products experienced the highest weekly inflow in history last week, reaching a record $4.39 billion. With this increase, total inflows since the beginning of 2025 have risen to $27 billion, while assets under management (AuM) have reached an all-time high of $220 billion.

Ethereum dazzles, Bitcoin lags behind

This week's star was undoubtedly Ethereum. ETH products nearly doubled their own record with a weekly inflow of $2.12 billion. Total inflows in 2025 reached $6.2 billion, already surpassing the total for 2024. The continuous inflows recorded over the last 13 weeks represent 23% of Ethereum's total assets.

As interest in Bitcoin continues, this week saw an inflow of $2.2 billion. While this figure remains below last week's $2.7 billion, BTC remains a favorite among investors. Bitcoin ETPs (exchange-traded products) accounted for 55% of total BTC exchange volume and continued to reflect significant investor interest.

Solana, XRP, and Sui shine on the altcoin front

Besides Ethereum and Bitcoin, significant activity was also observed in altcoins. Solana saw notable inflows of $39.1 million, XRP $36.1 million, and Sui $9.3 million. Multi-asset products also saw $16.4 million in outflows. Total monthly outflows for XRP reached $57.3 million. Some projects, such as Litecoin, Cardano, and Chainlink, saw limited inflows. Altcoin data is as follows:

- Ethereum (ETH): $2,118.7 million inflow

- Solana (SOL): $39.1 million inflow

- XRP: $36.1 million inflow

- Sui: $9.3 million inflow

- Cardano (ADA): $0.3 million inflow

- Chainlink (LINK): $0.9 million inflow

Geographic distribution: The US alone led the way

The majority of fund inflows originated in the US. The $4.36 billion inflow from the US alone accounted for almost all of the total weekly flow. Switzerland was in positive territory with contributions of $47.3 million, Hong Kong $14.1 million, and Australia $17.3 million. However, outflows were observed in some countries, such as Brazil (-$28.1 million), Germany (-$15.5 million), and Sweden (-$21 million).

iShares tops the charts, Grayscale suffers losses

The biggest gainer of the week was iShares ETFs, with a massive $4.3 billion in inflows. Grayscale is still in negative territory with $1.3 billion in outflows for the year, despite limited inflows of just $135 million. Other major names like ARK Invest and Fidelity saw mixed results, while CoinShares XBT products also closed the week with $25 million in outflows.