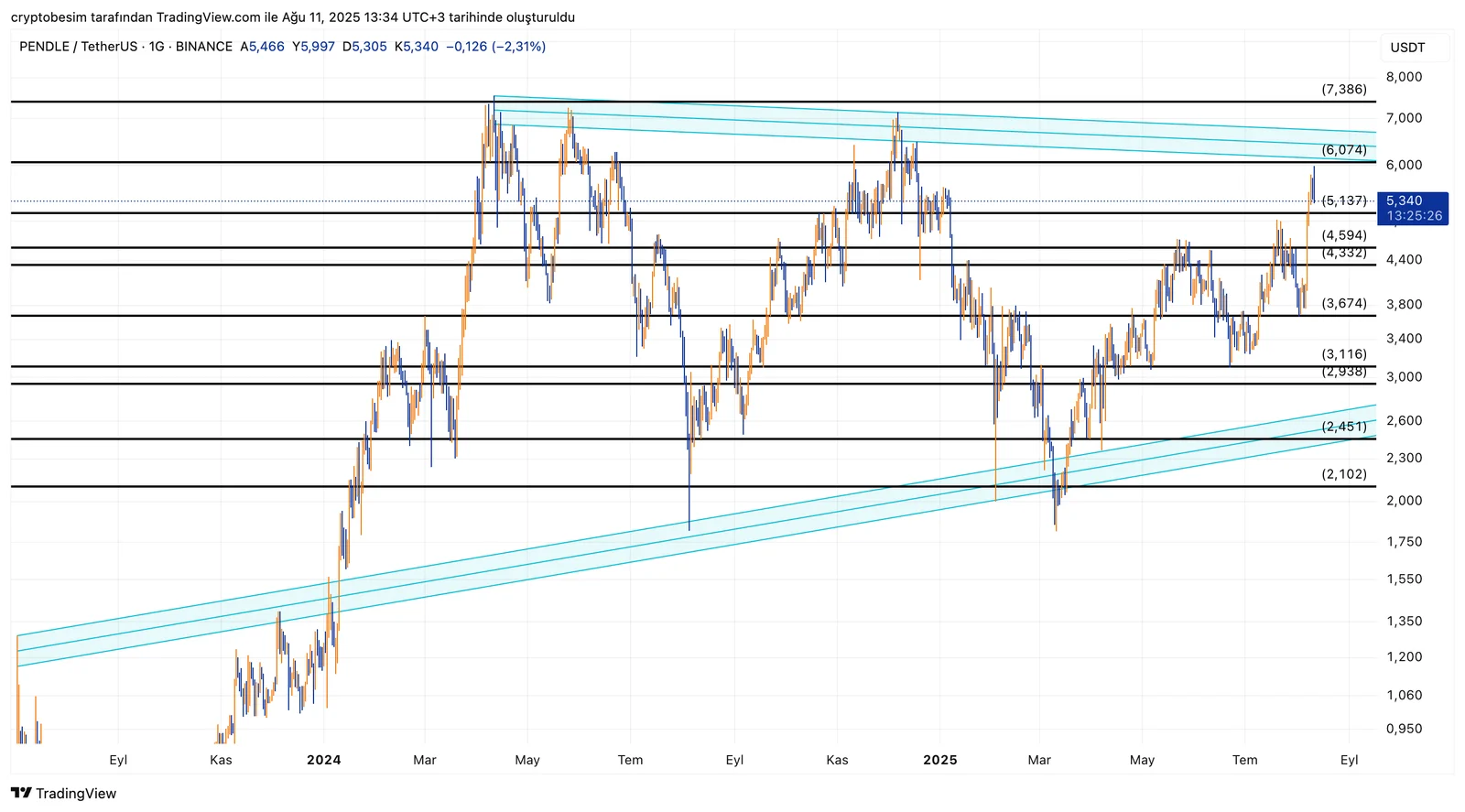

PENDLE Technical Outlook

PENDLE has been trading within a contracting price structure for an extended period. This pattern has formed through the convergence of both descending and ascending trendlines, resulting in progressively narrower price action.

Currently, the price is attempting to hold just above the horizontal resistance area at $5.13. This level is particularly important as it sits near the upper boundary of the contracting structure, making it a potential breakout point. A strong upward breakout with volume could open the way towards $6.07 and $7.38 as the next target levels.

On the downside, the $4.59 – $4.33 range stands out as the first support zone. A close below this area would increase the risk of a pullback towards the lower boundary of the contracting formation. In such a case, $3.67 and $3.11 would serve as notable interim supports.

Given that contracting structures often resolve with a strong breakout, volatility for PENDLE is expected to increase in the coming period.

These analyses, which do not constitute investment advice, focus on support and resistance levels that may present short- to medium-term trading opportunities under current market conditions. However, all trading and risk management decisions remain the sole responsibility of the user. The use of stop-loss orders is strongly recommended for any positions taken based on this analysis.