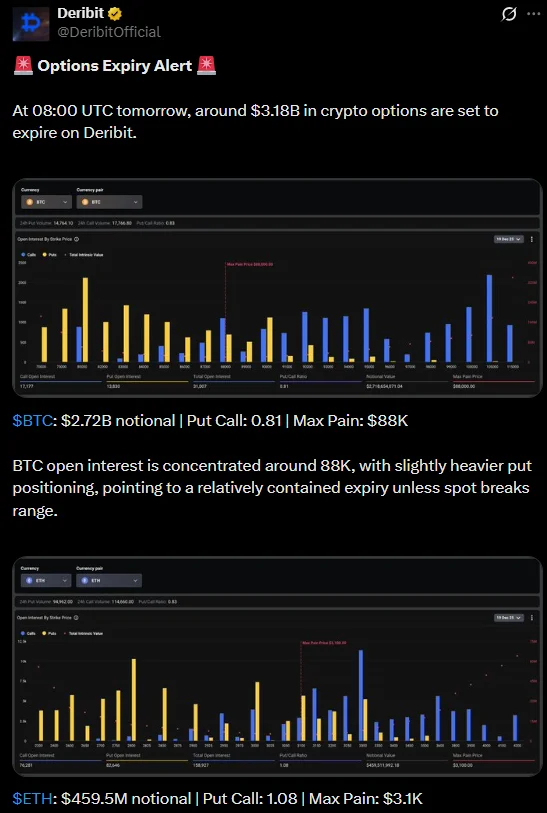

As the year draws to a close in the cryptocurrency markets, a notable expiration occurred in the Bitcoin and Ethereum options market. According to Deribit data, approximately $3.16–$3.18 billion worth of Bitcoin and Ethereum options expired on Friday. This latest major settlement, occurring amid reduced liquidity before the Christmas holidays, reveals that the market's direction remains unclear.

Bitcoin options dominated the expirations

Bitcoin options accounted for the majority of expirations. Approximately $2.7 billion worth of BTC options expired, with the Bitcoin price trading around the $87,000 range in the hours leading up to expiration. The "max pain" level for Bitcoin was highlighted at $88,000. This level is closely watched in the derivatives market as it represents the price point where the most options become worthless. The spot price remaining just below this level suggests that unless a strong breakout occurs, the price may continue to move within a narrow range.

Open interest data also painted a cautious picture. While call contracts numerically outnumbered Bitcoin options, the concentration on the put side was noteworthy. With total open positions exceeding 30,000 contracts, the put/call ratio remained in the 0.76–0.80 range. This ratio indicated that investors had not completely abandoned the upside scenario, but had increased their need to hedge against downside risks. The concentration of put options, particularly around the $85,000 level, revealed that investors were planning exits or hedging in case of a potential pullback. The picture was slightly different on the Ethereum front. Approximately $460–470 million worth of ETH options expired, while the Ethereum price traded around $2,900. The maximum pain level for ETH was calculated at $3,100, and the spot price remained significantly below this level. The call and put distribution in Ethereum options was more balanced. The put/call ratio being just above 1 suggested a more neutral market outlook for Ethereum. Analysts noted that price ranges in Ethereum options are spread across a wider band compared to Bitcoin. While upward expectations are maintained at levels above $3,400, various hedging positions have also been taken against downward scenarios. This indicates that sharper movements in the Ethereum price may be possible if volatility increases again. Overall, it is observed that volumes in the options market slowed significantly in the last quarter of the year. The total open position size, which was over $46 billion at the end of the third quarter, decreased to approximately $39 billion as of the fourth quarter and has followed a horizontal trend in recent months. This picture shows that investors prefer hedging and a wait-and-see strategy instead of taking aggressive upward positions.

The crucial date: December 26

The market's attention is now focused on the larger-scale monthly, quarterly, and annual option expiration on December 26. Approximately $23 billion worth of options are expected to expire on this date. While a cautious outlook prevails for Bitcoin and Ethereum in the short term, upward expectations for longer-term contracts towards 2026 have not entirely disappeared. Reduced liquidity during the holiday season and global macroeconomic developments could make price movements even more sensitive in the coming days.