Ondo Finance's subsidiary, Ondo Global Markets, has officially opened the door to European regulation. With authorization from the Liechtenstein Financial Markets Authority (FMA), the company will be able to offer tokenized stocks and ETFs to investors throughout the European Economic Area. This step is considered critical because it marks the first time that blockchain-based securities and "on-chain" financial products have been placed under such a comprehensive regulatory framework in Europe.

Thanks to Liechtenstein's passporting system, the authorization extends beyond the country; it extends to all EU member states, as well as 30 countries, including Iceland, Norway, and Liechtenstein. This will allow US-listed stocks and ETFs to be offered to over 500 million potential investors in a tokenized and regulated format.

The company describes this authorization as "the beginning of a new era where traditional financial markets and blockchain infrastructure meet under the same roof, with regulatory oversight." Ondo Global Markets currently boasts over $315 million in total locked assets and over $1 billion in trading volume. These figures demonstrate the platform's current leadership in tokenized financial products.

With this new authorization, Ondo not only expands its existing products, such as tokenized US Treasury bonds, but also contributes to strengthening the legal status of tokenized securities in Europe. CEO Nathan Allman, known for his background at Goldman Sachs, has long led a strategy aimed at bringing traditional financial products to the onchain world. Allman emphasizes that despite the complex regulatory landscape of the European market, with the right infrastructure, onchain securities can be used safely by a broad range of investors.

The approval from the Liechtenstein FMA sets a significant precedent for tokenization in Europe's securities markets. While access to US stocks and ETFs, in particular, typically varies depending on national regulations, this step establishes a harmonized framework across the continent. According to experts, this situation could accelerate institutional investors' interest in tokenized assets.

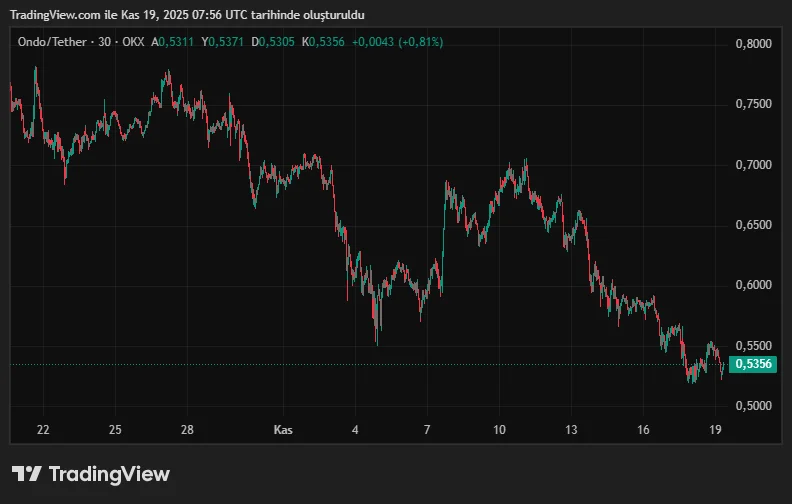

What's the latest on the ONDO price?

For Ondo's native token, ONDO, the price is currently at $0.53, according to market data. The token's market capitalization has reached $1.7 billion; however, the 42.89% decline in the last 90 days reflects the pressure exerted by general market conditions. Nevertheless, it is believed that the new gateway to Europe could increase confidence in the ONDO ecosystem in the medium term.

This broad access brought about by regulation creates a strong foundation for the future of tokenized financial products in Europe. Ondo's move is expected to accelerate the tokenization race by setting an example for other companies.