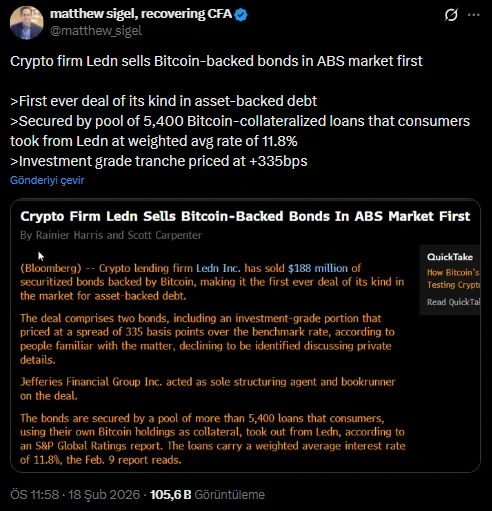

Crypto lending platform Ledn has made a notable financial move by issuing $188 million worth of Bitcoin-backed securities. According to Bloomberg, the transaction is seen as a significant milestone in the Bitcoin-backed asset-backed securities (ABS) space. The investment-grade tranche was priced 335 basis points above the benchmark interest rate.

$188 Million Sale with Bitcoin-Backed Bonds

Ledn's issuance is based directly on a pool of Bitcoin-backed consumer loans. According to the company, these bonds cover more than 5,400 individual loans, each secured by borrowers' Bitcoin assets. The weighted average interest rate on these loans is 11.8 percent.

Asset-backed securities are fundamentally based on the principle of transferring cash flows from a loan pool to investors. This model has long been used in traditional financial markets. Ledn's transaction is considered a first in terms of applying this structure with Bitcoin-backed loans. The development also caught the attention of Matthew Sigel, head of VanEck's digital assets division.

According to Bloomberg, the issuance consists of two different bond tranches. One is positioned at investment grade, while credit rating agency S&P Global gave the majority of the bonds a BBB- rating. The BBB- level indicates the lowest rung of the investment grade category. This shows that the product's risk profile has not completely disappeared, but it remains within a certain acceptance threshold for institutional investors. Approximately 4,078.87 Bitcoins were pledged as collateral for the bonds. This amount is estimated to have a market value of approximately $356.9 million. The fact that the collateral value is significantly higher than the issuance amount stands out as an element aimed at increasing investor security. Another noteworthy aspect of the transaction is the automatic liquidation mechanism. If the Bitcoin price experiences sharp declines and falls below the determined threshold levels, the Bitcoins pledged as collateral are automatically liquidated. This structure aims to protect bond investors, especially during periods of high volatility. The volatility in Bitcoin's price in recent months has made the resilience of such structures more apparent. Bitcoin has fallen by as much as 50% in the last four months, dropping to levels around $60,000. At the time of publication, it was trading around $66,329. This price volatility makes risk management of Bitcoin-backed loan models even more critical. Ledn is known as a platform that offers its users the opportunity to borrow without selling their Bitcoins. Since its establishment, the company has reached billions of dollars in loan volume. The investment of stablecoin giant Tether in Ledn in November was also among the developments indicating an increase in demand for Bitcoin-backed loans in the sector. Jefferies Financial Group acted as the sole structuring agent and bookmaker during the bond issuance.