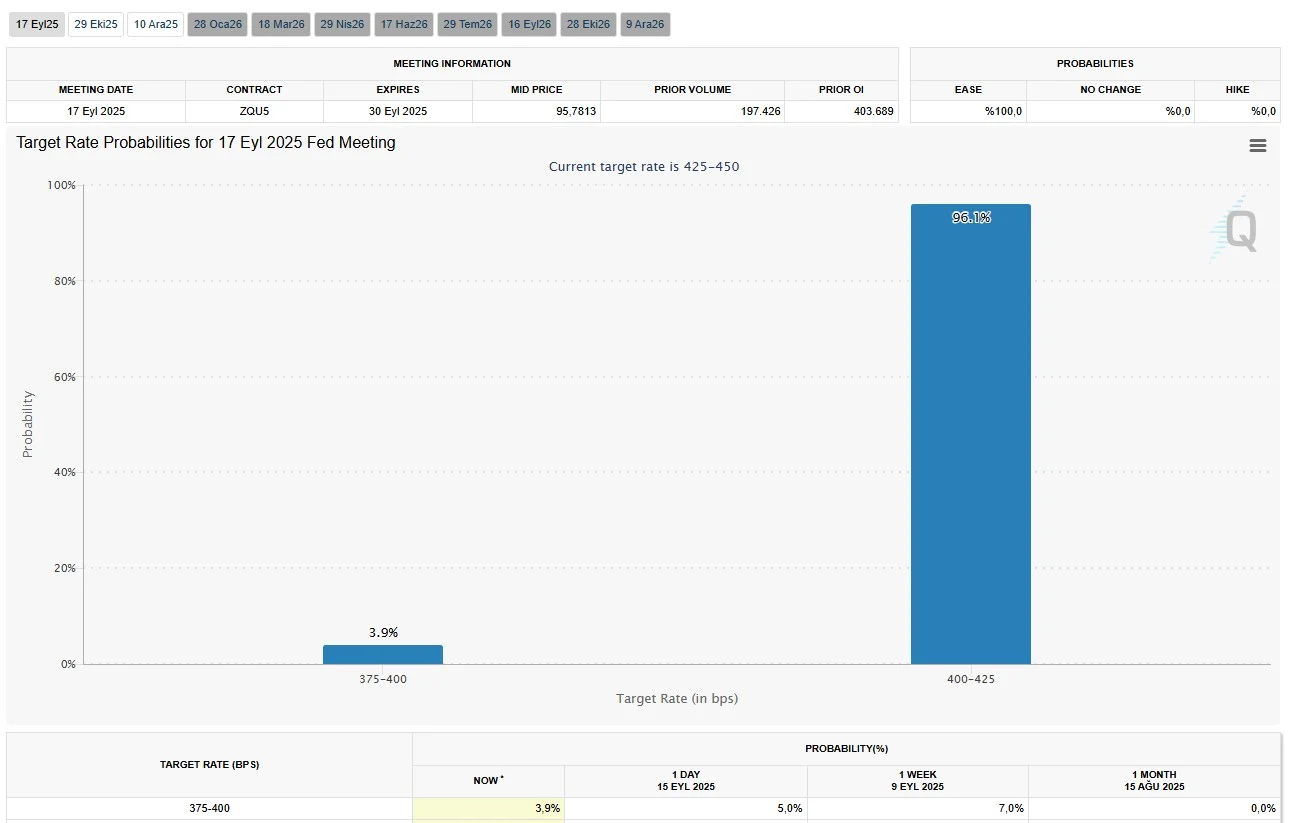

The US Federal Reserve (Fed) is preparing for one of the most critical meetings of 2025. The interest rate decision, to be announced tomorrow, September 17th, is thought to open the door to the first interest rate cut of the year. According to CME FedWatch Tool data, markets have priced in a 96% probability of a 25 basis point cut. This suggests that the decision is largely anticipated, and markets are positioning accordingly.

The Fed's September meeting will take place on September 16th and 17th. The critical interest rate decision will be announced on Tuesday, September 17th at 9:00 PM Turkish time. Markets are already fixated on this time; the press conference to be held by Jerome Powell following the decision will be the most important development that will shed light on the rest of the year.

However, the most decisive factor will be the press conference held by Fed Chair Jerome Powell after the meeting. Powell's messages will provide clues about how monetary policy will be shaped for the rest of the year. Some economists argue that the Fed should act more aggressively and cut interest rates by 50 basis points. However, most analysts view this possibility as unlikely. Regardless of the outcome, one person is certain to be unhappy with this process: US President Donald Trump. Trump has long referred to Powell as "Too Late Jerome," criticized his slow pace on interest rate cuts, and even demanded his resignation. Citing the European Central Bank and the Bank of England's multiple rate cuts throughout the year, Trump accuses the Fed of delays.

Optimism dominates Bitcoin and other markets

The general market sentiment is optimistic for now. The S&P 500 index opened the week at record highs. This rise was driven not only by interest rate expectations but also by Elon Musk's $1 billion purchase of Tesla shares. On the crypto side, Bitcoin has rebounded after weeks of sideways movement. If the largest cryptocurrency can surpass its 30-day high of $118,595, an attempt to break above the historic record of $124,457 could be on the horizon. The psychological barrier of $5,000 also appears critical for Ethereum.

However, experts also highlight the risks. The S&P 500 index has gained a remarkable 72 percent since the beginning of 2023. Some believe this momentum, fueled by investments in artificial intelligence, has overheated. The crypto market has seen a much sharper rise. Bitcoin has gained 600 percent in the last two and a half years, Ethereum 275 percent, and XRP 780 percent. Therefore, the possibility of a potential correction remains.

Steve Sosnick, chief strategist at Interactive Brokers, stated that the Fed could signal a "hawkish interest rate cut" this week when announcing its decision. He noted that markets have largely priced in the reduction, but that future expectations could be tempered. According to him, even if the Fed implements the cut, it may want to dampen excessive optimism about the future. He noted that inflation remains uncontrolled, and that core CPI and PCE are rising again.

New Development at Fed

A new development has occurred that will impact decision-making at the Fed. The Senate has approved Stephen Miran as the replacement for Adriana Kugler, who left office in August. Miran, who won a narrow 48-47 vote, will remain on the board until January 2026. It is known that Miran believes interest rate cuts are overdue, so this will strengthen his support for a reduction in decisions to be made this week. There are even speculations in the US press that Miran may eventually become a candidate to replace Powell as Fed chair.

In short, the key factor in market direction will not only be the magnitude of the rate cut, but also the signals Powell delivers at his press conference. On the one hand, there is pressure from Trump and the election atmosphere, and on the other, overheated stock markets due to inflation concerns. The crypto market, once again, stands out as a "risky asset" in this equation. Investors will be keeping an eye on announcements from Washington this week.